Taxes August 13, 2025

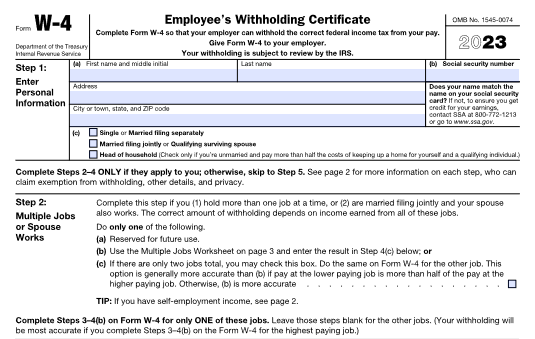

Nevada Dems Seek Clarification from Treasury Department on ‘No Tax on Tips’ Policy

In a letter, Democratic members of Nevada’s federal delegation urged the Treasury Department to address possible shortfalls of the One Big Beautiful Bill Act's "no tax on tips" provision as it’s implemented.