Taxes September 1, 2023

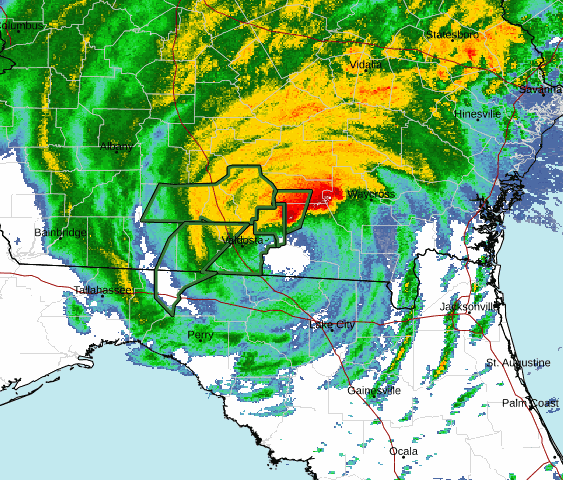

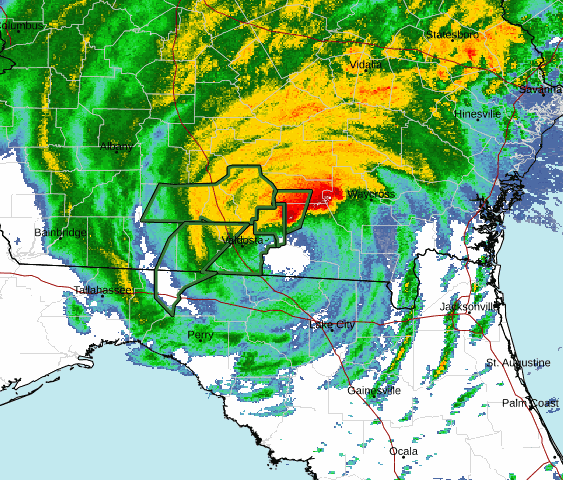

IRS Gives Tax Filing Delay to Hurricane Idalia Victims

These taxpayers now have until Feb. 15, 2024, to file various federal individual and business tax returns and make tax payments.

Taxes September 1, 2023

These taxpayers now have until Feb. 15, 2024, to file various federal individual and business tax returns and make tax payments.

Payroll August 30, 2023

Under proposed changes from the Dept. of Labor, any salaried employee making less than $55,000 per year, or $1,059 per week, would be eligible for overtime. That would be a significant jump from the current cutoff at $35,568 per year.

Taxes August 29, 2023

Under the 2015 Fixing America’s Surface Transportation (FAST) Act, the IRS can deny, revoke or limit a passport if you have a seriously delinquent tax debt.

Taxes August 29, 2023

The proposed regulations include prevailing wage and registered apprenticeship requirements for clean energy projects.

Taxes August 28, 2023

In addition to IRS representation training sessions, the partnership will enable tax professionals to explore adding new revenue streams to their practices with tax resolution services.

Taxes August 25, 2023

The last time the agency increased interest rates on tax overpayments and underpayments was for Q1 of this year.

Taxes August 25, 2023

The proposed regulations are viewed by backers as critical to policing a largely unregulated sector plagued by tax avoidance.

Taxes August 25, 2023

The IRS on Aug. 23 announced 2024 indexing adjustments for important percentages under the Affordable Care Act.

Taxes August 23, 2023

These proposed temporary regulations provide some guidance to the pre-registration filing requirements, as well as the clarification and definition of applicable entities.

Taxes August 23, 2023

When it comes to a corporation’s relationship with its accounting firm, the firm itself is less important than the partner who leads its engagement team in lowering its tax rate.

Taxes August 23, 2023

11 candidates' positions on issues such as the Trump tax cuts, trade with China, energy, banking, Federal Reserve, and inflation.

Taxes August 22, 2023

The heavy highway vehicle use tax is an annual federal excise tax on heavy highway motor vehicles operating on public highways.