This study was originally published on the Clever Real Estate blog.

While many rent vs. buy calculators give a brief overview of costs, most don’t consider all of the monthly expenses involved in purchasing a home. From repairs and renovations to HOA fees and landscaping, a true cost analysis of homeownership should include all the variables.

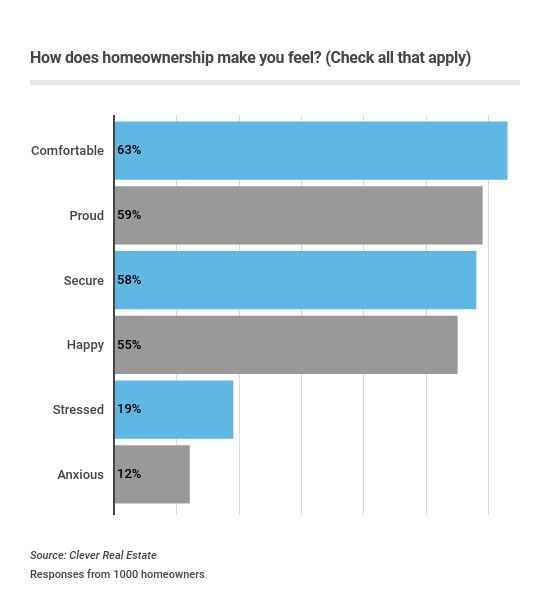

We surveyed 1,000 homeowners to learn not only how much they’re spending to maintain their homes, but also gain a better sense of the incalculable costs and benefits of homeownership.

For those looking for hard and fast numbers, we found that the average homeowner spends approximately $2,676 on maintenance and repairs, $6,649 on home improvements, $2,600 in property taxes, and $1,228 on homeowners insurance every year.

However, these numbers don’t tell the whole story.

Our study dives deep into Americans’ general feelings about homeownership, homeowner savings, time investments, renovation projects homeowners are financing, as well as tax and insurance data broken down on the state level.

- What are the biggest regrets homeowners have?

- Are homeowners taking on too much debt to finance their home projects?

- What renovations and repairs are homeowners planning in 2019?

- Which states are the most expensive in terms of property taxes and home insurance premiums?

Read on for answers to these questions and more!

Key Findings

- The average U.S. homeowner spends $2,676 on maintenance and repairs, $6,649 on home improvements, $2,600 in property taxes, and $1,228 on homeowners insurance every year.

- 59

57

The most common repair projects run relatively cheap, but home buyers should be wary of buying a home with a history of more expensive problems (water damage, structural issues, septic tank leaks, or broken sewer lines). The all-important seller’s disclosure details previous issues, so read up.

Of course, there are additional expenses outside of maintaining the home itself.

Our survey found that 77

Most respondents indicated having to replace multiple appliances, so new homeowners should budget appropriately.

We also found that 67

The cost of these services will vary depending on frequency, but homeowners associations average $2,400 to $3,600 in annual fees according to Realtor.com.

In spite of the additional upkeep required, most homeowners don’t experience buyer’s remorse.

We found that 65

Homeowners who’ve lived in their home for less than four years reported higher rates of home buyer’s remorse. 43

1 in 3 homeowners planning renovations will use financing alone, which can lead to mountains of compounding interest if the debt isn’t paid off quickly.

While home equity loans tend to have lower interest rates, averaging 5.76

The most popular projects include landscaping, new flooring, kitchen remodels, bathroom remodels, and new patios or decks. These projects aren’t cheap: the average kitchen remodel costs $22,134 and bathroom remodels cost around $9,723.

What’s more, there’s a significant difference between what homeowners anticipate spending on planned projects and actual reported spending.

Homeowners often spend two or three times as much for a renovation project than budgeted.

“Even seemingly small projects that you do yourself with no labor costs wind up costing more than you expect. You oftentimes have to buy or rent a tool to do a repair and even seemingly small/cheap repairs wind up costing a good buck.” —John Frigo, new homeowner

Our survey found that 1 in 3 homeowners were surprised by the cost of maintaining their home.

Where You Live Matters (A Lot)

“Location, location, location”

Taxes are an unavoidable part of homeownership, and they’re an important factor in the infamous “rent vs buy” debate. The average homeowner in the U.S. pays 1.12

These property taxes add up quickly — a homeowner in New Jersey pays five times as much on $206,000 home than a homeowner in Alabama!

Homeowners in New Jersey, New Hampshire, Connecticut, Massachusetts, and New York are hit hard by high property values and above average real-estate tax rates.

However, Carolyn L. Dessin, Professor of Law at University of Akron notes:

“It’s important to remember that level of tax is often tied to level of service — low taxes may mean weaker street maintenance, less funding for schools, etc.”

Similar rules apply for homeowners insurance: Homeowners in states that are prone to natural disasters like tornadoes

and earthquakes tend to pay the most for home insurance.

Homeowners can tweak their insurance policy to accommodate their budget by increasing their deductible or shopping around, but location is the biggest factor insurers use to determine risk — and costs.

A higher deductible also creates greater risk for the homeowner; when something serious does go wrong, you’ll be footing more of the bill.

=======

This study was originally published on the Clever Real Estate blog.

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more…Subscribe Already registered? Log In

Need more information? Read the FAQs