Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Payroll March 13, 2023

73% of workers with a side hustle are actively thinking about quitting their job. 60% of workers said that they would rather quit their job than return to the office five days a week.

Accounting March 13, 2023

The Treasury Department, Federal Reserve and Federal Deposit Insurance Corp. jointly announced the efforts aimed at strengthening confidence in the banking system

Taxes March 13, 2023

Republicans on the Ways and Means Committee gave the president’s latest budget request an icy reception.

Taxes March 13, 2023

From tight deadlines to too much work, achieving work-life harmony during the busy season can be challenging.

Taxes March 10, 2023

The new case involves a complex series of transactions where three brothers intermingled their business and personal interests.

Taxes March 10, 2023

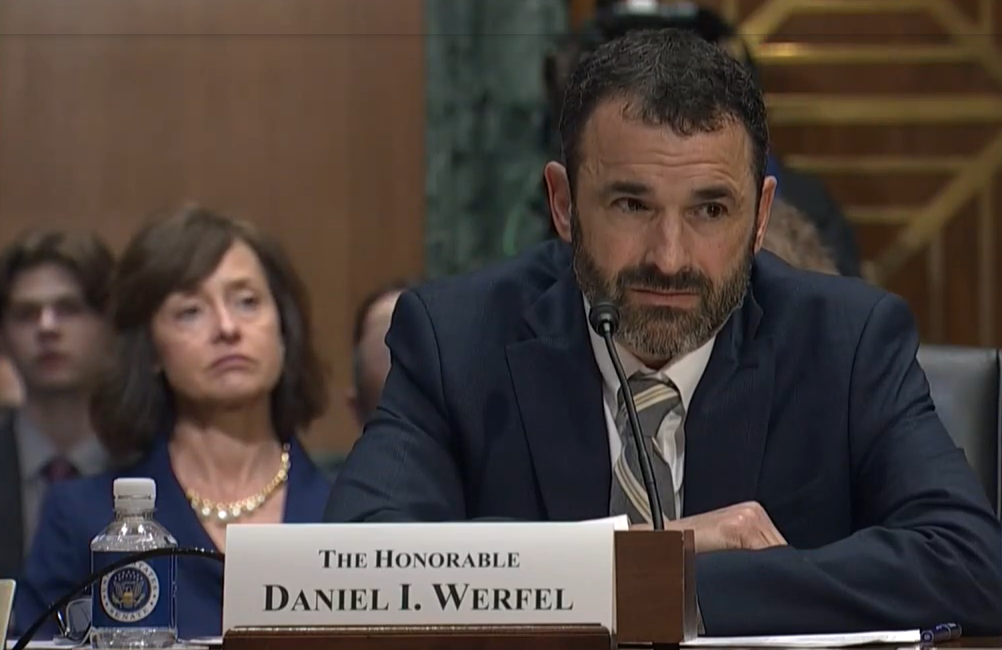

“He’s extremely well-suited for his current assignment,” Mark Everson, IRS commissioner from 2003-07, said about Werfel.

Taxes March 9, 2023

The new deadline of Oct. 16 applies to California and federal individual and business tax returns and payments.

Taxes March 9, 2023

The Senate voted 54-42 to confirm Werfel, a former acting IRS commissioner under the Obama administration.

Taxes March 9, 2023

Joe Manchin called Daniel Werfel “supremely qualified” but has “zero faith” he would have autonomy in the post.

March 8, 2023

The research uncovered three consistent pain points among survey respondents. In this post, we’re highlighting the findings specific to enterprise-level companies.

Taxes March 8, 2023

The Inflation Reduction Act reintroduces the corporate AMT, but with major changes, and it only applies to certain corporations, but a company only needs to pass the book income test once to be subject to AMT.

Sales Tax March 7, 2023

While you focus on your business, Avalara stays on top of legislative and policy changes that can affect your tax compliance.