Taxes April 12, 2023

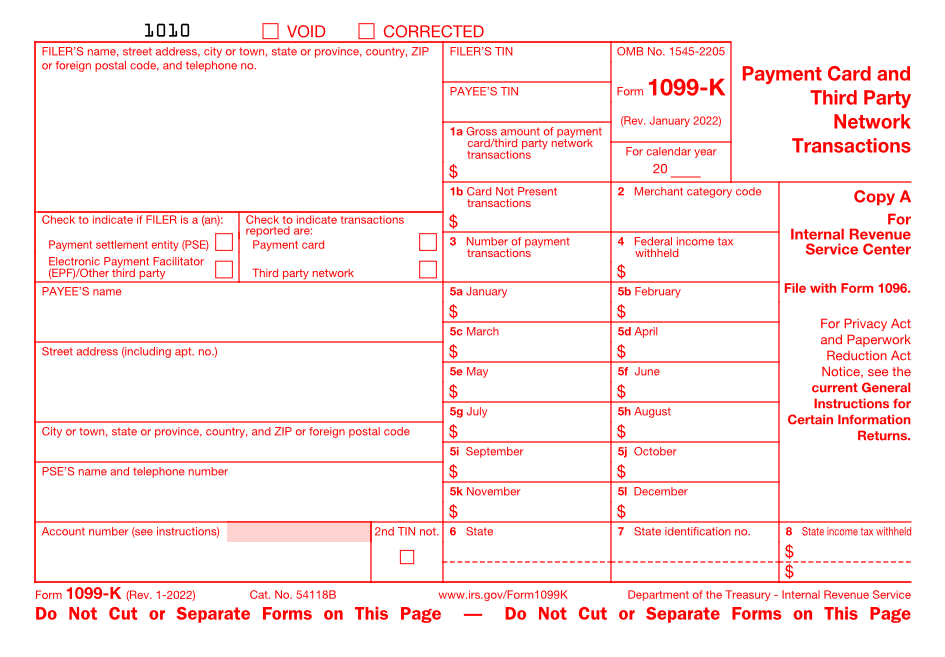

15 Ways Accountants Can Make More Money Under the New IRS Strategic Operations Plan

Now that the IRS has just released its Strategic Operations Plan which lays out the allocation of the funds, you may want to pay close attention to this plan.