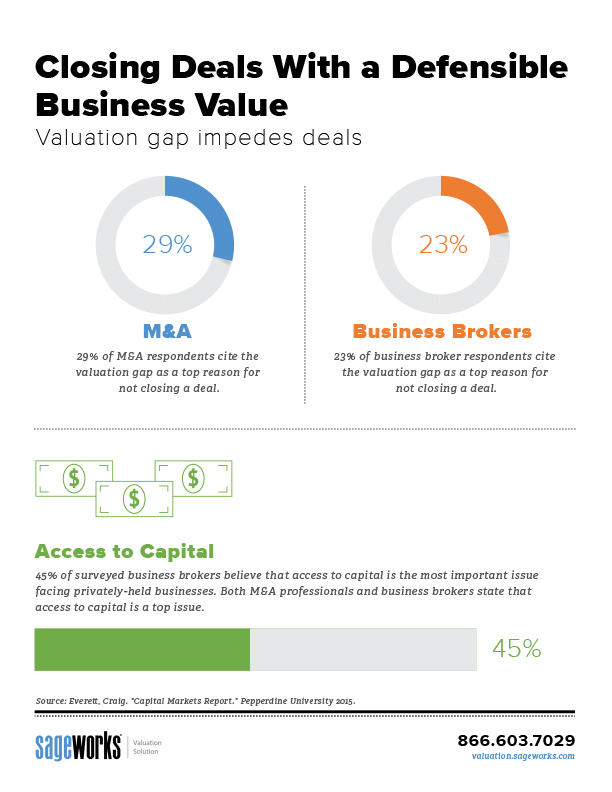

From the lack of proper documentation to a sudden change in the market, there are many reasons businesses fail to sell. One of the primary issues facing the sale of businesses is the valuation gap. A valuation gap is the difference between the owners perceived value and the actual market value.

For example, a business might not trade hands because the owner is not willing to sell at a price that is lower than his perceived value. On the flip side, a buyer might not be willing to purchase a business at its selling price because they have reasonable doubt of the proposed value.

M&A and business brokers both report this reason alone as top reason for a deal not closing. In order to avoid having deals fall apart, it is important for business owners to have a clear understanding of the value of their business that can be presented and defended to potential buyers. Using this as a motivating factor in presentations with potential clients can increase your chances of winning a new client. If a potential client wants to sell his or her business at a particular value, it is best that they have certainty as they move towards the ideal date they wish to sell.

After delivering a valuation to a client, if they don’t like the current value of their business, consider providing tips for improving business value. For example, by simply increasing the businesses cash flow or access to capital, a business may be able to increase its value. This approach can turn a one-time valuation into repeat business for reassess how a business has been progressing after it has made vital changes.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs