Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes September 14, 2023

A rash of bogus ERC claims in recent months has prompted the IRS to put the program on hold through at least the end of 2023.

September 14, 2023

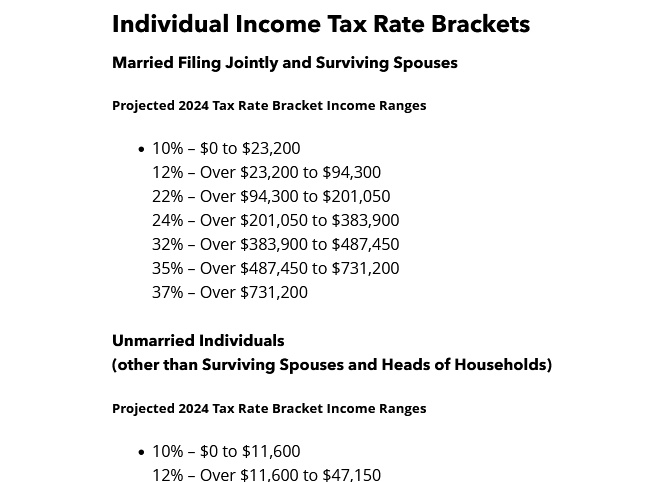

This year’s report projects that several key deductions for taxpayers will see notable year-over-year increases, with the foreign earned income exclusion ...

Taxes September 14, 2023

The AICPA has provided resources and information to its members to warn their clients of red flags that could indicate that a vendor is dishonest and discourage ...

Firm Management September 14, 2023

campaign, a collaborative effort between Feeding Georgia and the Georgia Society of Certified Public Accountants (CPAs), raised an impressive $347,537.38 - the equivalent of nearly 1.4 million meals.

Payroll September 13, 2023

Pay is beginning to catch up in the race, and since May, has been rising faster than inflation after losing ground for more than two years.

Taxes September 13, 2023

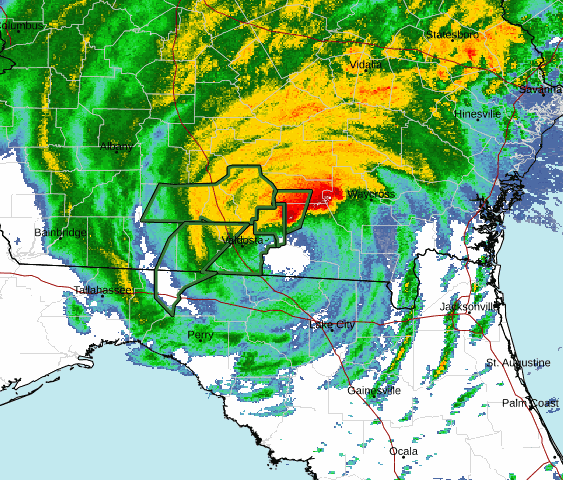

Affected individuals and businesses will have until Feb. 15, 2024, to file returns and pay any taxes that were originally due during this period.

Accounting September 13, 2023

The guide offers tips to help safeguard loved ones, health, property, and crucial records.

Taxes September 13, 2023

SAP Endorsed Apps are premium certified by SAP with added security, in-depth testing, and measurements against benchmarks results.

Taxes September 12, 2023

The question at the heart of the case is whether Mayo Clinic should be considered an educational institution for tax purposes.

Payroll September 12, 2023

A Kansas woman pleaded guilty on Sept 1, 2023, to willfully failing to account for and pay over employment taxes to the IRS.

September 12, 2023

The IRS often views business travel expense deductions with a healthy dose of skepticism. Consult with your professional tax advisor to ensure you’re on firm ground.

September 12, 2023

The guidance also provides general rules for determining a taxpayer's financial statement income and AFSI.