Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

August 4, 2015

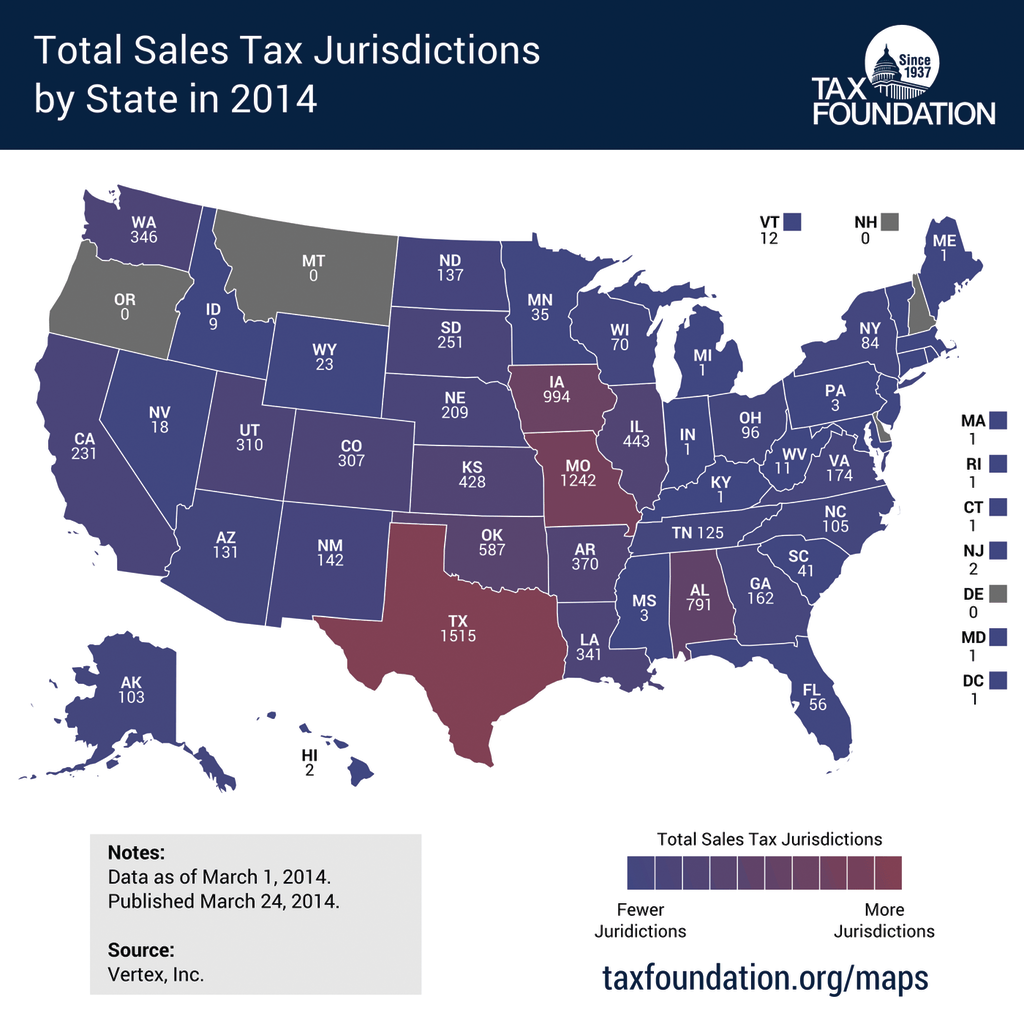

The U.S. average combined sales tax rate shrunk marginally in the second quarter despite a 30 percent increase in new local indirect taxes, according to the latest ONESOURCE Indirect Tax report from Thomson Reuters.

August 4, 2015

If Hillary Clinton is elected president of the United States next year, she’s going to have to take a pay-cut. In an effort to provide greater transparency in her presidential bid, the Democratic frontrunner released eight years worth of tax returns on July 31, all of them joint returns filed with her husband, former President...…

August 4, 2015

Cocuy, Burns & Co., P.A., a CPA and consulting firm in Wellington, Fla. and Templeton & Company, LLP, a leading South Florida-based firm, combined practices effective August 1, 2015. Juan Cocuy and Tom Burns became partners in the newly combined firm...

August 2, 2015

The field for next year’s presidential derby is crowded and prospective candidates have started jockeying for position. One of the main issues that can set these politicians apart is tax reform. Some candidates have already unveiled detailed proposals ...

July 31, 2015

Currently, the tax return due date for calendar-year partnerships is April 15th, the same the due date for individual returns. The law changes the deadline to March 15th for calendar-year partnerships and the 15th day of the third month following the ...

July 30, 2015

Koskinen stepped into the limelight in 2013 when President Obama appointed him to succeed Daniel Werfel, who in turn had replaced Acting IRS Commissioner Steven Miller while the Tea Party scandal unfolded. The current head honcho at the IRS had ...

July 30, 2015

The ONESOURCE Indirect Tax engine technology automatically provides estimates as items are placed into the hybris order. Detailed tax calculations are provided at the time of checkout, and users can keep track of tax liabilities for downstream compliance.

July 29, 2015

“Tax planning” is one of those things we all say we do. But how many of us really do it right, and do it for profit? TaxCoach gives you a comprehensive system for giving clients tangible tax planning that delivers tangible results.

July 29, 2015

Some of New York’s most ambitious young CPAs will gather in Midtown Friday for NextGen 2015, an annual interactive career development conference hosted by the New York State Society of Certified Public Accountants.

July 29, 2015

A 2015 survey of travel managers found that more than 50 percent say the booming on-demand and sharing economies are a top trend impacting travel programs.

July 27, 2015

I know, I know…the subjects of fun summer camp and “funless” income tax preparation don’t exactly go together as well as toasted ‘mallow and graham. But for as painful as taxes might be, there is some value here for anyone that sent a child to camp last summer, or is planning to in the coming months....…

July 27, 2015

Recently, the Department of Labor (DOL) has released proposed rules to update the exemptions from overtime.