Accounting February 28, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 28, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

March 6, 2026

March 6, 2026

Taxes February 3, 2026

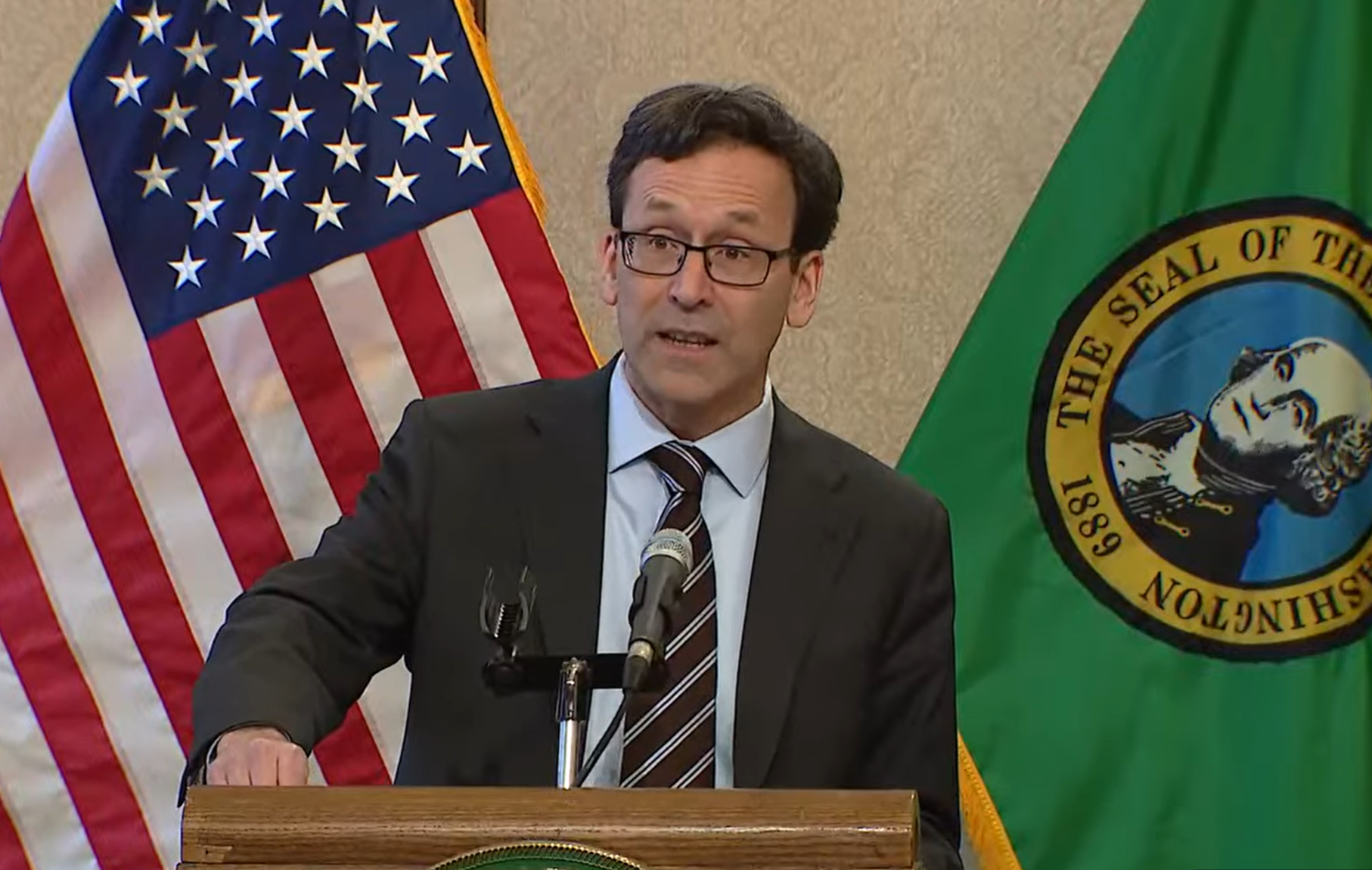

Two key Oregon Democrats on Monday unveiled a plan to increase state revenue by dropping several state tax breaks copied from President Donald Trump’s sprawling tax-and-spending law passed last year.

Taxes February 3, 2026

In a long-anticipated bill, which is getting formally introduced this week, legislative Democrats are proposing a 9.9% tax on annual earnings of more than $1 million starting in 2028.

Taxes February 3, 2026

This collaboration introduces a new integration, enabling customers to leverage GruntWorx’s AI-enhanced Optical Character Recognition automation.

IRS February 2, 2026

Core tax systems remain operational during a shutdown, meaning Americans can still file their tax returns and receive refunds, according to the Internal Revenue Service.

Sales Tax February 2, 2026

For the third year in a row, Louisiana has the highest average combined state and local sales tax rate in the country at 10.11%, according to a new report from the Tax Foundation.

Taxes February 2, 2026

In an email to tax professionals on Monday, the IRS said it recently updated qualifications for Simple Payment Plans, formerly known as “streamlined installment agreements,” to include business taxpayers.

