Taxes October 3, 2023

Three Complex Tax Issues Businesses are Facing Now

There are a myriad of challenges and changes in the tax codes affecting their business clients each tax season.

Taxes October 3, 2023

There are a myriad of challenges and changes in the tax codes affecting their business clients each tax season.

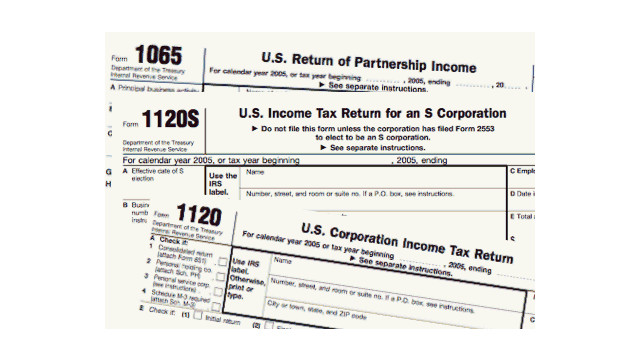

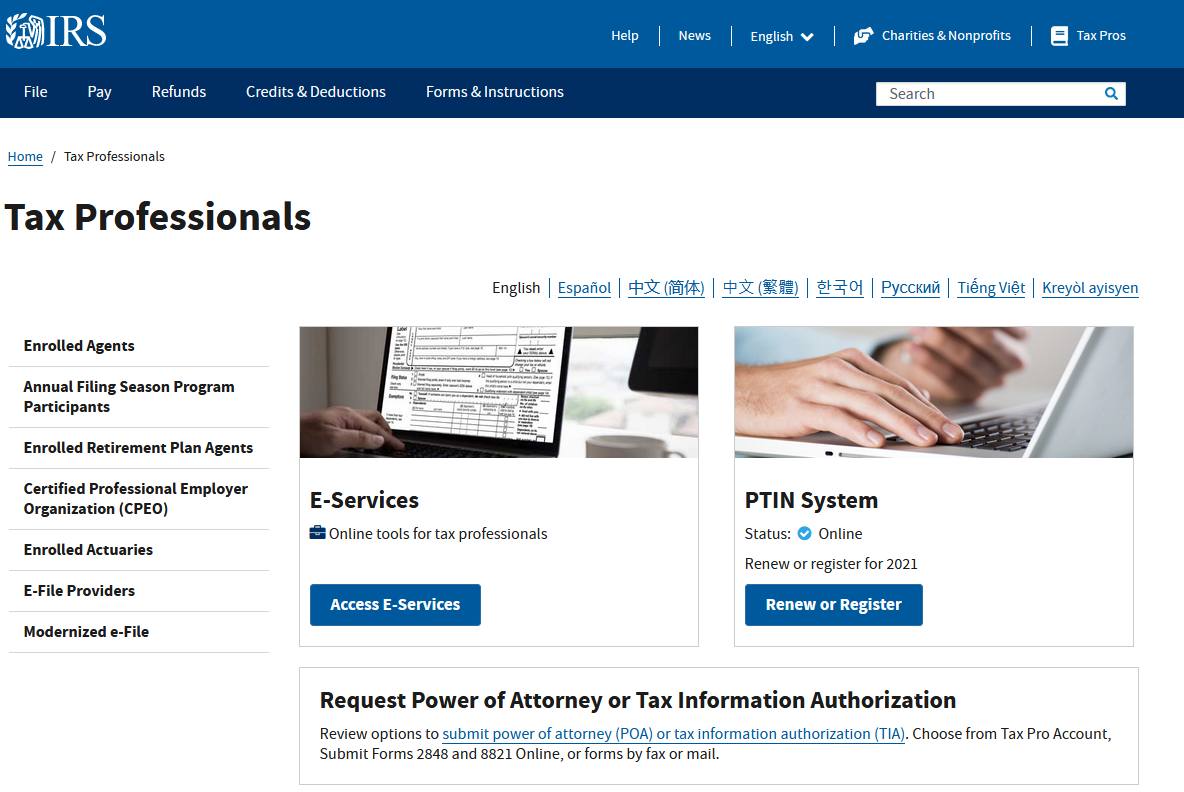

Taxes October 2, 2023

New additions to Tax Pro Account, available through IRS.gov, will help practitioners manage their active client authorizations on file with the Centralized Authorization File (CAF) database.

Taxes September 30, 2023

The Senate overwhelmingly passed bipartisan legislation Saturday to avoid a disruptive U.S. government shutdown, sending the bill to President Joe Biden for his expected signature just hours before a midnight deadline.

Accounting September 30, 2023

The latest House stopgap bill passed with the support of 126 Republicans, while 90 GOP lawmakers voted “no.” Only one Democrat, Rep. Mike Quigley, D-Ill., opposed it, over the omission of Ukraine aid.

Taxes September 29, 2023

Spanish prosecutors claim she failed to pay $7.1 million in taxes in 2018 and is using an offshore company to avoid paying taxes.

Taxes September 29, 2023

Contingency plan calls for the IRS to furlough two-thirds of its workforce and press pause on most core tax administration functions.

Taxes September 28, 2023

The letter goes on to express concern that an October shutdown of the government will likely impact the timely processing of extended 2022 tax returns due by Oct 16, 2023.

Taxes September 28, 2023

The House panel voted along party lines to disclose additional documents related to the probe into the president's son's taxes.

Taxes September 28, 2023

Jack Fisher and James Sinnott designed, marketed and sold to high-income clients abusive syndicated conservation easement tax shelters based on fraudulently inflated charitable contribution tax deductions, promising them deductions 4.5 times the amount the taxpayer clients paid.

Accounting September 28, 2023

In an unexpected portion of his decision, the judge essentially stripped Trump of the ability to run his businesses in New York by canceling his certificates and any controlled by his adult sons.

Taxes September 26, 2023

Chatbots will be used to help answer basic taxpayer questions about three notices in the CP series, the IRS said on Tuesday.

Payroll September 26, 2023

For the bottom 80% of households by income, bank deposits and other liquid assets were lower in June this year than they were in March 2020.