July 21, 2014

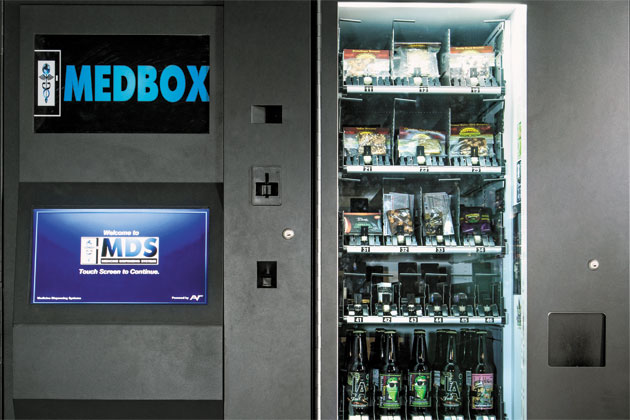

Are Marijuana Vending Machines the Next Step? Doctors are Asking for Them

Are vending machines the next step for marijuana distribution and sales?

July 21, 2014

Are vending machines the next step for marijuana distribution and sales?

July 17, 2014

Thomson Reuters has released the 2014-2015 edition of the Tax Planning Guide, which accountants, lawyers, tax professionals, and financial advisors distribute to clients and prospects.

July 16, 2014

As part of its ongoing efforts to deter identity theft, the Internal Revenue Service has issued final regulations on use of truncated Taxpayer Identification Numbers (TINs). The new regulations, which apply to those who furnish and receive payee statements and tax-related documents, generally follow proposed regulations issued last year, albeit with some modifications.

July 16, 2014

For active and reserve members of the U.S. military, the Internal Revenue Service has released a list of tax tips that cover the tax issues and benefits specific to those in uniform.

July 15, 2014

America's largest professional organization of tax and accounting professionals has had enough with the IRS.

July 15, 2014

When Roderick J. McDavis became Ohio University's president a decade ago, he moved into 29 Park Place, a 7,000-square-foot, 2 1/2-story home at the heart of OU's campus in Athens.

July 10, 2014

A new report by the agency that oversees the Internal Revenue Service says it's time to revise the ubiquitous Form 1040, the form used by individual taxpayers to report their annual income.

July 2, 2014

A 65-year-old New Mexico woman is accused of stealing nearly $400,000 from her employer, including forging more than 200 checks and paying $30,000 in mortgage payments via electronic transfers from her employer's account.

July 1, 2014

The Internal Revenue Service announced on Tuesday that Individual Taxpayer Identification Numbers (ITINs) will expire if not used on a federal income tax return for five consecutive years. The IRS will not begin deactivating ITINs until 2016, however.

July 1, 2014

Small charities have a new, simpler process for applying for tax-exempt status. The Internal Revenue Service has introduced Form 1023-EZ, a shorter application form to help small charities apply for 501(c)(3) recognition.

July 1, 2014

Americans gave more to charities over the past three months than they did during the same period last year, according to the Blackbaud Index, which tracks charitable giving.

June 30, 2014

The operations supporting ADP's SmartCompliance Tax Credits module have successfully completed its first Service Organization Controls (SOC) 2 Type 1 audit.