September 3, 2014

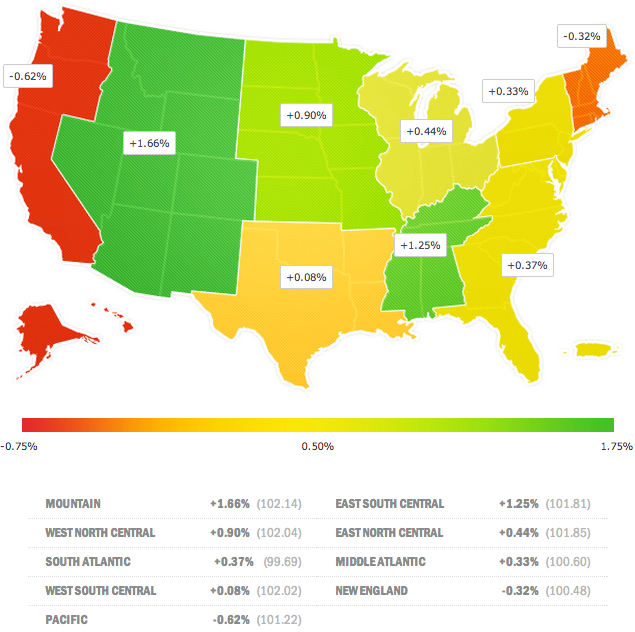

Small Business Hiring Up Across U.S. for First Time in 2014

Small businesses with primarily 1-10 employees, often referred to as micro businesses, saw a month-over-month increase in hiring (0.1 percent) for the first time in 2014, according to the August 2014 SurePayroll Small Business Scorecard. SurePayroll Inc., is a provider of online payroll services to small businesses.