Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes November 19, 2025

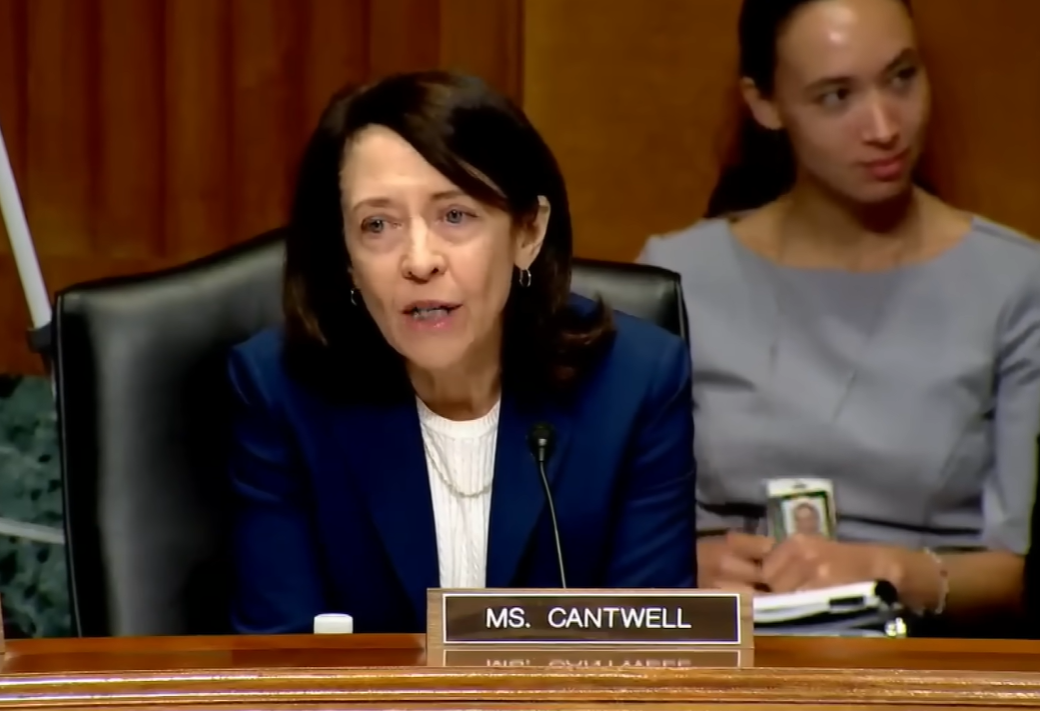

In a letter to the Joint Committee on Taxation, Sen. Maria Cantwell (D-WA) called for an analysis of the current landscape of college athletics centered around the policies that shield much of the industry from taxation.

Taxes November 19, 2025

Donald Trump’s presidential library foundation plans to raise almost a billion dollars in tax-exempt contributions over the next two years to build and operate his high-rise legacy project in downtown Miami, according to new tax filings.

Taxes November 18, 2025

Diana Miller-Lloyd, 44, who currently lives in Jacksonville, FL, pleaded guilty in Hartford federal court to aiding in the preparation of false tax returns.

Taxes November 18, 2025

For individuals, the rate for tax underpayments and overpayments will be 7% per year, compounded daily, the IRS said on Nov. 13.

Special Section: Guide to 2025 Tax Changes November 14, 2025

An ABLE account works like the better-known Section 529 account for higher education expenses. After you establish the account and contribute to it, any earnings inside the account are exempt from current tax.

Taxes November 13, 2025

The amount individuals can contribute to their 401(k) plans and individual retirement accounts will be higher in 2026, the IRS announced on Nov. 13.

Taxes November 12, 2025

In 2026, leading finance organizations will operate more like analytics consultancies, using real-time tax, margin, and compliance data to guide daily decisions.

Special Section: Guide to 2025 Tax Changes November 10, 2025

It must seem like the annual threshold of $600 has been in place forever to long-time payroll managers and CPAs. In fact, it hasn’t budged an inch since 1954!

Taxes November 6, 2025

The Treasury Department and the IRS issued guidance on Nov. 5 providing penalty relief to employers and other payors for tax year 2025 on the new information reporting rules for cash tips and qualified overtime compensation in the tax-and-spending law.

Taxes November 6, 2025

This chart makes it easy to estimate when you will likely get your income tax refund, based on when and how you file. No form entry required.

Taxes November 5, 2025

In an email sent to comptrollers in the 25 states that partner with the agency on Direct File, the IRS said the program won't be provided next year and "no launch date has been set for the future."

Taxes November 5, 2025

While many provisions await Treasury and IRS guidance, small business clients are already asking how the law will affect their taxes in 2025 and beyond. This overview highlights key changes relevant to their planning.