Accounting February 28, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 28, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

March 6, 2026

March 6, 2026

Taxes January 15, 2026

An easy-to-view chart with no data entry. See when you will probably get your 2026 IRS income tax refund.

Taxes January 15, 2026

Gov. Mike Kehoe wants Missouri voters to phase out the state's income tax and fill the resulting $9 billion budget hole with an expansion of the state’s sales tax base.

Taxes January 14, 2026

The planes were seized from Thomas Shaughnessy, who has been "uncooperative" with the IRS as it attempts to collect the just over $1.6 million he owes from 2014, according to court records.

Taxes January 14, 2026

Sixty-one percent of Washingtonians back the idea of a 9.9% tax on incomes greater than $1 million, versus just 29% opposed, according to a poll from Northwest-based DHM Research.

Technology January 14, 2026

Armanino said Wednesday it has launched TaxAdvantage, which the top 20 accounting firm said is a one-stop technology platform designed to solve the pain points of corporate tax management.

Taxes January 13, 2026

In a letter to the chairmen and ranking members of both tax-writing panels in Congress, ADP says it supports a five-year extension of the WOTC, which has been proposed in legislation by lawmakers in the House and the Senate.

Taxes January 13, 2026

Misuse of these tools for complex financial decisions is creating a growing and costly risk, one accountants and bookkeepers fear will intensify as more firms treat AI outputs as reliable guidance.

General News January 13, 2026

Adam Beckerink, who is accused of throwing his estranged wife to her death down a South Loop luxury condo stairwell, will have a full detention hearing Jan. 16, a Cook County judge ordered, after making a first, brief appearance Tuesday.

Taxes January 12, 2026

Taxpayers can begin preparing their taxes now and then have the system electronically file the return once the IRS officially starts accepting them later this month.

Taxes January 12, 2026

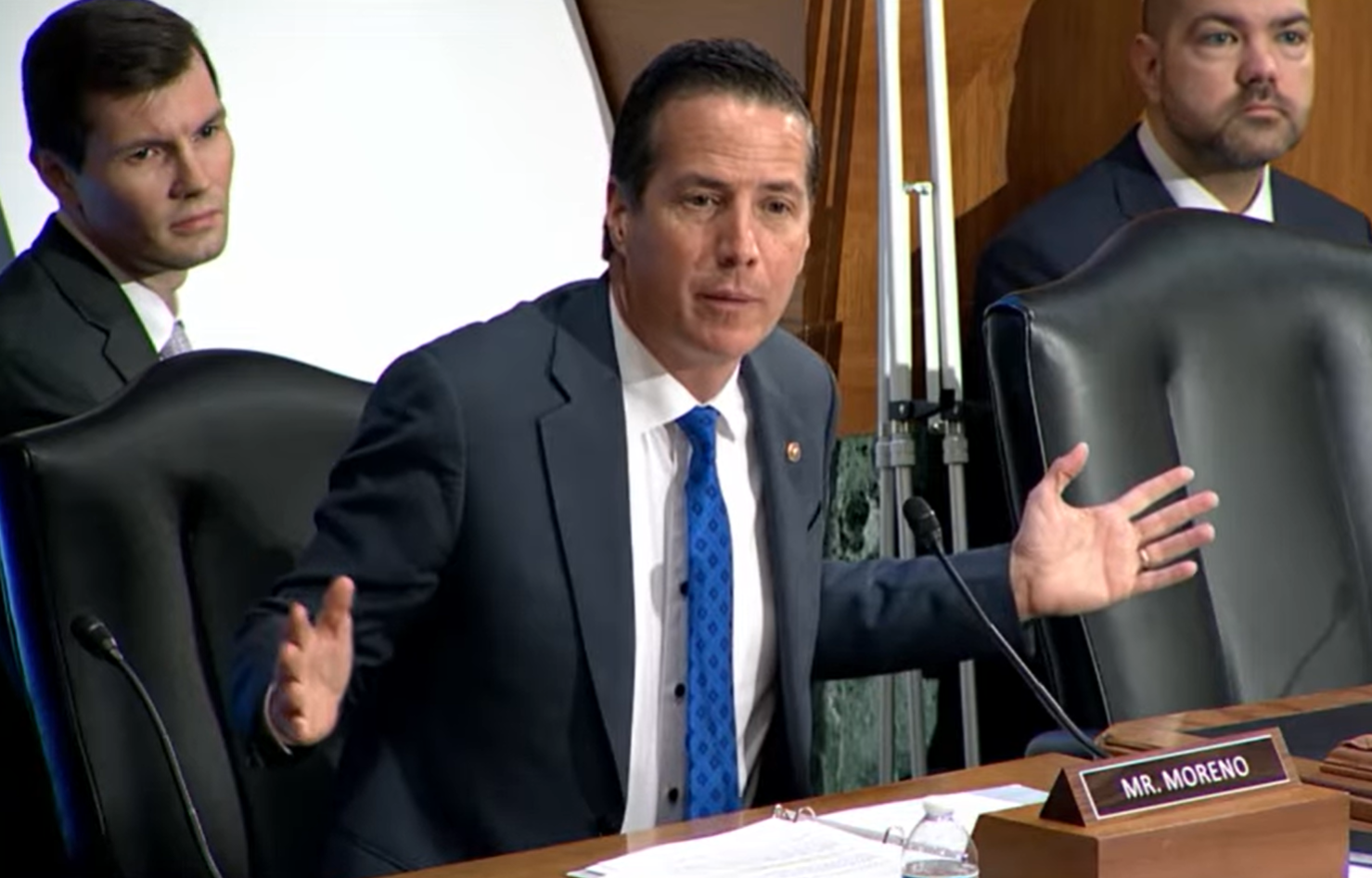

Sen. Bernie Moreno, R-Ohio, is one of approximately a dozen senators who're participating in talks to extend Obamacare credits that lapsed on Jan. 1, according to Politico.

Taxes January 12, 2026

Gov. Gavin Newsom on Jan. 9 doubled down on California’s commitment to electric vehicles with proposed rebates intended to backfill federal tax credits canceled by the Trump administration.

Taxes January 9, 2026

The House voted 230-196 Thursday to send a three-year extension of the expired tax credits to the Senate. Seventeen Republicans supported the measure.