April 11, 2020

QuickBooks Capital Approved as Paycheck Protection Program (PPP) Lender

Company preparing to accept applications for billions of dollars in requested PPP relief next week. 1 in 12 American employees is paid through QuickBooks Payroll

April 11, 2020

Company preparing to accept applications for billions of dollars in requested PPP relief next week. 1 in 12 American employees is paid through QuickBooks Payroll

April 9, 2020

The Internal Revenue Service today has issued guidance providing tax relief under the CARES Act for taxpayers with net operating losses. Recently the IRS issued tax relief for partnerships filing amended returns.

April 7, 2020

The American Institute of CPAs (AICPA) is thanking the Treasury Department and Small Business Administration (SBA) for providing further clarity on the application process for the Paycheck Protection Program (PPP), the $349 billion small business ...

April 7, 2020

The American Institute of CPAs (AICPA) has recommended a defined set of documents for lenders to rely on as well as some key clarifications in the Treasury Department and Small Business Administration’s Paycheck Protection Program (PPP) application ...

April 6, 2020

Paycheck Protection loans, which are provided through SBA-approved lenders, are available to small business borrowers to cover payroll and other operating costs. Included among the application requirements is specific documentation related to payroll.

April 6, 2020

The federal Coronavirus Aid, Relief and Economic Security (CARES) Act includes the Paycheck Protection Program (PPP) to help more than 30 million U.S small businesses. The program offers $349 billion in loans to businesses and nonprofits with no more ...

April 5, 2020

For the calculation of the Average Monthly Payroll cost under the Paycheck Protection Program (PPP), the Gross Payroll approach should be used for the application, according to the recommendation from the AICPA-led small business funding coalition.

April 3, 2020

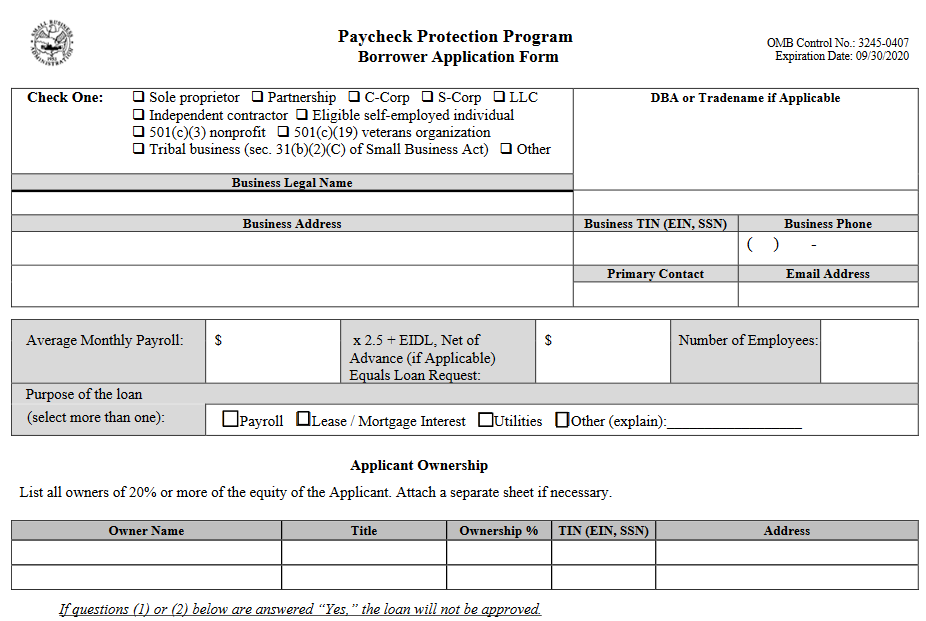

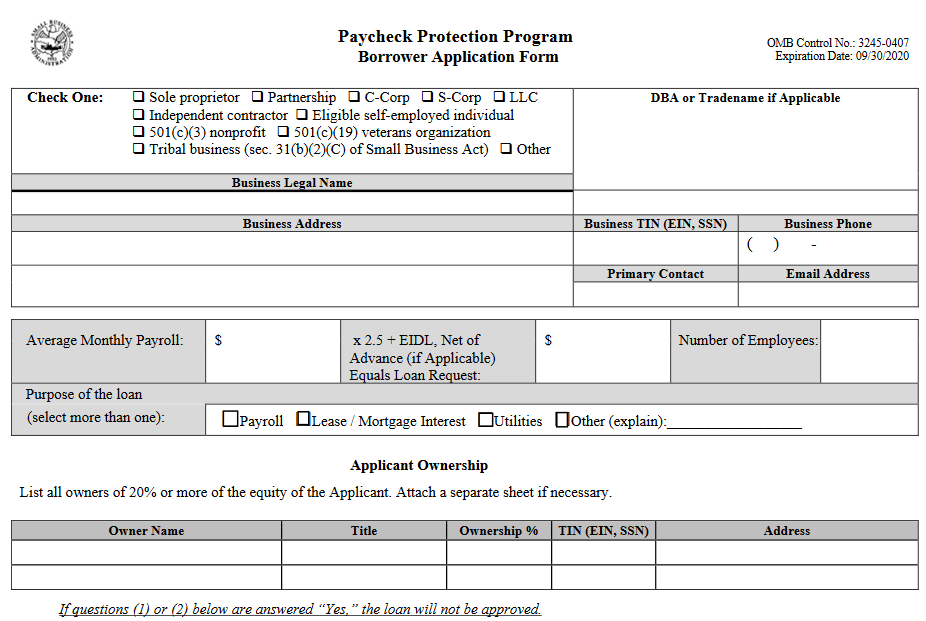

Downloadable PDF of the Small Business Administration's Paycheck Protection Program borrower application form. For use by small businesses requesting Coronavirus relief loans from the SBA.

April 2, 2020

There are many technology options to work remotely, including video conferencing technology to conduct employee and client meetings, tax software via the cloud, and a hosted desktop environment that employees can access from anywhere, anytime.

April 2, 2020

As projections of the coronavirus death toll soar, forecasts for the ensuing economic carnage have also quickly turned much darker – both for the depth and duration of the damage.

April 2, 2020

Initial U.S. unemployment insurance claims rose last week to over 6.6 million, bringing the total number of people to file initial claims in the last two weeks to nearly 10 million.

April 1, 2020

Small businesses shuttered by coronavirus countermeasures can start applying for emergency loans to cover payroll and other costs as soon as Friday, according to Treasury Department guidance.