Small Business January 5, 2026

Three Practical A/R Improvements That Help Businesses Get Paid Faster

One of the simplest changes a business can make is to invoice as soon as work is delivered rather than waiting for a weekly or end-of-cycle batch.

Small Business January 5, 2026

One of the simplest changes a business can make is to invoice as soon as work is delivered rather than waiting for a weekly or end-of-cycle batch.

Technology January 5, 2026

Leah was first introduced in 2022 as the company’s AI solution, offering a more intuitive, simple and human-centered way for users to interact with AI across their daily work.

Mergers and Acquisitions January 5, 2026

The top 200 accounting firm started the new year by announcing it has launched a new financial services platform geared toward privately held SMBs, self-made entrepreneurs, and family-owned companies that will be led by former Baker Tilly CEO Alan Whitman.

Small Business January 2, 2026

A cybersecurity expert reveals six common social media mistakes that leave small businesses vulnerable to hackers during peak sales periods.

Small Business December 30, 2025

Businesses and states are grappling with the fallout of the federal government’s quick elimination of the penny.

General News December 29, 2025

Jim Beam, which is one of the largest makers of American whiskey in the world, is planning to shut down production in Happy Hollow in Clermont, KY Jan. 1 through 2026.

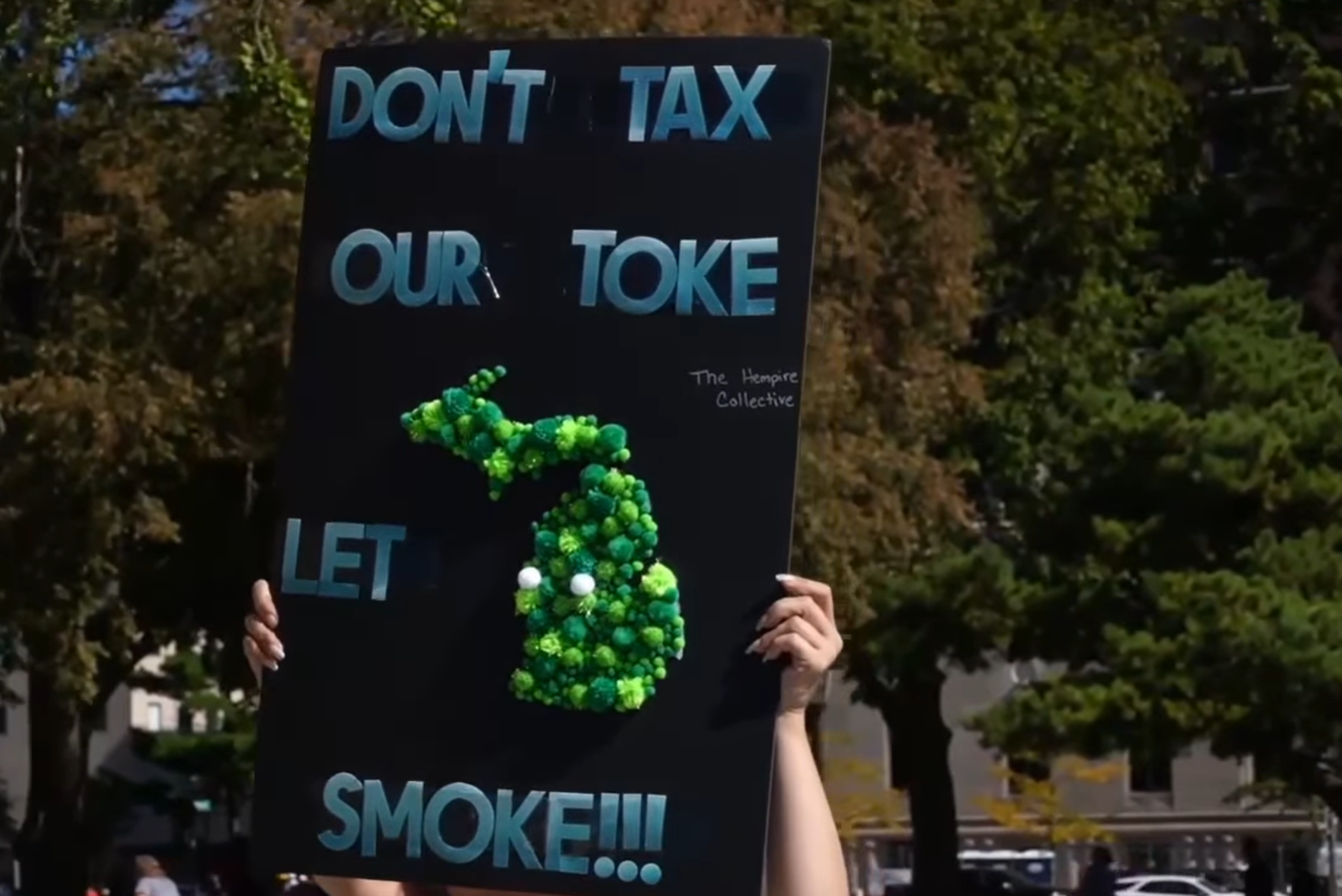

Taxes December 26, 2025

The Michigan Cannabis Industry Association on Tuesday appealed a lower court ruling that upheld the imposition of a new 24% wholesale tax on marijuana sales, set to take effect Jan. 1, 2026.

