Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

IRS October 24, 2023

The fee to renew or obtain a PTIN for 2024 is $19.75, down from $30.75 in 2023. Failure to have a valid PTIN may result in penalties.

Payroll October 20, 2023

An employer in danger of being assessed back taxes for certain workers may avoid liability if it qualifies for “Section 530 relief.”

Taxes October 19, 2023

The IRS on Thursday offered steps small businesses can take to cancel their tax credit claim if they have doubts about its legitimacy.

Taxes October 17, 2023

Their willingness to use the Direct File program may be overstated because of the survey the IRS used to gauge their interest, TIGTA says.

Taxes October 17, 2023

The IRS on Tuesday unveiled more details about Direct File, the agency’s free online tax filing program that is debuting in 2024.

Taxes October 16, 2023

As of June 30, the agency has spent approximately $1.95 billion of the nearly $80 billion it will receive over a 10-year period.

Taxes October 16, 2023

The new estimate reflects a rise of more than $192 billion from the prior estimates for tax years 2014 to 2016.

Taxes October 16, 2023

For 2023, however, many taxpayers who had received an extension to file, also later faced various forms of natural disasters for which the IRS has granted additional time to file.

Income Tax October 11, 2023

Gyetvay was convicted of concealing his ownership and control over substantial offshore assets and did not file tax returns or pay taxes on millions of dollars of income.

Taxes October 6, 2023

The consumer discount is one of the significant changes to electric vehicle tax credits implemented under the Inflation Reduction Act.

Taxes October 5, 2023

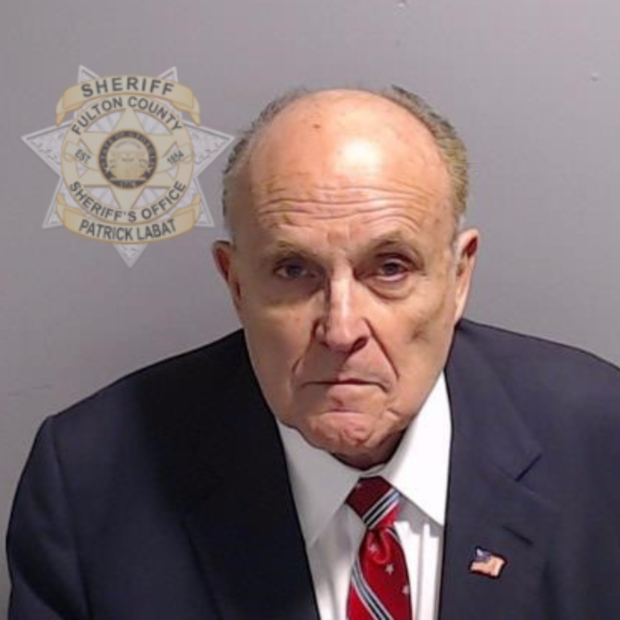

According to a report, former New York City mayor Rudolph Giuliani owes $549,435.26 in unpaid taxes and, as a result, the agency has placed a tax lien on a condo he owns in south Florida.

Taxes October 5, 2023

Taxpayers, particularly wealthy filers, were warned Thursday about scams involving exaggerated art donation deductions.