IRS February 2, 2026

The IRS announced last week that it's accepting applications for the Electronic Tax Administration Advisory Committee through Feb. 28.

Taxes February 2, 2026

Economists have their doubts about a proposal from Connecticut gubernatorial candidate Betsy McCaughey, a Republican, to repeal the state's income tax.

Taxes January 30, 2026

At a Bloomberg forum event in San Francisco, California Gov. Gavin Newsom said the proposed billionaire tax would ultimately degrade the state’s tax base as the ultrawealthy left the state.

Taxes January 30, 2026

The suit was filed Thursday in Miami federal court by the president, his sons Donald Jr. and Eric, and the Trump Organization, which manages the president’s real estate holdings.

Taxes January 29, 2026

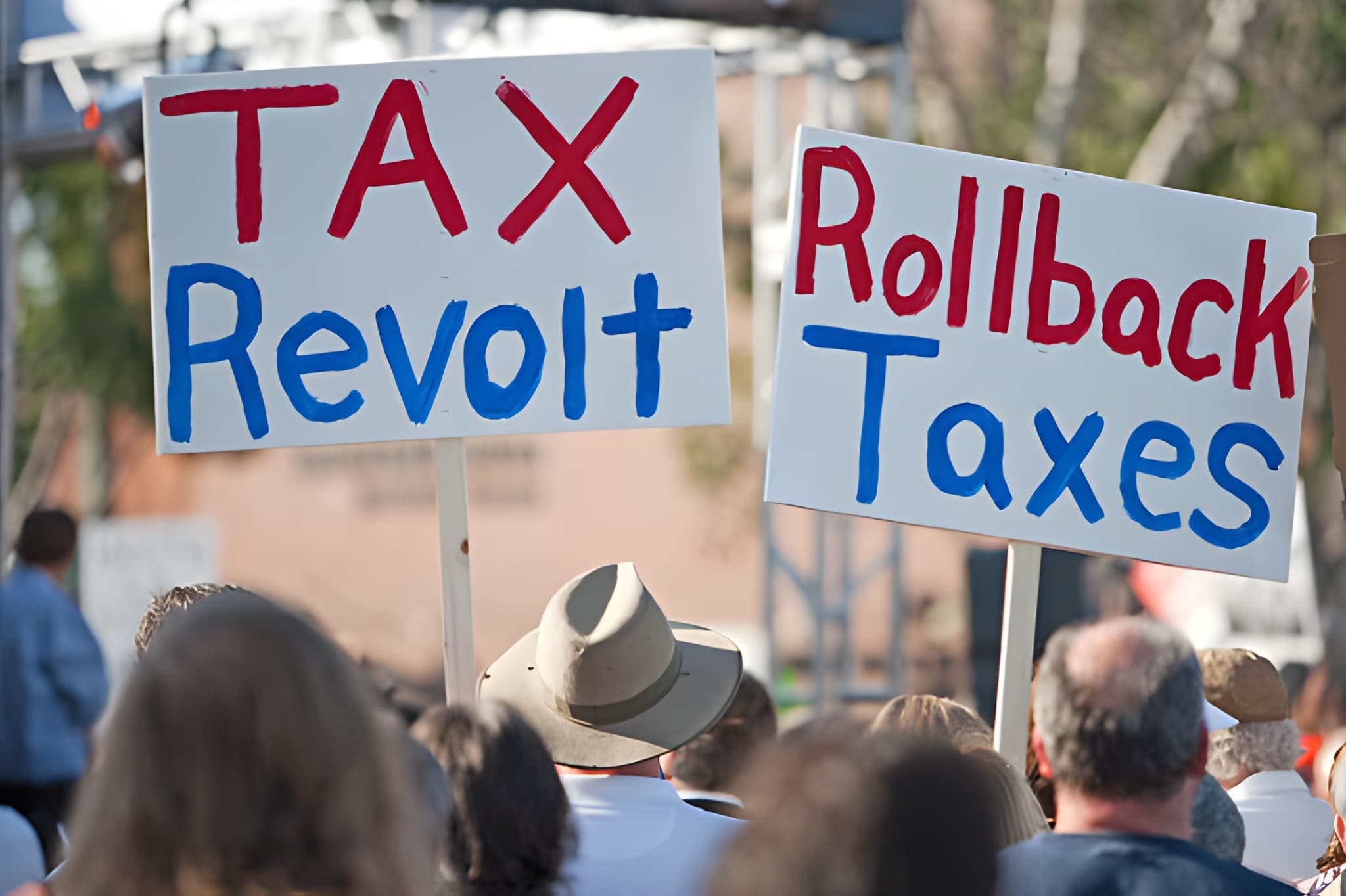

There's historical precedent for tax protests, but there are real-world consequences to not paying taxes that one Connecticut tax preparer said makes such a protest inadvisable.

IRS January 29, 2026

As the 2026 tax season gets underway, the head of the IRS announced a major shake-up, initiating personnel and operational changes intended to improve taxpayer service and modernize the agency.