IRS August 8, 2025

IRS Commissioner Billy Long Removed by Trump Two Months After Confirmation

Treasury Secretary Scott Bessent will add acting IRS chief to his duties until Long's replacement is installed.

IRS August 8, 2025

Treasury Secretary Scott Bessent will add acting IRS chief to his duties until Long's replacement is installed.

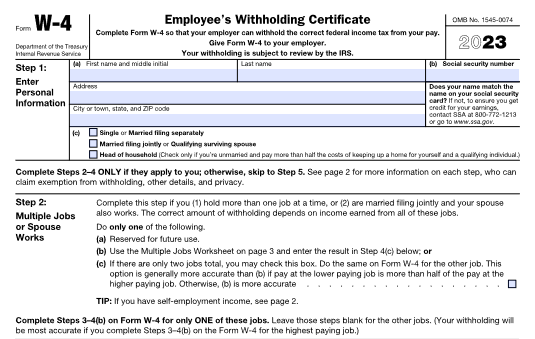

OBBBA Tax Act August 7, 2025

The Internal Revenue Service recently stated that, as part of its phased implementation of the One Big Beautiful Bill Act, there will be no changes to certain information returns or withholding tables for Tax Year 2025 related to the new law.

Taxes August 4, 2025

Ron Wyden, the Senate Finance Committee’s top Democrat, questioned why the IRS had not audited at least $158 million in payments that private equity titan Leon Black made to Jeffrey Epstein between 2012 and 2017 for complex tax-related transactions.

Taxes July 28, 2025

A new IRS memorandum highlights changes aimed at reducing examination times for large corporations while making the audit process more customer-driven, consistent, and efficient.

Firm Management July 28, 2025

O'Donnell, who served two separate stints as acting chief of the IRS before leaving the agency in February, has joined KPMG as a senior managing director within its Washington National Tax practice.

Taxes July 25, 2025

Business Tax Account designated officials must revalidate their accounts by July 29 in order to maintain access, the IRS said on Wednesday.

Taxes July 24, 2025

The slot reporting threshold is governed by an IRS regulation, so the change will not go into effect until the agency updates its rules.

Taxes July 23, 2025

The IRS recently announced tax relief for individuals and businesses located in the city of St. Louis and St. Louis and Scott counties in Missouri after an EF3 tornado caused widespread destruction on May 16.

Accounting July 23, 2025

Americans were asked which type of tax filing and payment relief would be helpful after experiencing a natural disaster.

IRS July 22, 2025

The IRS workforce has been slashed from approximately 103,000 employees in January when Donald Trump began his second term as president to 77,428 in May, with some of the biggest job cuts among tax examiners and revenue agents, according to a new TIGTA report.

Taxes July 21, 2025

Individuals and businesses with addresses in Chaves, Lincoln, Otero, and Valencia counties in New Mexico now have until Feb. 2, 2026, to file various federal tax returns and make tax payments.

Accounting July 21, 2025

In a letter sent to Treasury and the IRS earlier this month, the AICPA requested additional guidance related to catch-up contributions designated as Roth contributions within Section 603 of the SECURE 2.0 Act of 2022.