September 12, 2023

How to Get a Tax Break for Temporary Work Assignments

The IRS often views business travel expense deductions with a healthy dose of skepticism. Consult with your professional tax advisor to ensure you’re on firm ground.

September 12, 2023

The IRS often views business travel expense deductions with a healthy dose of skepticism. Consult with your professional tax advisor to ensure you’re on firm ground.

September 12, 2023

The guidance also provides general rules for determining a taxpayer's financial statement income and AFSI.

Taxes September 12, 2023

Notice 2023-63 includes interim rules on the capitalization and amortization of specified research or experimental expenditures.

September 11, 2023

To qualify for transportation deductions, you must be traveling away from your tax home to a business location.

Taxes September 8, 2023

A judge has ruled that Intuit Inc., the maker of the popular TurboTax tax filing software, “engaged in deceptive advertising in violation of Section 5 of the FTC Act” and deceived consumers when it ran ads for “free” tax products and services for which many consumers were ineligible.

Taxes September 8, 2023

The agency is opening examinations of 75 of the largest partnerships in the U.S. that on average have over $10 billion in assets.

September 8, 2023

The BIG tax often catches business owners by surprise. Fortunately, however, you may be able to avoid adverse tax consequences with some astute planning.

Taxes September 6, 2023

New IRS guidance marked the second time this year the agency raised the specter of subjecting state refunds to federal income tax.

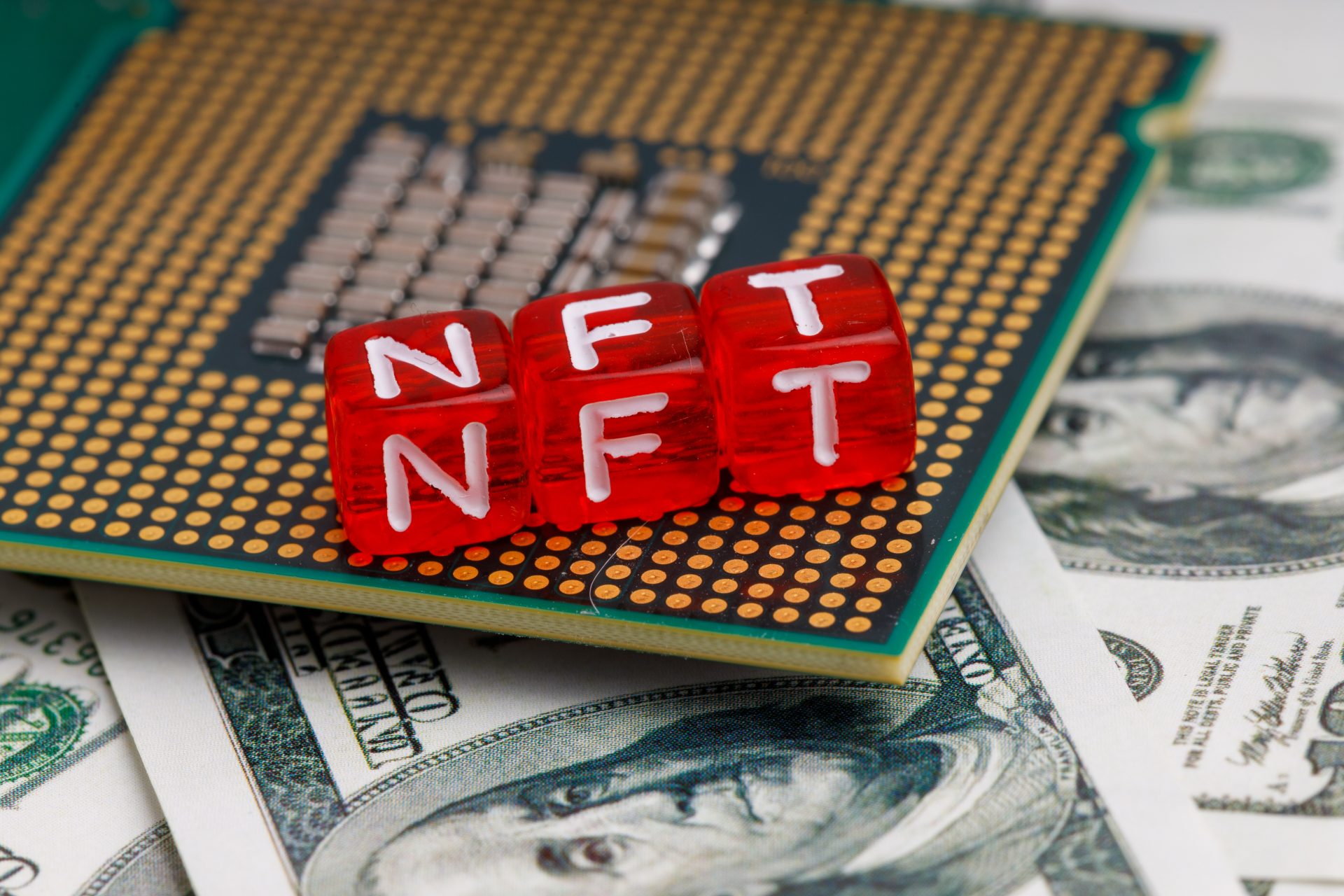

Taxes September 6, 2023

Is the sale of an NFT subject to tax? Should it be? While lawmakers and tax officials worldwide have at least 91.8 million reasons to ensure tax laws account for sales of NFTs and other new tech, crafting tax policies for NFTs is difficult.

Taxes September 5, 2023

Compliance Tracker ensures accurate and timely tax filings, reducing risk of non-compliance and penalties by incorporating trusted data compiled and maintained by Bloomberg Tax’s in-house tax analysts.

Taxes September 4, 2023

The accumulated earnings tax must be paid in addition to the regular corporate income tax. Despite recent threats by Congress to raise the ante, this penalty tax remains at the 20% rate.

September 1, 2023

The guidance is being issued as part of the IRS's efforts to provide additional certainty to states and their residents regarding the federal income tax consequences of state payments made to taxpayers.