January 14, 2015

Printable 2014 IRS Form 1040A (for Income Taxes Filed by April 15, 2015)

Printable 2014 IRS Form 1040A (for Income Taxes Filed by April 15, 2015).

January 14, 2015

Printable 2014 IRS Form 1040A (for Income Taxes Filed by April 15, 2015).

January 14, 2015

Already the most-disliked federal agency, the Internal Revenue Service is about to see its reputation take another dive as customer service sinks to worst level since 2001, according to National Taxpayer Advocate Nina E. Olson.

January 12, 2015

As part of end-of-year tax legislation by Congress, the half-million dollar maximum deduction was retroactively preserved for 2014, as were a couple of other related provisions. But these extensions authorized by the Tax Increase Prevention Act ...

January 12, 2015

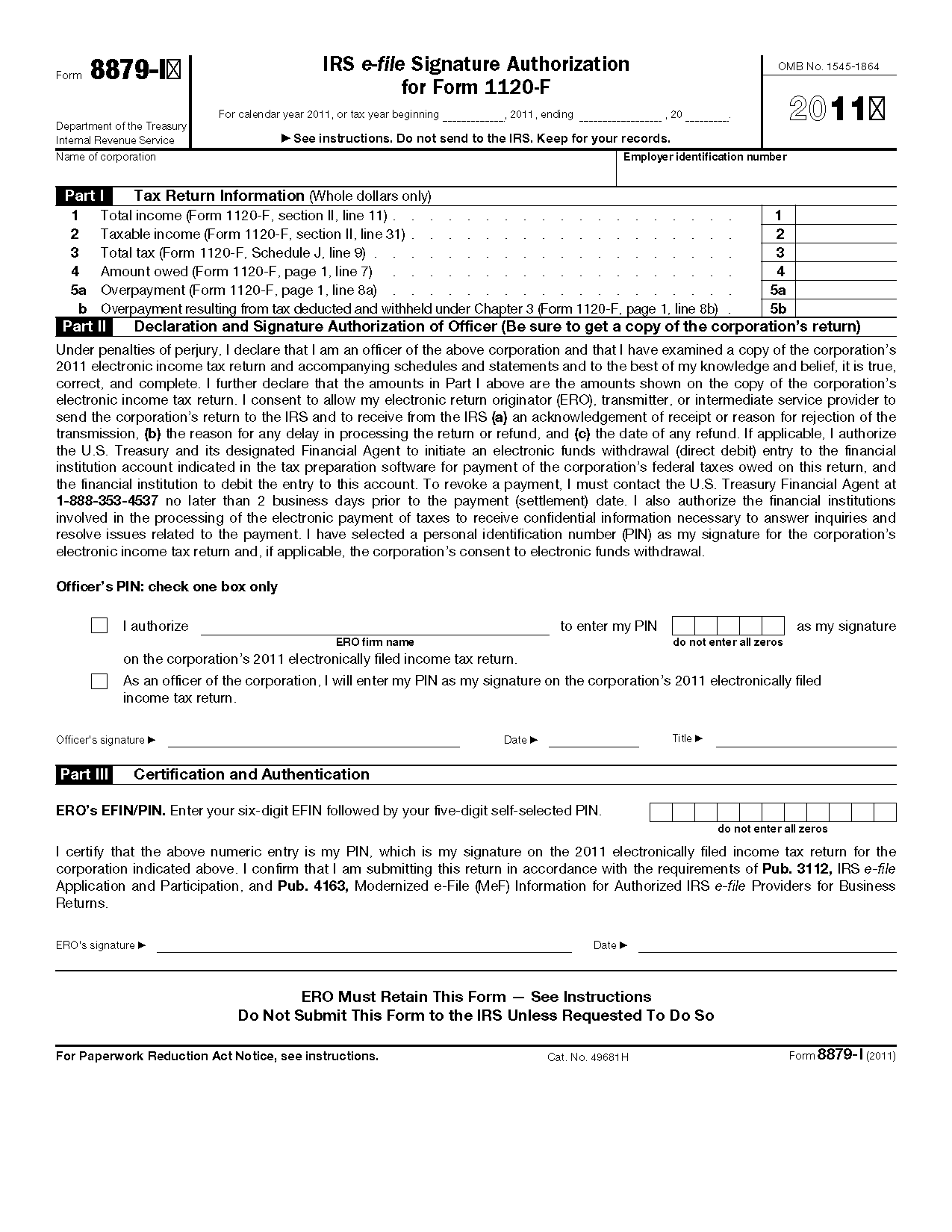

Downloadable and printable version of IRS Form 8879.

January 11, 2015

Printable TY 2014 IRS Form 7004 - Automatic Extension for Business Income Taxes - For Filing in 2015

January 5, 2015

Printable IRS Employers Tax Guide.

January 2, 2015

It's almost that time of year again... Tax season. And one of the top-searched questions each new year, at least until around April 15, is "When can I expect my income tax refund?"

January 1, 2015

The year 2014 may be officially in the past, but there's still time for many Americans to gain notable tax savings.

December 29, 2014

Following the passage of the extenders legislation, the Internal Revenue Service announced today it anticipates opening the 2015 filing season as scheduled in January.

December 12, 2014

The Internal Revenue Service is releasing a revenue procedure today providing rules for the nationwide rollout of post-Appeals mediation for Offer in Compromise (OIC) and Trust Fund Recovery Penalty (TFRP) cases. The IRS Office of Appeals originally ...

December 12, 2014

A new report says the Internal Revenue Service (IRS) used its legislative authority appropriately when it temporarily hired employees at salaries higher than those typically given to Federal Government senior executives.

December 5, 2014

The Internal Revenue Service today announced that interest rates will remain the same for the calendar quarter beginning Jan. 1, 2015. The rates will be: three (3) percent for overpayments (two (2) percent in the case of a corporation); three (3) percent for underpayments; five (5) percent for large corporate underpayments; and one-half (0.5) percent...…