Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes October 5, 2023

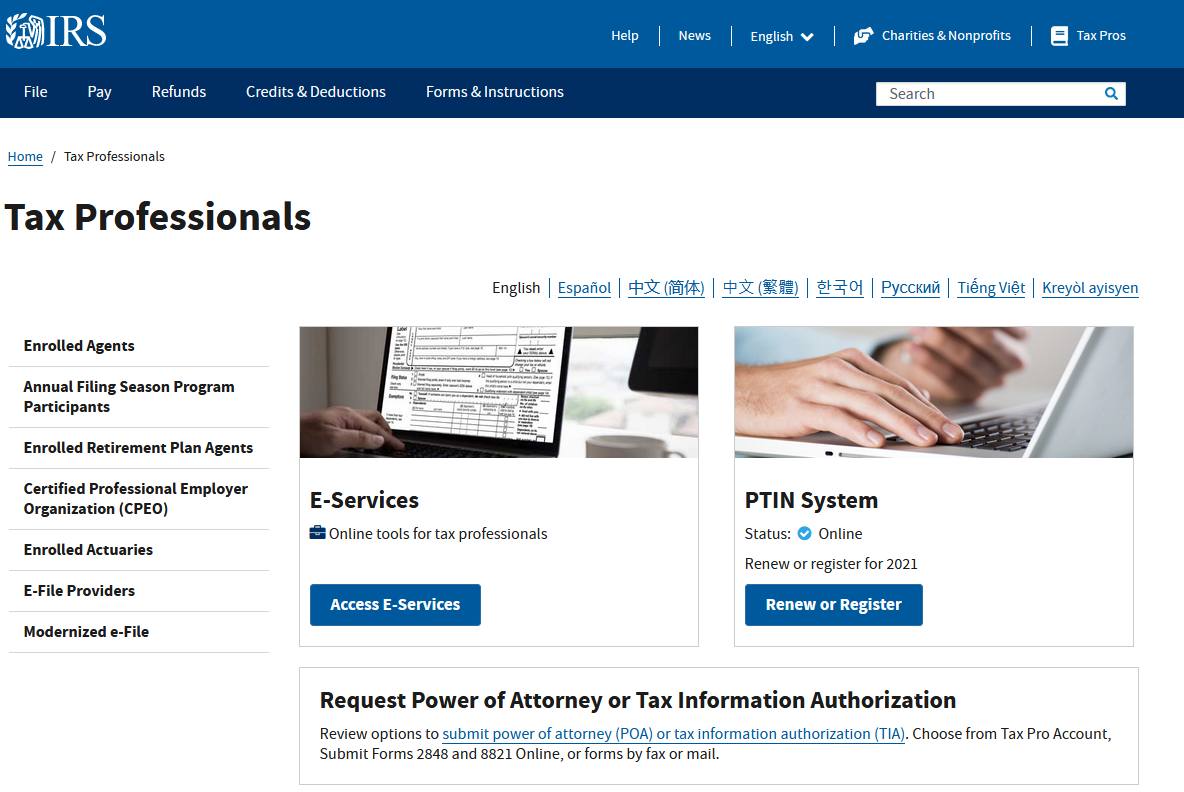

The IRS is slashing the costs for paid tax return preparers to renew their preparer tax identification numbers in 2024 by nearly 36%.

Taxes October 3, 2023

There are a myriad of challenges and changes in the tax codes affecting their business clients each tax season.

Taxes October 2, 2023

New additions to Tax Pro Account, available through IRS.gov, will help practitioners manage their active client authorizations on file with the Centralized Authorization File (CAF) database.

Accounting September 30, 2023

The latest House stopgap bill passed with the support of 126 Republicans, while 90 GOP lawmakers voted “no.” Only one Democrat, Rep. Mike Quigley, D-Ill., opposed it, over the omission of Ukraine aid.

Taxes September 29, 2023

Contingency plan calls for the IRS to furlough two-thirds of its workforce and press pause on most core tax administration functions.

Taxes September 28, 2023

The letter goes on to express concern that an October shutdown of the government will likely impact the timely processing of extended 2022 tax returns due by Oct 16, 2023.

Taxes September 28, 2023

The House panel voted along party lines to disclose additional documents related to the probe into the president's son's taxes.

Taxes September 28, 2023

Jack Fisher and James Sinnott designed, marketed and sold to high-income clients abusive syndicated conservation easement tax shelters based on fraudulently inflated charitable contribution tax deductions, promising them deductions 4.5 times the amount the taxpayer clients paid.

Taxes September 26, 2023

Chatbots will be used to help answer basic taxpayer questions about three notices in the CP series, the IRS said on Tuesday.

Taxes September 26, 2023

Taxpayers can use the special per diem rates to substantiate the amount of expenses for lodging, meals, and incidental expenses.

Taxes September 25, 2023

All individuals and business owners in these two states now have until Feb. 15, 2024, to file their returns and make tax payments.

Taxes September 20, 2023

Group within LB&I will be tasked with holding large partnerships and other pass-throughs accountable on tax compliance.