Taxes December 31, 2025

IRS-CI Releases Its 2025 Highlight Reel

From tax evasion to cybercrime, IRS Criminal Investigation’s top 10 cases of 2025 resulted in multiyear prison sentences and multimillion-dollar financial settlements.

Taxes December 31, 2025

From tax evasion to cybercrime, IRS Criminal Investigation’s top 10 cases of 2025 resulted in multiyear prison sentences and multimillion-dollar financial settlements.

Taxes December 30, 2025

The IRS announced on Dec. 29 that the optional standard mileage rate for business use of automobiles will increase by 2.5 cents to 72.5 cents per mile driven in 2026.

Taxes December 26, 2025

As a result of the new stipulation, the date stamped on mailed items may be several days later than when the mail was actually deposited, raising concerns for taxpayers who rely on the postmark to document the timing of charitable gifts.

Taxes December 26, 2025

The IRS announced tax relief for individuals and businesses in Washington state affected by severe storms, straight-line winds, flooding, landslides, and mudslides that began on Dec. 9.

Taxes December 26, 2025

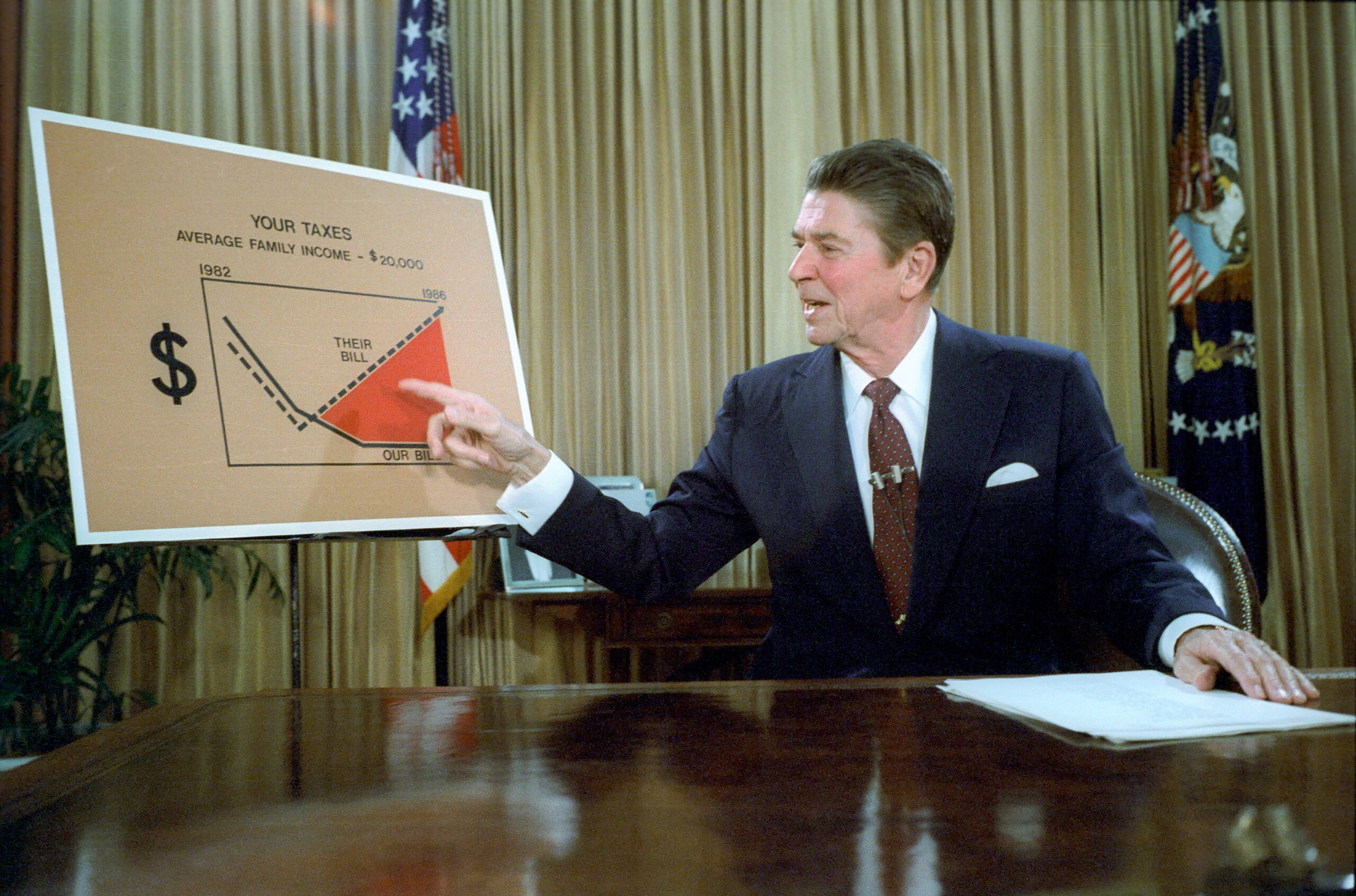

The legendary 1981 Reagan tax cut included a little-known provision called tax indexing, which has been saving taxpayers money ever since—far more money than most of us can imagine.

Taxes December 23, 2025

The IRS Whistleblower Office said Dec. 19 that it's making it easier for whistleblowers to report tax cheats to the IRS with the launch of the new digital Form 211, "Application for Award for Original Information."

Taxes December 23, 2025

Announcement 2026-01, which was issued on Dec. 22, notes that future IRS guidance will explain the process of how eligible taxpayers can submit a dyed fuel refund claim.

Taxes December 22, 2025

The IRS on Monday opened a 90-day public comment period, which ends March 22, for proposed updates to its voluntary disclosure practice, including a more streamlined penalty framework.

Taxes December 22, 2025

Notice 2026-01 provides a safe harbor for businesses that wish to claim the Section 45Q tax credit for qualified carbon oxide captured and disposed of in secure geological storage occurring during calendar year 2025.

Taxes December 22, 2025

This new credit, established under the One Big Beautiful Bill Act, is for contributions to scholarship granting organizations that serve elementary and secondary school students from low- and middle-income families.

Taxes December 18, 2025

The confirmation follows Monday’s posting of a draft IRS Form W-2G, reflecting changes mandated by the OBBBA, which amended federal information-reporting requirements for certain payments, including casino gambling winnings.

Taxes December 18, 2025

Among the most immediate impacts of rescheduling marijuana as a Schedule III drug would be relief from IRS Code 280E, which prevents businesses that handle Schedule I or II substances from deducting routine expenses such as rent, payroll and equipment.