IRS October 6, 2025

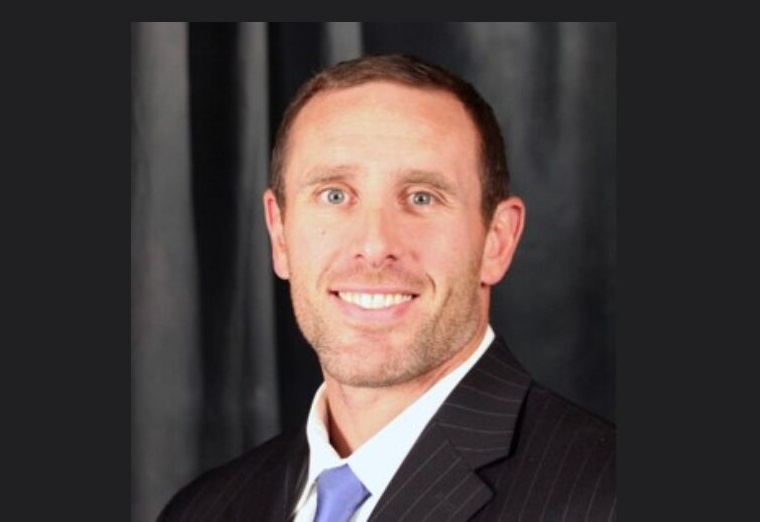

Jarod Koopman Named IRS Acting Chief Tax Compliance Officer

In this acting role, Koopman will oversee IRS compliance operations, including the LB&I division, SB/SE division, TE/GE division, IRS-CI unit, Office of Professional Responsibility, Return Preparer Office, and the Whistleblower Office.