Taxes September 15, 2025

13 States That Don’t Tax Your Retirement Income

Here’s what you need to know about how different states tax retirement income, including the states where you won't pay taxes at all.

Taxes September 15, 2025

Here’s what you need to know about how different states tax retirement income, including the states where you won't pay taxes at all.

Taxes September 15, 2025

More than a quarter of large U.S.-based influencers—those with at least 100,000 followers—reported earning tips, according to a 2024 study by the Creative Class Group.

Advisory September 12, 2025

For firms to succeed, we must adapt our operational strategies to meet these challenges head-on. These are three key factors contributing to the increased demand for tax services.

Taxes September 12, 2025

The One Big Beautiful Bill Act (OBBBA) signed into law earlier this year tweaks the alternative minimum tax (AMT) rules for individuals. Overall, the news for taxpayers is “mixed,” beginning in 2026.

Taxes September 11, 2025

For the first time in history, the new law creates a “floor” for deducting charitable donations deductions. At the same time, it opens up deductions to non-itemizers as well as itemizers.

Taxes September 11, 2025

The report accounts for several new adjustments made under the One Big Beautiful Bill Act (OBBBA) that affect tax planning for taxpayers in 2026 and beyond.

Taxes September 11, 2025

The CTC is now bigger and better—permanently. The new also retains a special tax credit for non-child dependents.

Taxes September 11, 2025

The deduction isn’t just for teachers (although they are the most common benefactors). It may also be claimed by someone who works as an instructor, counselor, principal, or aide for students in K-12.

Special Section: Guide to 2025 Tax Changes September 11, 2025

The new “One Big Beautiful Bill Act” (OBBBA) is enhancing several tax breaks relating to education in addition to increasing family tax credits for raising young children.

Taxes September 9, 2025

Thousands of taxpayers have filed inaccurate or frivolous returns that falsely claim the Fuel Tax Credit and the Sick and Family Leave Credit, often resulting in the denial of refunds and steep penalties, the IRS said Sept. 8.

Payroll September 9, 2025

The rule of 55 can benefit workers who have an employer-sponsored retirement account and are looking to retire early or need access to the funds if they’ve lost their job near the end of their career.

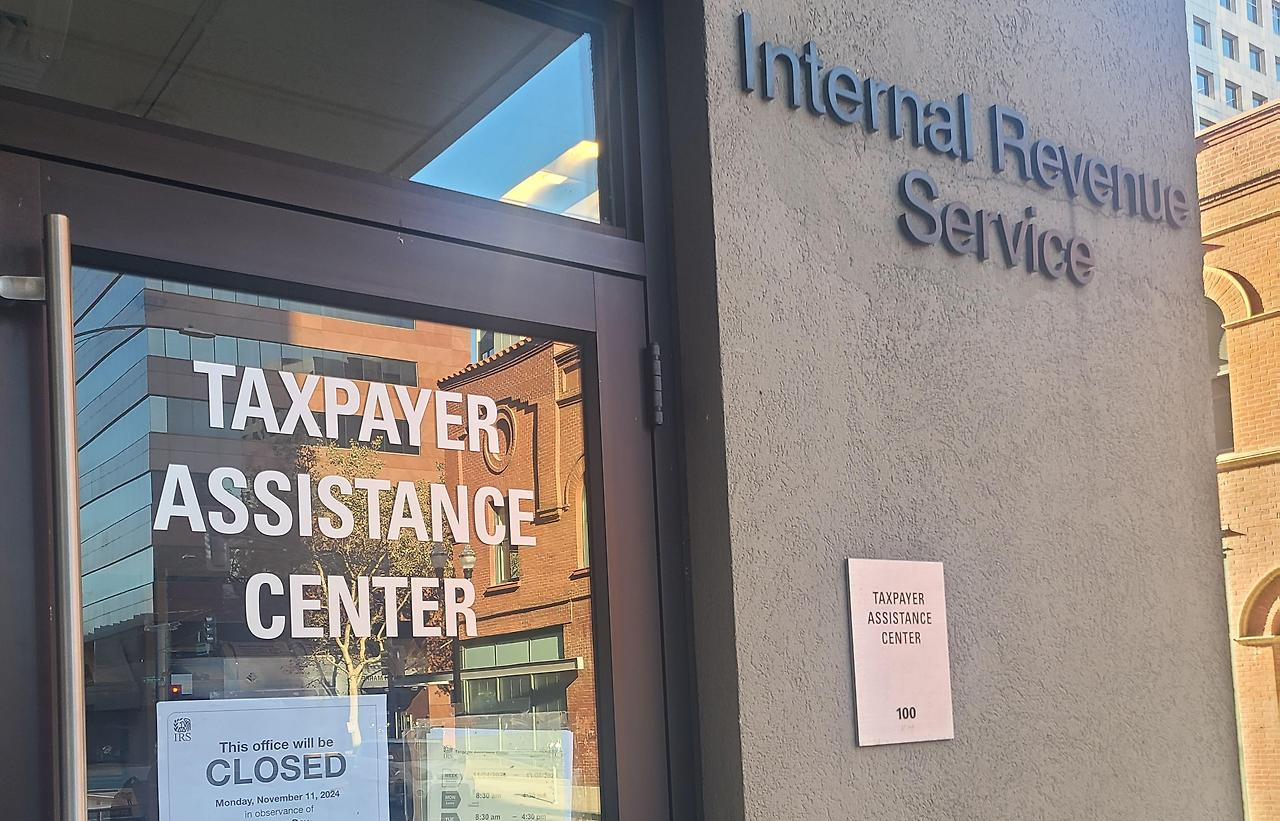

Taxes September 9, 2025

The IRS is reportedly closing nine taxpayer assistance centers in six states later this year in an apparent cost-savings move, as the agency faces a potentially smaller budget for fiscal year 2026.