September 21, 2020

Sales Tax News Roundup

The roundup is an overview of recent sales tax changes across the U.S.

September 21, 2020

The roundup is an overview of recent sales tax changes across the U.S.

August 25, 2020

Transaction tax changes are on pace to reach the second highest total in the past 11 years. 150 city sales tax rate adjustments have occurred to date this year—with all but 10 being rate hikes—and those numbers aren’t likely to slow down.

August 10, 2020

Retailers with no physical presence in Tennessee are currently required to collect and remit Tennessee sales tax if their annual sales into the state exceed $500,000. Starting October 1, 2020, out-of-state businesses and marketplace facilitators must ...

August 4, 2020

Federal, state, and local officials scrambled to support struggling businesses and individuals when the coronavirus (COVID-19) first hit. They placed temporary moratoriums on evictions, pushed income tax due dates to July 15, and waived interest and ...

July 21, 2020

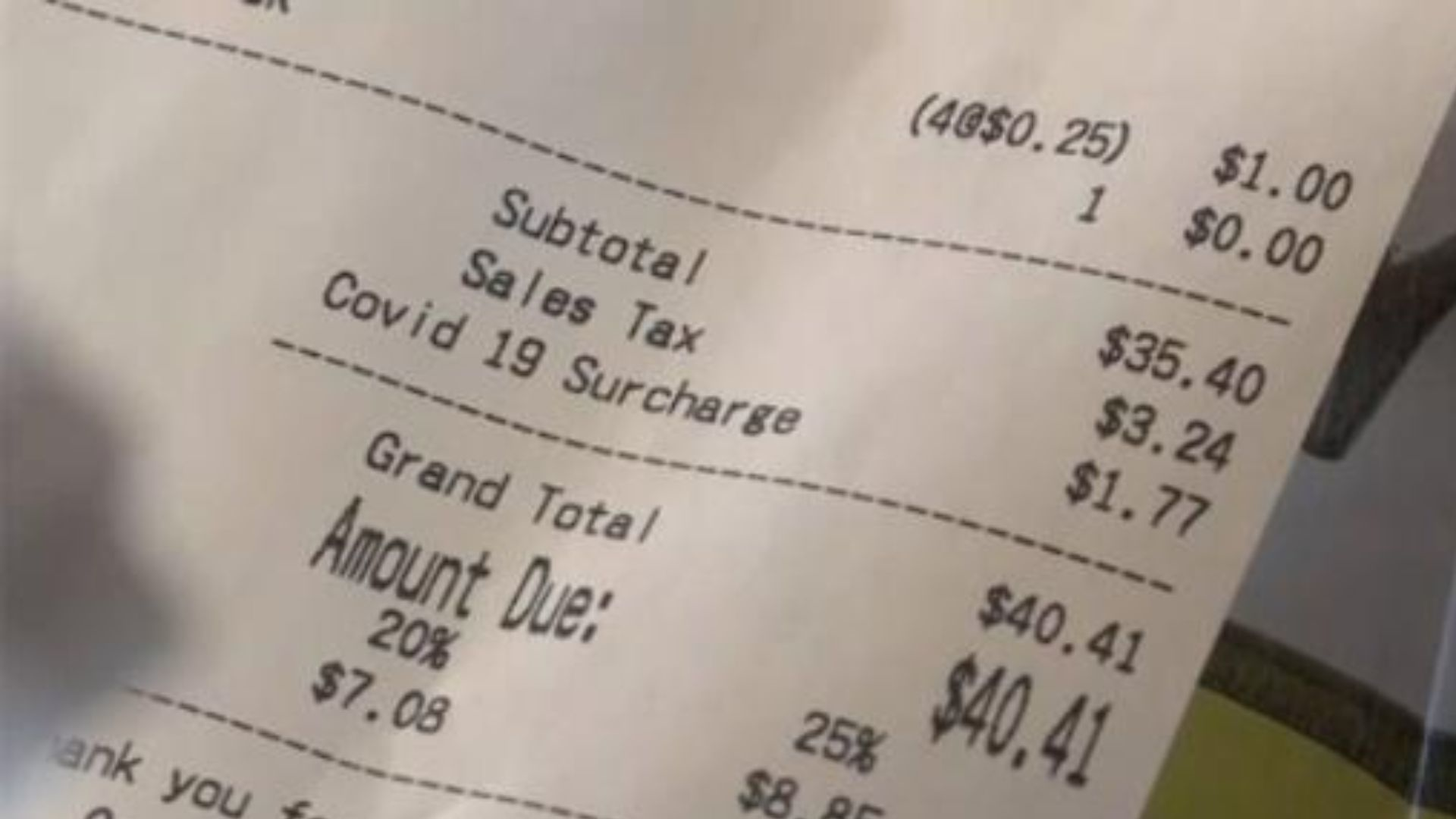

Business owners, especially restaurants and bars, should anticipate a sales tax audit if they are implementing Covid-related fees.

![telecommuting-map[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/07/telecommuting_map_1_.5f109c6053ecc.png)

July 16, 2020

The sudden shift to remote work for many corporations in response to Covid-19 may lead to costly compliance burdens as 36 state tax departments indicate that having just one employee telecommuting from their state will create nexus for ...

June 24, 2020

The midyear update to Avalara's annual sales tax changes report takes stock of what’s transpired in the world of sales tax since the start of the year. It also introduces emerging trends.

June 18, 2020

Preparing and filing sales tax returns is a time-consuming and sometimes costly process. Automated solutions provide a better way for small businesses to manage their sales tax returns process by saving time, reducing ...

June 16, 2020

Retailers large and small need to take the time to implement a tax strategy that accounts for existing and expanding e-commerce compliance challenges – if they haven’t already. The tax landscape may have changed, but there are ways to keep up.

![ecommerce-2607114_960_720[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/05/ecommerce_2607114_960_720_1_.5ebaf7e387198.png)

May 12, 2020

Staying up to date on changing sales tax laws is already an extremely difficult and daunting task for small business owners and e-commerce merchants. Now, factor in the influx of brick-and-mortar stores moving their business online due to COVID and the...

![shutterstock_91234700[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/05/shutterstock_91234700_1_.5eb456233f8ce.png)

May 7, 2020

In the best-case scenario, businesses may be able to host and attend scaled-down in-person events sometime this summer. If the virus resurges in September, as some experts believe it will, in-person events may not resume before the spring or summer of ...

April 20, 2020

In a continued effort to slow the spread of COVID-19, local and state governments have issued orders for nonessential businesses and establishments to close their doors. These orders, combined with the lack of consumers making their way into ...