Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

September 15, 2015

The Avalara Sales Tax Compliance App provides an automated sales tax calculation and return filings compliance solution within the familiar QBO interface. It’s cloud-based and always up to date, ensuring that sales tax rate, rule and boundary ...

September 15, 2015

Paper checks are dangerous. They represent a serious fraud risk. Does this risk worry you? According to a survey of 540 accountants and bookkeeping professionals, the answer is probably yes.

September 15, 2015

Navient has been awarded a performance-based contract from the Indiana Department of Revenue. Under the terms of the contract, Navient will assist with the Tax Amnesty 2015 program, which allows taxpayers who have past-due taxes a limited-time ...

September 14, 2015

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

September 10, 2015

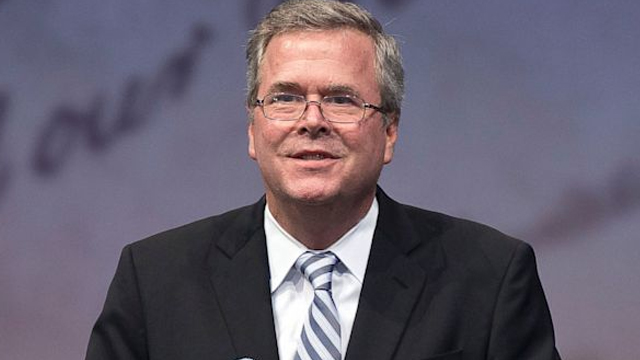

Bush unveiled his long-awaited tax reform plan against the backdrop of a North Carolina factory. Unlike other approaches from his conservative brethren, Bush went out on a limb in proposing sweeping changes that would slash taxes for millions of ...

September 10, 2015

The survey found that, despite the nearly universal feeling among college students about the importance of personal financial management skills – 99 percent said they were either extremely or very important –they are not actively taking steps to ...

September 10, 2015

Planner CS is part of the CS Professional Suite of tax products from Thomson Reuters. Part of the CS Professional Suite of tax, accounting and practice management applications. Planner CS offers full integration with other Thomson Reuters while also ...

September 10, 2015

ProSystem fx Planning is part of the ProSystem fx Suite of products from CCH. ProSystem fx Planning integrates with other CCH tax products. ProSystem fx Planning can also be used as a stand-alone product. While not currently available as an online ...

September 10, 2015

BNA’s Tax Planner is available as either a desktop product or as web-based software, which is hosted by Bloomberg BNA. BNA’s user interface has a menu bar at the top of the screen that offers access to various program functions.

September 10, 2015

Drake Tax Planner is a good fit for firms that have less complicated tax planning needs. Designed for both individuals who wish to map out their own tax plan, as well as firms providing tax planning services, the product offers straightforward tax ...

September 9, 2015

Assuming the client meets all the requirements of Section 121 and the gain doesn’t exceed the allowable limits, the federal income tax bill is zero. Right? Not always. As a new case handed down by the Eighth Circuit Court illustrates, a taxpayer may ...

September 9, 2015

With over 50 tax provisions on the table to be extended through the end of 2016, it’s definitely not too early to begin planning scenarios on how those provisions, if passed, will affect your client’s tax liability.