Accounting February 19, 2026

Voting Opens for 2026 Readers’ Choice Awards!

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Accounting February 19, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Taxes March 6, 2026

Sen. Chris Van Hollen, D-MD, has introduced a proposal that would eliminate federal income taxes for workers earning up to $46,000 and married couples earning up to $92,000, potentially exempting about half of U.S. workers from the tax.

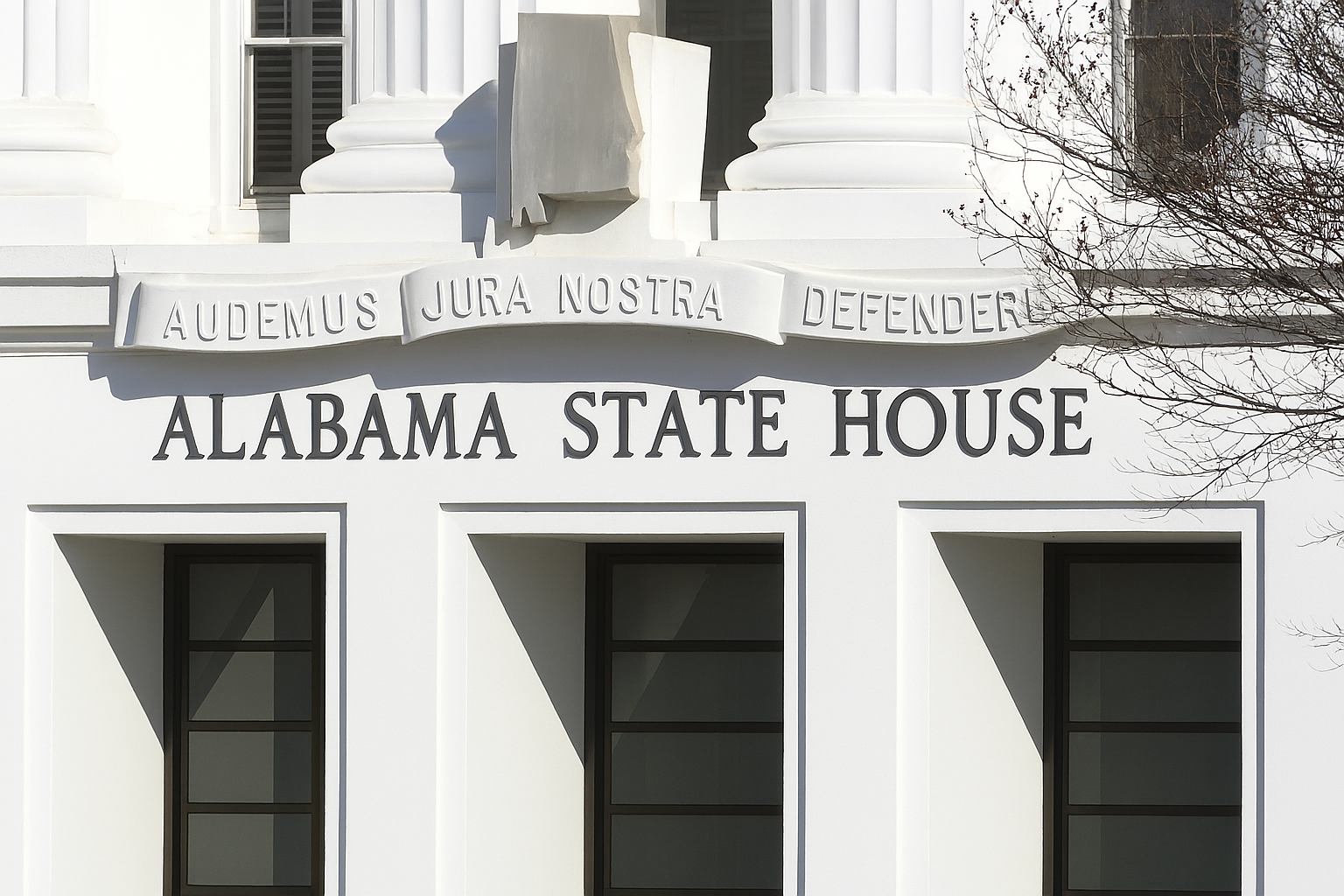

Sales Tax March 6, 2026

Alabama lawmakers may tweak how the state doles out revenue from the online sales tax, a move to try to resolve a complex disagreement involving the state, cities, counties, and school boards.

Taxes March 5, 2026

With tax-filing season in full-go mode and with March 5 being National Slam the Scam Day, the IRS on Thursday announced its annual "Dirty Dozen" list of tax scams for 2026 that threaten the tax and financial information of taxpayers, businesses, and tax professionals.

Technology March 5, 2026

A new consumer-focused tax filing platform was released Thursday by Prime Meridian, a Palo Alto, CA-based company that includes former IRS commissioner Danny Werfel as a strategic advisor.

Small Business March 5, 2026

State law enforcement officials from 24 states asked a court to block a set of 10% worldwide tariffs President Donald Trump announced last month and refund any tariffs already paid.

Taxes March 5, 2026

This tax-deductible money move can help individuals lower their tax bills while growing their retirement savings.

Taxes March 5, 2026

The analysis of 30,000 U.S. users with moderate trading activity found $435 million in inflated capital gains for the 2025 tax year alone—a 944% overstatement compared to actual gains of $46 million.

Mergers and Acquisitions March 5, 2026

Dallas-based tax services and software firm Ryan said Thursday it has acquired Hucke and Associates, a property tax consulting firm based in New York City.

Taxes March 5, 2026

While 82% of Americans say they’re concerned about tax fraud or identity theft this filing season, many don’t feel fully prepared to spot today’s increasingly convincing scams, McAfee says.

IRS March 5, 2026

House Ways and Means Democrats on Wednesday pressed IRS CEO Frank Bisignano on data access concerns in his first testimony on Capitol Hill since he took on his newly created role at the tax agency.

Taxes March 4, 2026

The Treasury Department and the IRS issued a fact sheet on Feb. 27 that clarifies two changes to the adoption tax credit in President Donald Trump's tax law that was enacted last July.

Taxes March 4, 2026

The Mississippi House of Representatives recently passed legislation that would make name, image and likeness earnings tax-exempt for college athletes at the state level.