Sales Tax September 24, 2025

Sales Tax Rates and Rules Changes Skyrocket Across States in 2025, Says Vertex Report

In the first half of 2025, states made 408 sales tax rate changes and new rates – a 24% increase compared to the first half of 2024.

Sales Tax September 24, 2025

In the first half of 2025, states made 408 sales tax rate changes and new rates – a 24% increase compared to the first half of 2024.

Small Business September 22, 2025

Numerous state sales tax updates take effect October 1, 2025. Read on to learn about new rates, exemptions, and rules that may impact your sales tax compliance in October 2025.

Technology August 28, 2025

The recognition celebrates Avalara’s commitment to creating a positive impact on its employees, communities, and the environment through its meaningful Corporate Social Responsibility (CSR) initiatives.

Taxes August 22, 2025

Alabama’s county commissions issued a call to action at their summer conference in Orange Beach: protect the state’s internet sales tax system.

Sales Tax August 7, 2025

Sales tax risk is a silent disruptor. For finance leaders, it’s about time lost, strategic momentum drained, and avoidable exposure creeping in. But it doesn’t have to be.

Small Business June 26, 2025

Sales tax holidays typically delight consumers, but they can be hard on retailers. Keep reading to find out why and to learn which states will have sales tax holidays in 2025.

Small Business February 6, 2025

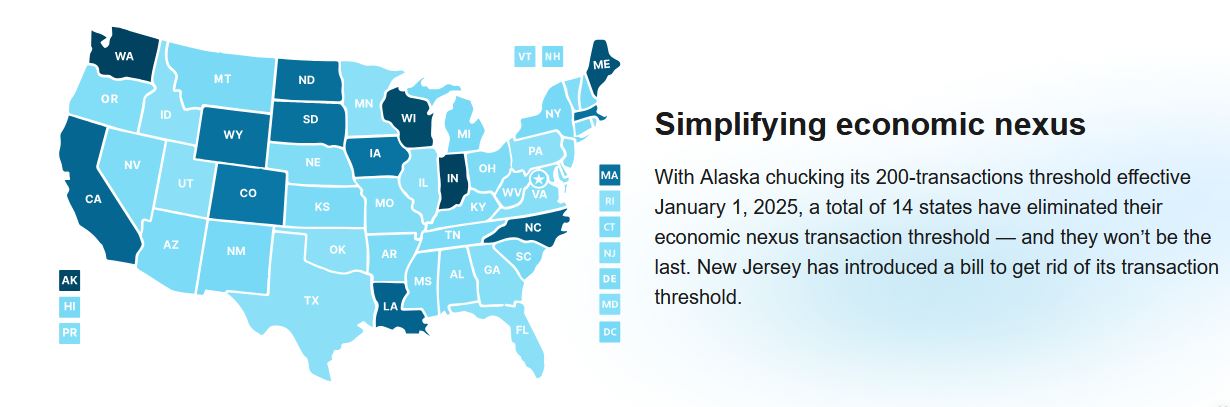

The report covers sales tax changes specifically affecting the manufacturing, retail, and software industries. It also addresses beverage alcohol, communications, excise, lodging, and VAT changes.

Small Business February 4, 2025

Key findings in the 2025 Avalara Tax Changes report point to nascent state-by-state efforts to alleviate the burden of tax compliance related to economic nexus laws.

Small Business January 21, 2025

A handful of home rule states − Colorado, Alabama, Louisiana, Arizona, and Alaska – are making moves toward simplification. Still, businesses selling into home rule states continue to face an onerous tax compliance burden.

Small Business January 16, 2025

The integrated offering from Swap and Avalara reduces cross-border complexity and compliance risk and ensures duties, taxes, and fees are paid at checkpoints to improve cart conversion in more marketplaces.