Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

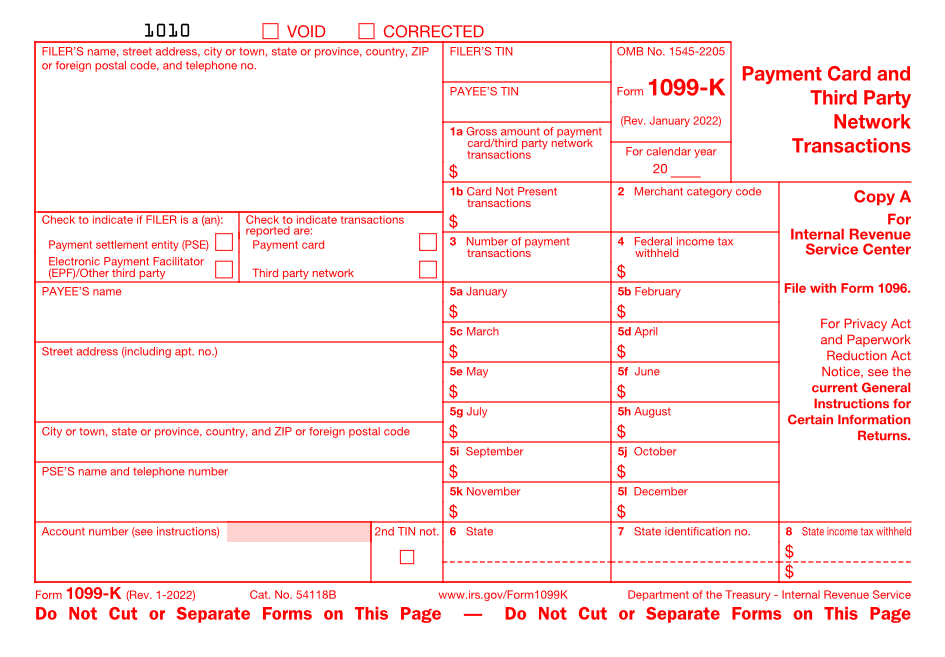

Taxes April 12, 2023

The IRS lists 21 different 1099 forms. Here is an overview of each form, as of March 2023, and why you could receive one.

Taxes April 11, 2023

When you officially add your spouse to the company payroll, they are taxed on the compensation, but are also eligible for benefits just like any other employee.

Taxes April 8, 2023

The IRS says most e-filed tax refunds are direct deposited into taxpayer bank accounts in as little as 10 days, so why pay to get your refund?

Taxes April 7, 2023

From 2012 through 2016, Tedla and her coconspirators prepared and electronically filed with the IRS fraudulent returns on behalf of clients and illegally-obtained identities of unwitting taxpayers

Taxes April 7, 2023

Unscrupulous preparers who include errors or false information on a tax return could leave a taxpayer open to liability for unpaid taxes, penalties and interest.

Taxes April 7, 2023

Beginning April 3, 2023, the IRS will make available the electronic version of the Form 8940 that exempt organizations use to make miscellaneous determination requests online at Pay.gov.

Taxes April 7, 2023

Anyone can request an automatic six-month extension to file. An extension allows for extra time to gather, prepare and file paperwork with the IRS.

Taxes April 7, 2023

She also shares hope that with long-term funding and prudent management, there is light at the end of the tunnel for taxpayers and practitioners who have experienced problems.

Taxes April 6, 2023

As the IRS begins implementation of this plan, the agency will work with the public, partners and oversight groups to ensure the transformation work meets the needs of taxpayers and the nation.

Accounting April 5, 2023

“Revenue Procedure 2022-19 provided much needed guidance and relief for S corporations which inadvertently terminate their S election,” said Jon Williamson, Senior Manager – AICPA.

Taxes April 3, 2023

This means eligible taxpayers will have until July 31 to file and pay tax returns, as well as to make 2022 contributions to their IRAs and health savings accounts.

Taxes April 3, 2023

The right CRM platform secures client aspects beyond contact data: purchase history, previous questions and communications, lifetime value, financials, and demographics...