Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes June 21, 2023

In her midyear report to Congress, National Taxpayer Advocate Erin Collins shared several IRS improvements this filing season.

Accounting June 21, 2023

Twenty percent of respondents said their firm or company has warned employees against the unauthorized use of generative AI at work.

Taxes June 20, 2023

House Democrats’ latest proposal to expand the child tax credit includes a new feature: a $2,000 payment for newborn babies.

Accounting June 20, 2023

Avalara certified integration partners have met criteria developed by Avalara for performance and reliability.

Small Business June 20, 2023

Among parents, nearly all (94%) want their children to forge their own path, rather than follow in their footsteps.

Payroll June 20, 2023

The grant, which allocates $250,000 annually over four years, will support job training and workforce development programs in key markets where Paychex has a high concentration of employees.

Taxes June 20, 2023

Hunter Biden has been charged with illegally possessing a handgun in 2018 as well as two tax misdemeanors, for failing to file and pay taxes on time in 2017 and 2018.

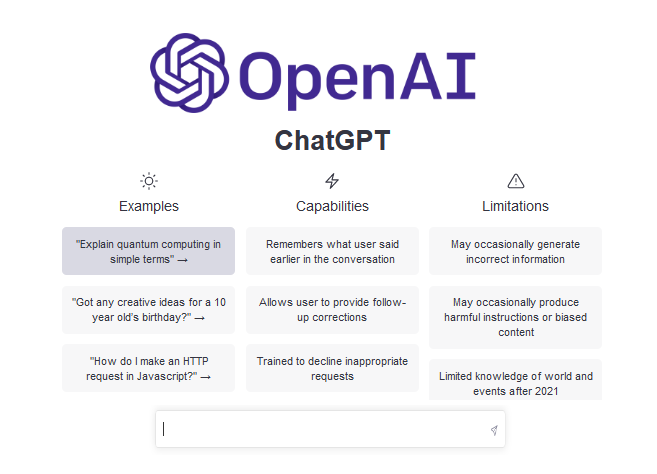

Accounting June 15, 2023

Avalara is the first tax compliance software provider to work with OpenAI to use its protocol to build an integrated plugin for ChatGPT.

Technology June 15, 2023

In addition to training sessions for IRS representation, the partnership will enable attorneys and law firms to explore adding new revenue streams to their practices with tax resolution services.

June 15, 2023

The proposal would gradually raise the age at which future retirees can claim full Social Security benefits from 67 to 69.

Taxes June 15, 2023

The IRS miscalculated 2021 child tax credit payments for thousands of eligible taxpayers as of May 5, 2022, TIGTA said.

Taxes June 15, 2023

Here are several key points about the home sale exclusion that you should know about before you hand over the keys.