Accounting February 28, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 28, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

March 6, 2026

March 6, 2026

Taxes December 9, 2025

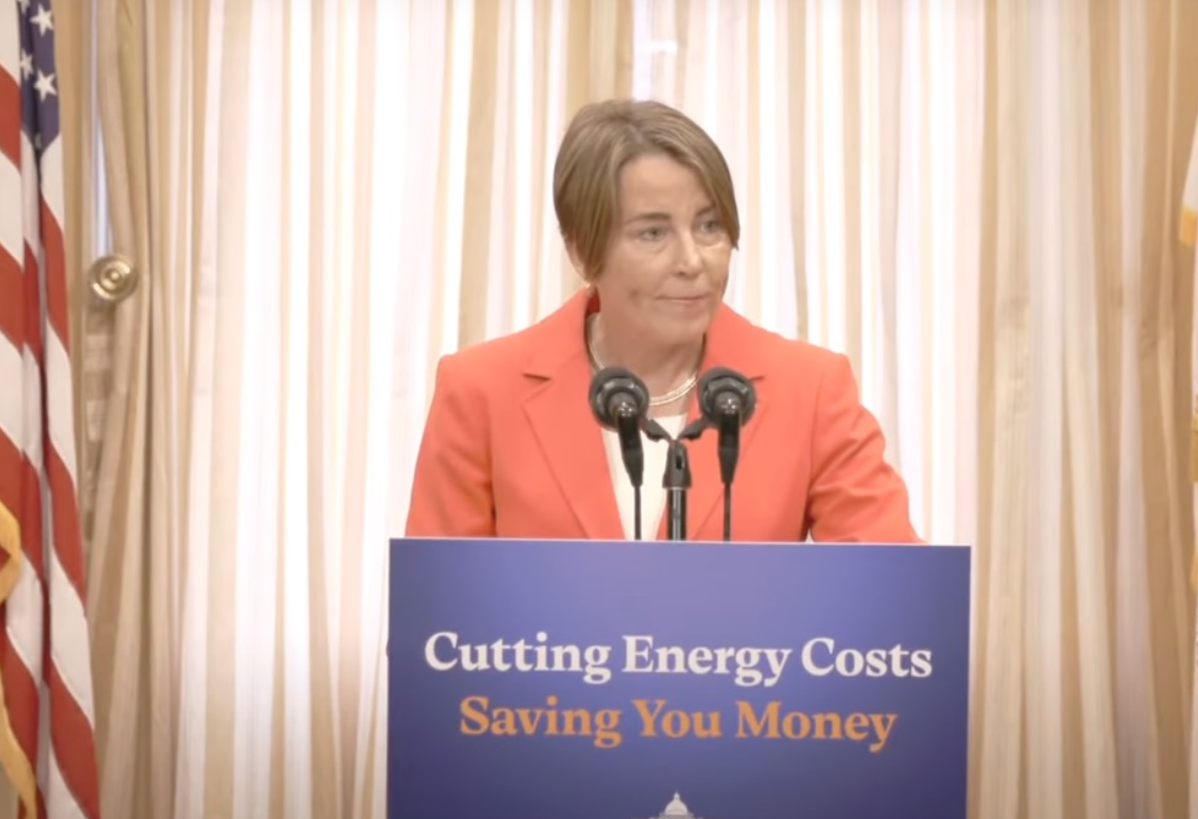

Gov. Maura Healey on Tuesday called on Congress to approve an extension of Affordable Care Act tax credits, warning that health care costs for millions of Americans would skyrocket if lawmakers fail to act.

Taxes December 9, 2025

A Michigan judge ruled against marijuana businesses in the state Dec. 8, rejecting their arguments that a new 24% wholesale tax on their products, imposed by the Legislature as part of a road-funding deal, should be immediately blocked.

Technology December 9, 2025

Ramp has launched 1099 filing directly inside its Bill Pay product, giving businesses a fully integrated solution to prepare and file forms 1099-NEC and 1099-MISC in just a few clicks.

Taxes December 8, 2025

Republican U.S. Sens. Bernie Moreno of Ohio and Susan Collins of Maine are introducing legislation to extend the tax credits for two years while imposing new restrictions on eligibility.

Taxes December 8, 2025

Even if you never claim a tax deduction, the federal government may still know which charities you support.

Taxes December 8, 2025

The suggestions include recommendations to help alleviate time compression constraints currently impacting the ability of tax practitioners to prepare complete and accurate returns for PTEs, specifically those with tiered structures.

Legislation December 8, 2025

For CPAs, accountants, and tax professionals, the OBBB delivers sweeping reforms, some long-awaited from the Tax Cuts and Jobs Act (TCJA) of 2017 and some unexpected.

Taxes December 6, 2025

With an S corporation, the owners are of the business essentially taxed like partners in a partnership. In contrast, C corporation owners must cope with “double taxation” where income is first taxable to the corporation and then distributions are taxed to the owners.

Taxes December 5, 2025

The federal health insurance exchanges established by the Affordable Care Act allowed the enrollment of fake beneficiaries and the payout of accompanying premium subsidies, a Government Accountability Office report published Wednesday found.

Taxes January 5, 2026 Sponsored

Filing corrected returns can be confusing—but it doesn’t have to be. Join Amanda Watson, EA, for a practical session designed to help you confidently navigate amended and superseded returns.

Taxes December 4, 2025

All client uploads, communications, and workpapers sync across Karbon’s platform for a unified experience spanning contacts, jobs, client tasks, and billing within the single client portal experience, Karbon for Clients.

Taxes December 4, 2025

Sen. Elizabeth Warren and Rep. Donald S. Beyer Jr. are leading opposition to a potential regulatory carve-out from a new minimum tax on corporate profits that critics say could generate an unjustified windfall for big companies.