March 4, 2015

Ranking the Best Expense Management Programs

Certify, Concur and Expensify lead rankings of business expense management programs.

March 4, 2015

Certify, Concur and Expensify lead rankings of business expense management programs.

March 4, 2015

The Maryland State Board of Public Accountancy voted unanimously on Tuesday to adopt the final CPE regulations for "nano learning," also known as 10-minute CPE increments. The regulations will be in effect by March 31, 2015. Maryland joins Ohio in ...

March 3, 2015

In celebration of Women's History Month, the National Women's Business Council (NWBC) is kicking off the month with a story-telling project to highlight and share honest advice, important truths and inspiring stories from women entrepreneurs.

March 3, 2015

The rankings consist of the top 30 most affordable programs based on the tuition and fees for earning the degree. Only institutions with accounting accreditation from Association to Advance Collegiate Schools of Business were considered for the rankings.

March 2, 2015

The majority of purchases today are made using debit or credit cards. And in an age of intense competition, many retailers have resorted to offering loyalty or discount cards to reward customers with special pricing and targeted sales offers.

February 26, 2015

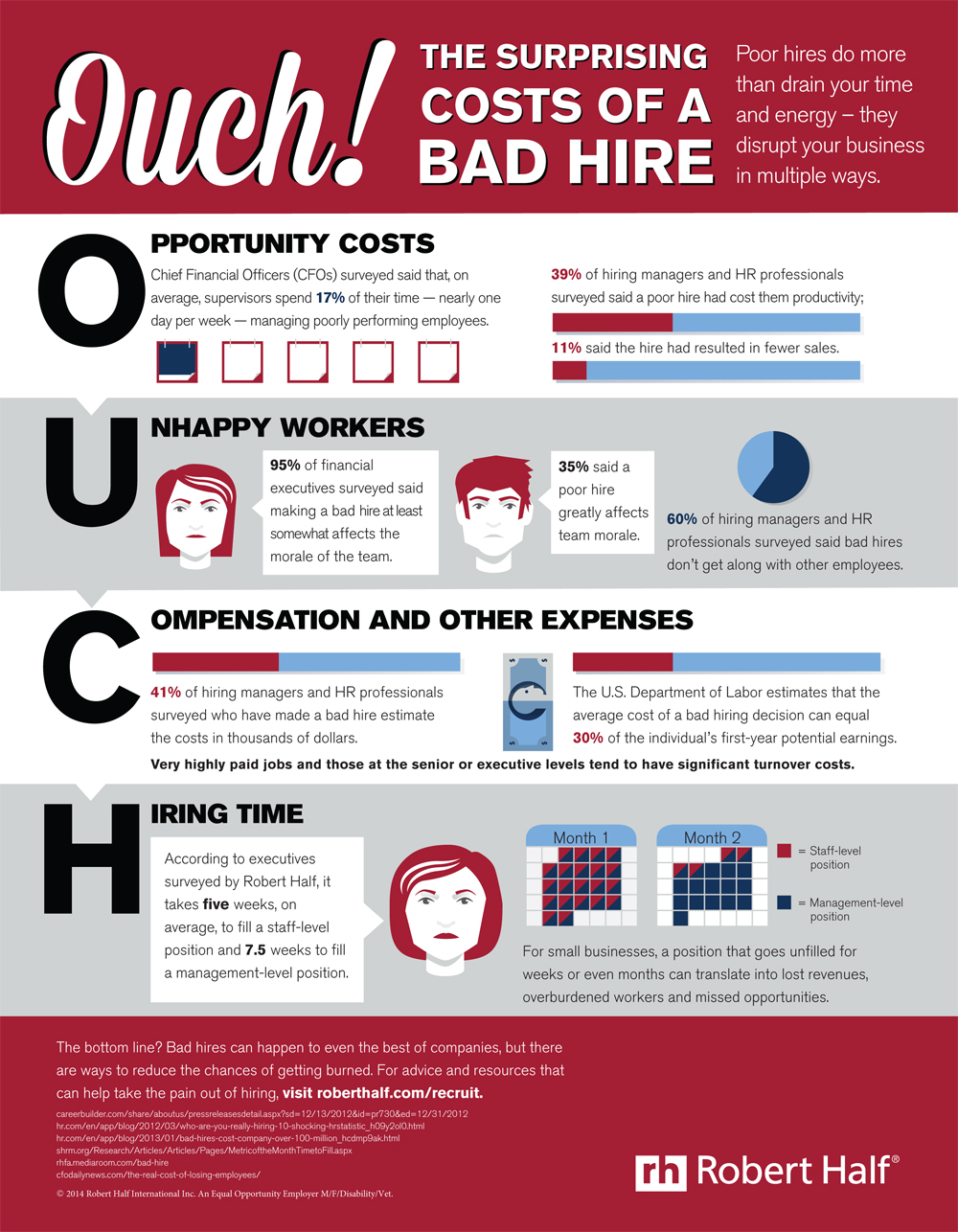

Making a bad hire can be very expensive to organizations. In fact, research suggests (www.blissassociates.com/html/articles/employee_turnover01.html) replacing an employee who doesn’t work out can cost at least 150 percent of that worker’s salary. Still,

February 25, 2015

A well-qualified CIO can and should be a key member of your management team, yet few firms are taking full advantage of this strategic resource. By well-qualified CIO, I am referring to those IT professionals that display both acumen and potential in a va

February 25, 2015

The road show is a national tour of Minority Serving Institutions (MSI) that is focused on engaging students and raising awareness about the possibilities of entrepreneurship, exposing these students to available programs and resources ...

February 25, 2015

In a February 23 letter, FinREC Chairman Jim Dolinar and AICPA Investment Companies Expert Panel Chairman Brent Oswald expressed support for the FASB’s effort to provide consistency and transparency through alignment of disclosure and ...

February 24, 2015

Too many firms shoot from the hip in determining who should become a partner, essentially re-defining promotion criteria every time they discuss the subject. Don’t you owe it to yourselves to spend one paltry hour formalizing, in writing, critically ...

February 23, 2015

Not only are New York City small business owners expecting to see revenue and sales growth, but 70 percent of survey respondents said they are feeling optimistic or excited about their business.

February 23, 2015

For a flat fee, subscribers will now have access to a wealth of webinars, on-demand and eLearning courses on a wide variety of legal and tax topics.