Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes May 24, 2024

The taxpayer failed to report any of the $700,000 payment as taxable income on his return. So the IRS stepped in and the case ended up in the Tax Court.

Taxes May 22, 2024

The five-year extension agreement between the IRS and Free File Inc. will continue the program through October 2029.

Taxes May 21, 2024

The most recent version of Form 656-B, Offer in Compromise Booklet, was released by the IRS in April.

Taxes May 20, 2024

Federal tax breaks aim to boost sustainable jet fuel production to curb emissions from commercial planes and meet climate targets.

Taxes May 15, 2024

The risk a compromised CAF number presents to practitioners and taxpayers is prompting these additional security measures.

Taxes May 9, 2024

Starting on July 1, the rate for overpayments and underpayments for individuals will be 8% per year, compounded daily.

IRS May 9, 2024

Beginning in January, you'll be able to contribute more to your health savings account, based on the IRS's latest inflation adjustments.

Technology May 8, 2024

The new program follows the release of the draft Form 1099-DA for digital asset transaction reporting by the IRS last month.

IRS May 7, 2024

During a House Appropriations subcommittee hearing May 7, Danny Werfel gave lawmakers an update on the tax credit's status.

Income Tax May 7, 2024

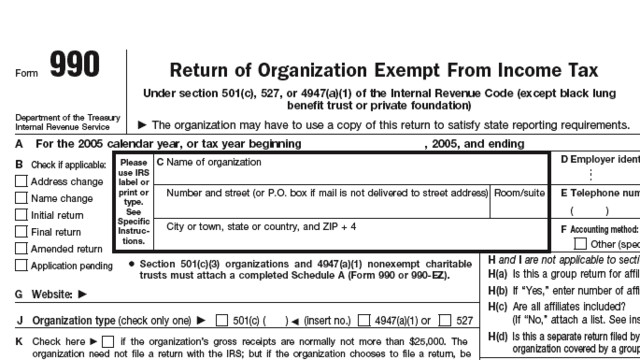

While the April 15 tax deadline for most Americans to file their individual annual tax returns has passed, there are several deadlines each year, some for individuals, businesses, nonprofits and even organizations that are tax-exempt.

IRS May 6, 2024

The FAQs are intended to assist individuals, employers, and retirement plan and IRA service providers, the IRS said.

Taxes May 3, 2024

But the IRS chief emphasized once again that audit rates won't increase for small businesses and taxpayers making under $400,000.