Taxes January 12, 2023

IRS Says 2023 Filing Season to Start on Jan. 23

The IRS is expecting more than 168 million individual tax returns to be filed this year, most coming before April 18.

Taxes January 12, 2023

The IRS is expecting more than 168 million individual tax returns to be filed this year, most coming before April 18.

Taxes January 11, 2023

Fourth quarter 2022 estimated tax payments are due on or before January 17, 2023. Many taxpayers are required to make quarterly estimated tax payments during the year, and others do so voluntarily to stay current on their taxes.

Taxes January 11, 2023

Taxpayers in any county covered by a federal emergency declaration have until May 15 to pay their income taxes.

Taxes January 11, 2023

“We have begun to see the light at the end of the tunnel,” Erin Collins wrote in her latest report to Congress.

Accounting January 10, 2023

Those who supported the original funding bill say the increase will help the agency increase collections on existing tax laws, and therefore increase revenue, by ...

Taxes January 9, 2023

The bill had been a 2022 campaign priority for most GOP Congressional candidates, but to take effect, it would need to next pass in the ...

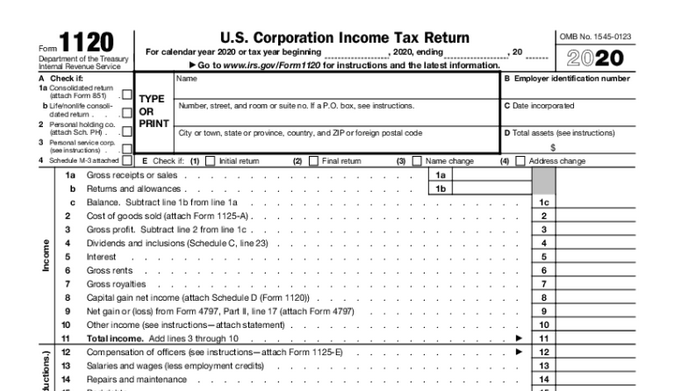

Taxes January 9, 2023

A corporate alternative minimum tax (CAMT) will apply to certain corporations reporting more than $1 billion in annual adjusted book income averaged over a three-year period...

Taxes January 9, 2023

Many of the 12 million refunds come from a change in the way unemployment insurance was taxed.

Taxes January 9, 2023

The first bill in the GOP package aims to rescind the increased funding for the IRS in the Inflation Reduction Act.

Taxes January 8, 2023

As trusted advisors, CPAs have the knowledge and expertise to provide our clients with accurate and timely advice on a wide range of tax and financial matters.

Taxes January 6, 2023

The sports betting organization they managed evaded tens of millions of dollars in excise taxes for three years.

Taxes January 5, 2023

Low-income wage-earners taking the earned income tax credit had a higher-than-expected audit rate, report says.