Taxes January 28, 2026

After ‘Smooth’ 2025 Tax Season, Taxpayer Advocate Anticipates Challenges This Year

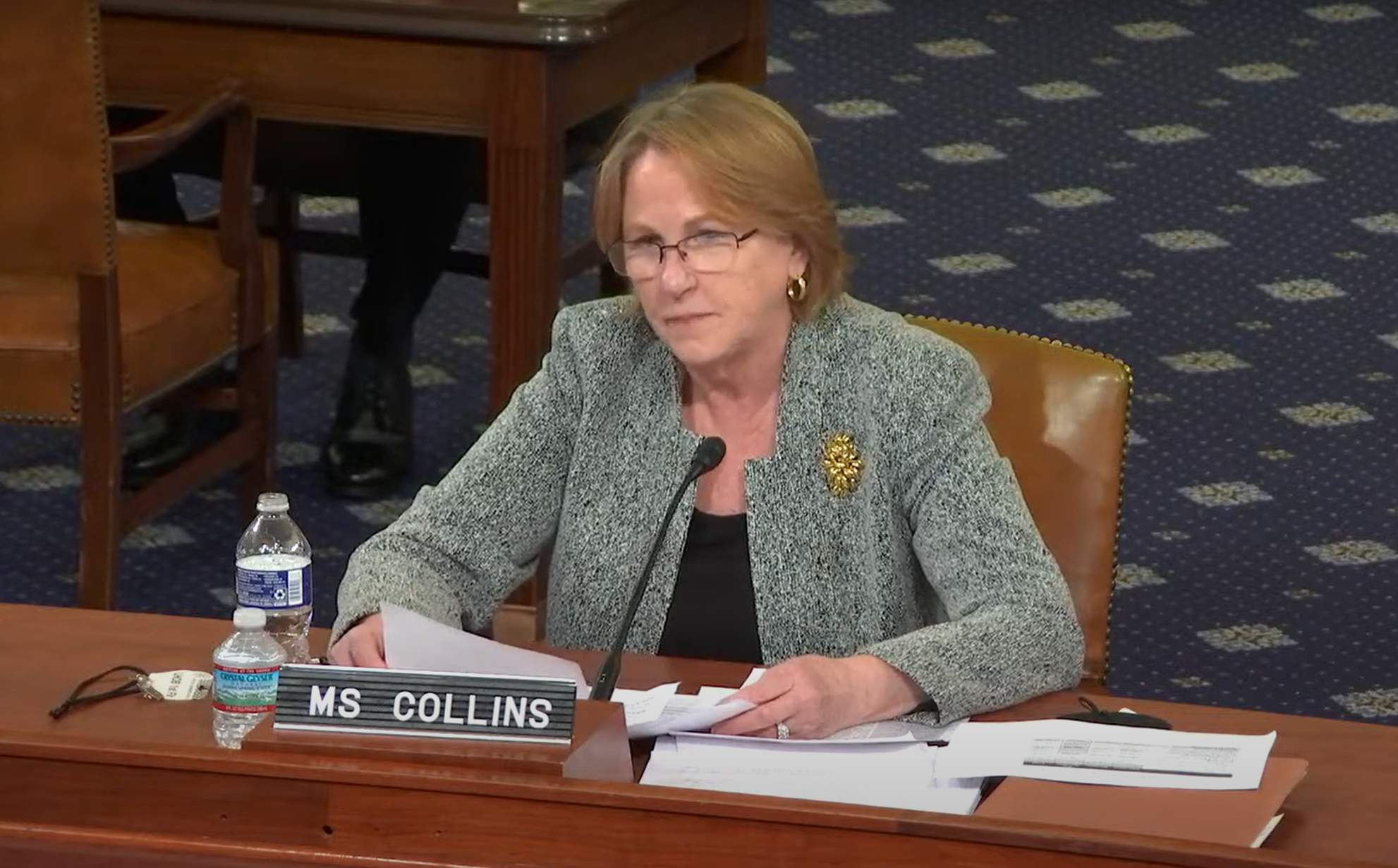

As the IRS enters the 2026 tax season facing workforce reductions and implementing major tax law changes, National Taxpayer Advocate Erin Collins warns in a new report that taxpayers could encounter more challenges when filing their taxes this year.