Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

September 1, 2023

The guidance is being issued as part of the IRS's efforts to provide additional certainty to states and their residents regarding the federal income tax consequences of state payments made to taxpayers.

Taxes September 1, 2023

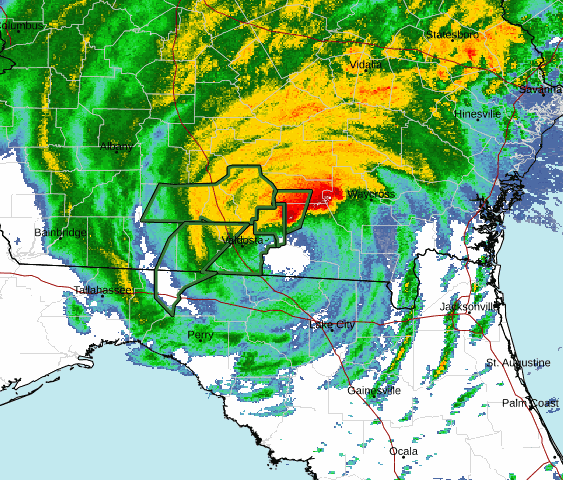

These taxpayers now have until Feb. 15, 2024, to file various federal individual and business tax returns and make tax payments.

Taxes August 29, 2023

Under the 2015 Fixing America’s Surface Transportation (FAST) Act, the IRS can deny, revoke or limit a passport if you have a seriously delinquent tax debt.

Taxes August 29, 2023

The proposed regulations include prevailing wage and registered apprenticeship requirements for clean energy projects.

Taxes August 28, 2023

In comment letters sent to the IRS, the AICPA requested improvements be made to two tax returns pertaining to foreign trusts.

Taxes August 28, 2023

In addition to IRS representation training sessions, the partnership will enable tax professionals to explore adding new revenue streams to their practices with tax resolution services.

Taxes August 25, 2023

The last time the agency increased interest rates on tax overpayments and underpayments was for Q1 of this year.

Taxes August 25, 2023

The proposed regulations are viewed by backers as critical to policing a largely unregulated sector plagued by tax avoidance.

Taxes August 25, 2023

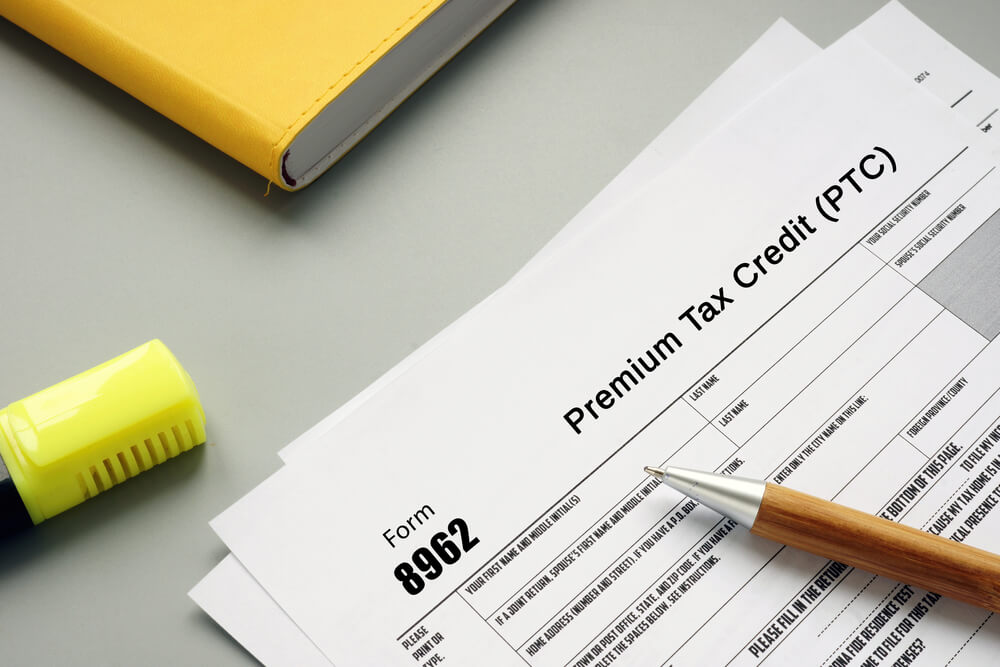

The IRS on Aug. 23 announced 2024 indexing adjustments for important percentages under the Affordable Care Act.

Taxes August 23, 2023

These proposed temporary regulations provide some guidance to the pre-registration filing requirements, as well as the clarification and definition of applicable entities.

Taxes August 23, 2023

When it comes to a corporation’s relationship with its accounting firm, the firm itself is less important than the partner who leads its engagement team in lowering its tax rate.

Taxes August 22, 2023

The heavy highway vehicle use tax is an annual federal excise tax on heavy highway motor vehicles operating on public highways.