Small Business December 22, 2025

The report also highlights that banks subject to government regulation continue to earn outsized returns on debit transactions, averaging nearly six times their costs.

Taxes December 18, 2025

Among the most immediate impacts of rescheduling marijuana as a Schedule III drug would be relief from IRS Code 280E, which prevents businesses that handle Schedule I or II substances from deducting routine expenses such as rent, payroll and equipment.

Technology December 18, 2025

CPAClub’s Guardian Pass is an annual subscription designed to help CPA firms plan, execute, and sustain the ongoing and periodic monitoring activities required under the AICPA’s System of Quality Management standards and the PCAOB’s QC 1000.

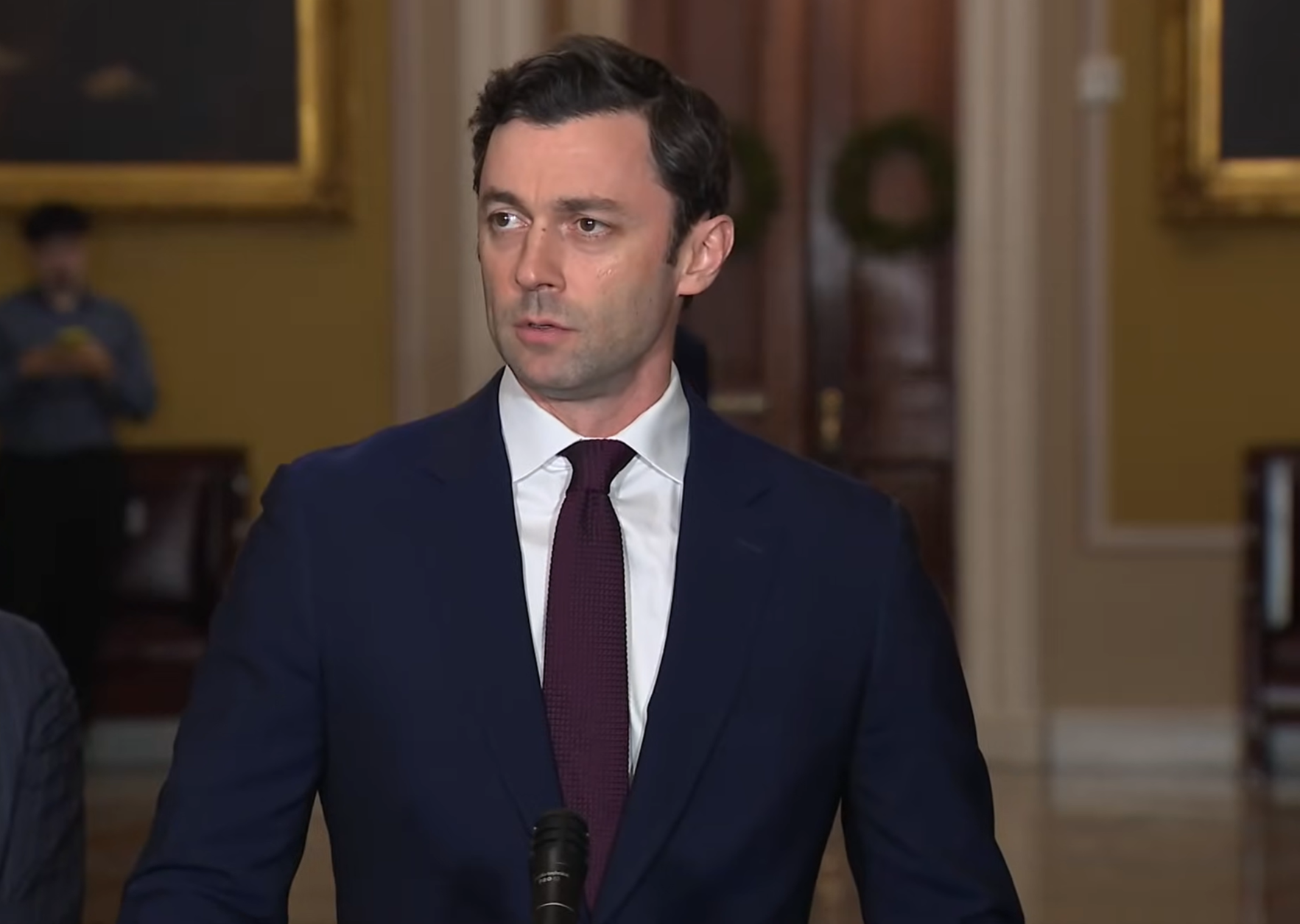

Taxes December 17, 2025

Sen. Jon Ossoff (D-GA) has teamed up with Republican Sen. Cindy Hyde-Smith of Mississippi on legislation to cut income taxes for qualifying small businesses with up to 15 employees.

Small Business December 17, 2025

As the U.S. Treasury phases out the use of the penny, it’s creating a host of new challenges for businesses and consumers that could cost all of us a good chunk of change.