Sales Tax March 6, 2026

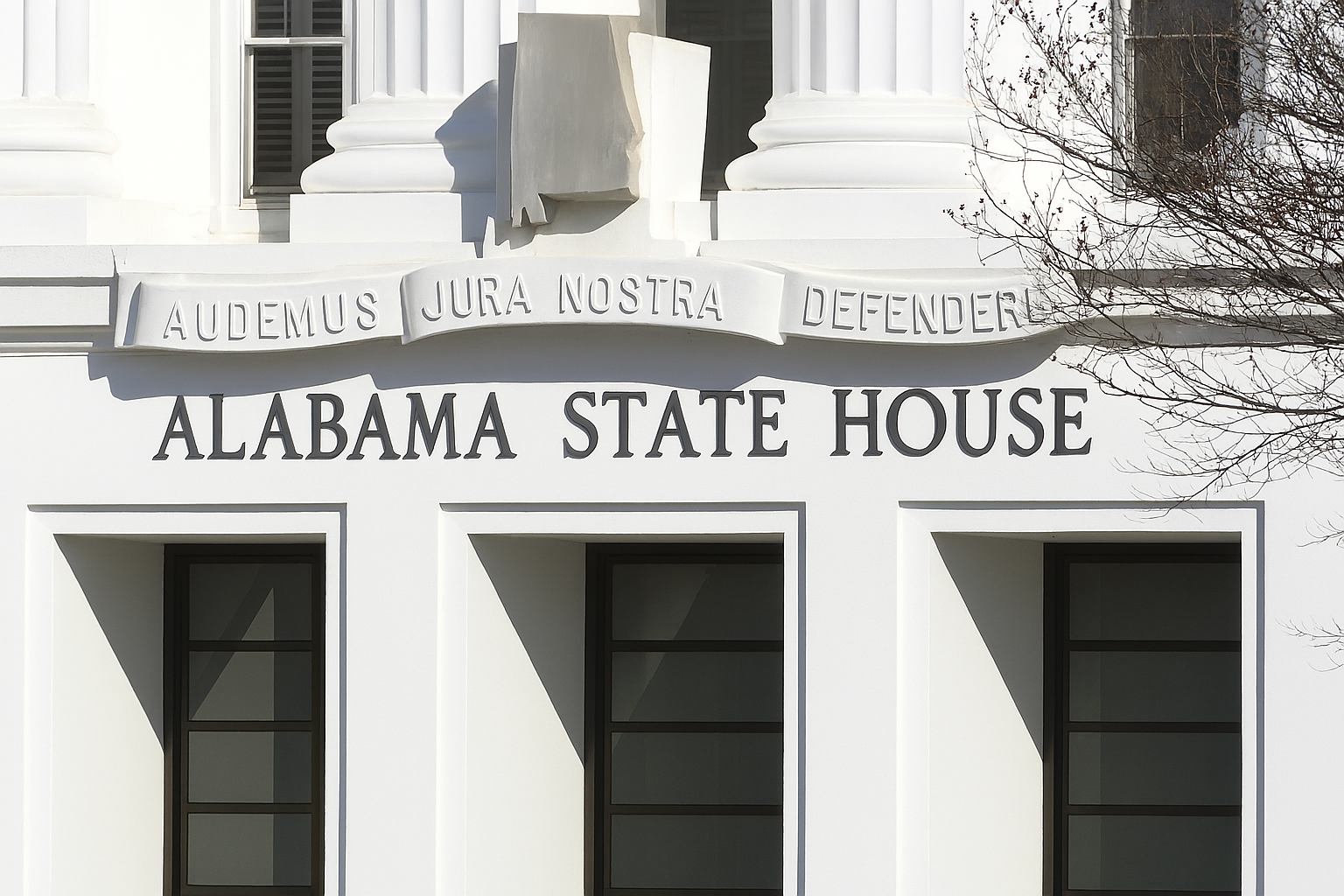

Alabama Lawmakers May Change Simplified Sellers Use Tax That Has Sparked Multiple Lawsuits

Alabama lawmakers may tweak how the state doles out revenue from the online sales tax, a move to try to resolve a complex disagreement involving the state, cities, counties, and school boards.