June 13, 2016

2016 Reviews of Sales and Use Tax Systems

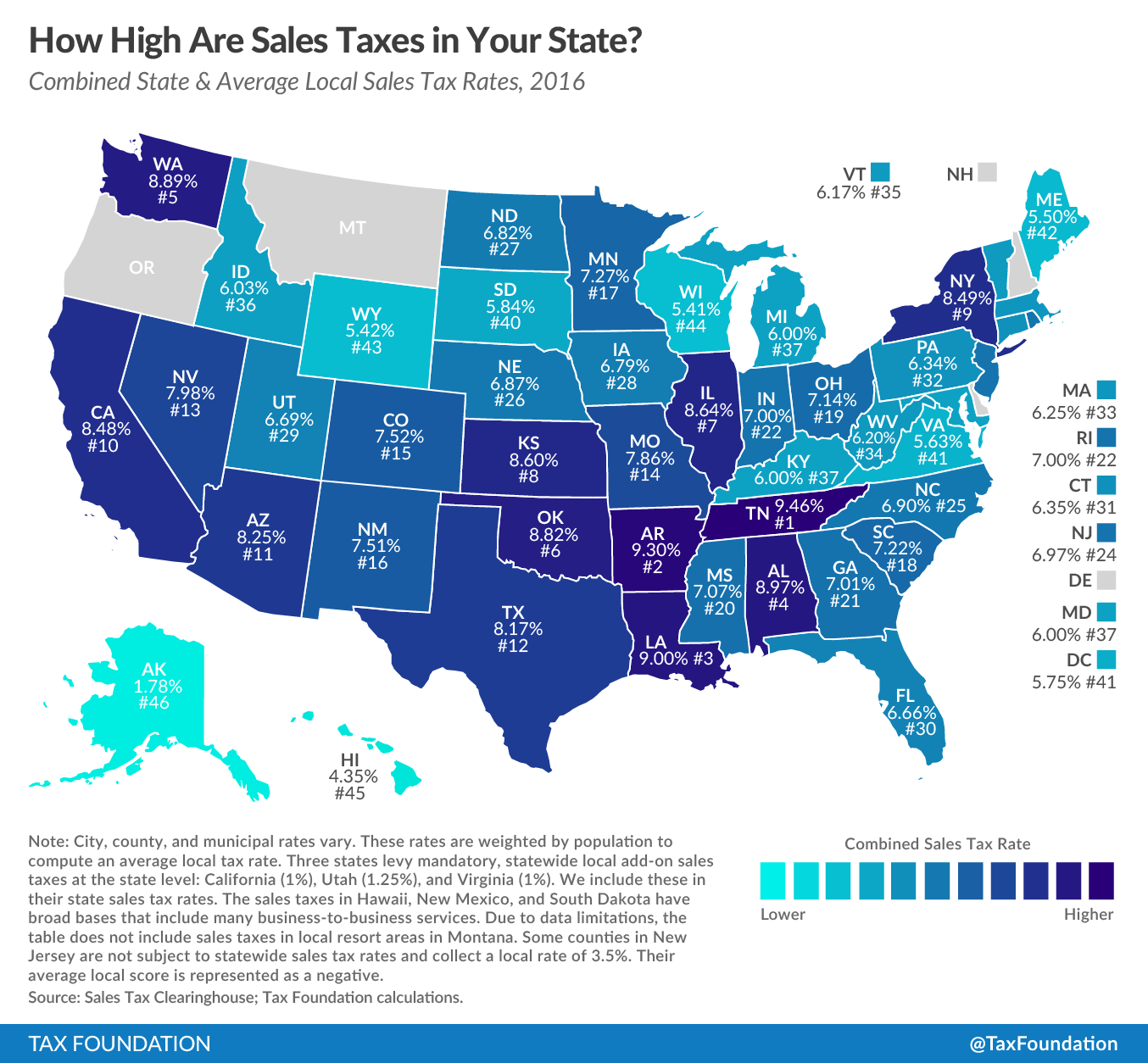

With the complicated rules, and the inordinate amount of time it would take today’s business owner to research and implement tax rates for cities, counties, states, and even countries, it’s imperative that today’s business owners invest in a software ...