Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes July 24, 2024

Individual and business taxpayers in 67 counties now have until Feb. 3, 2025, to file their returns and make tax payments.

Taxes July 22, 2024

The decision in Connelly v. United States last month impacts certain types of smaller businesses, in particular closely held companies.

Taxes July 17, 2024

As of July 14, taxpayers must sign in or register with either Login.gov or ID.me to access the FATCA registration system.

Taxes July 15, 2024

The agency has seen an influx of claims for the non-existent "self-employment tax credit," which is being promoted on social media.

Taxes July 12, 2024

A recent ransomware attack that impacted car dealerships prompted the IRS to alert vehicle dealers and sellers about these schemes.

Taxes July 11, 2024

The agency has launched several initiatives targeting wealthy individuals and large companies in an effort to close the tax gap.

Taxes July 10, 2024

These FAQs address which entities must apply for registration for the tax credit pursuant to Notice 2024-49, which the IRS issued in June.

Taxes July 9, 2024

Schemes have centered on the Fuel Tax Credit, Sick and Family Leave Credit, household employment taxes, and overstated withholding.

Taxes July 8, 2024

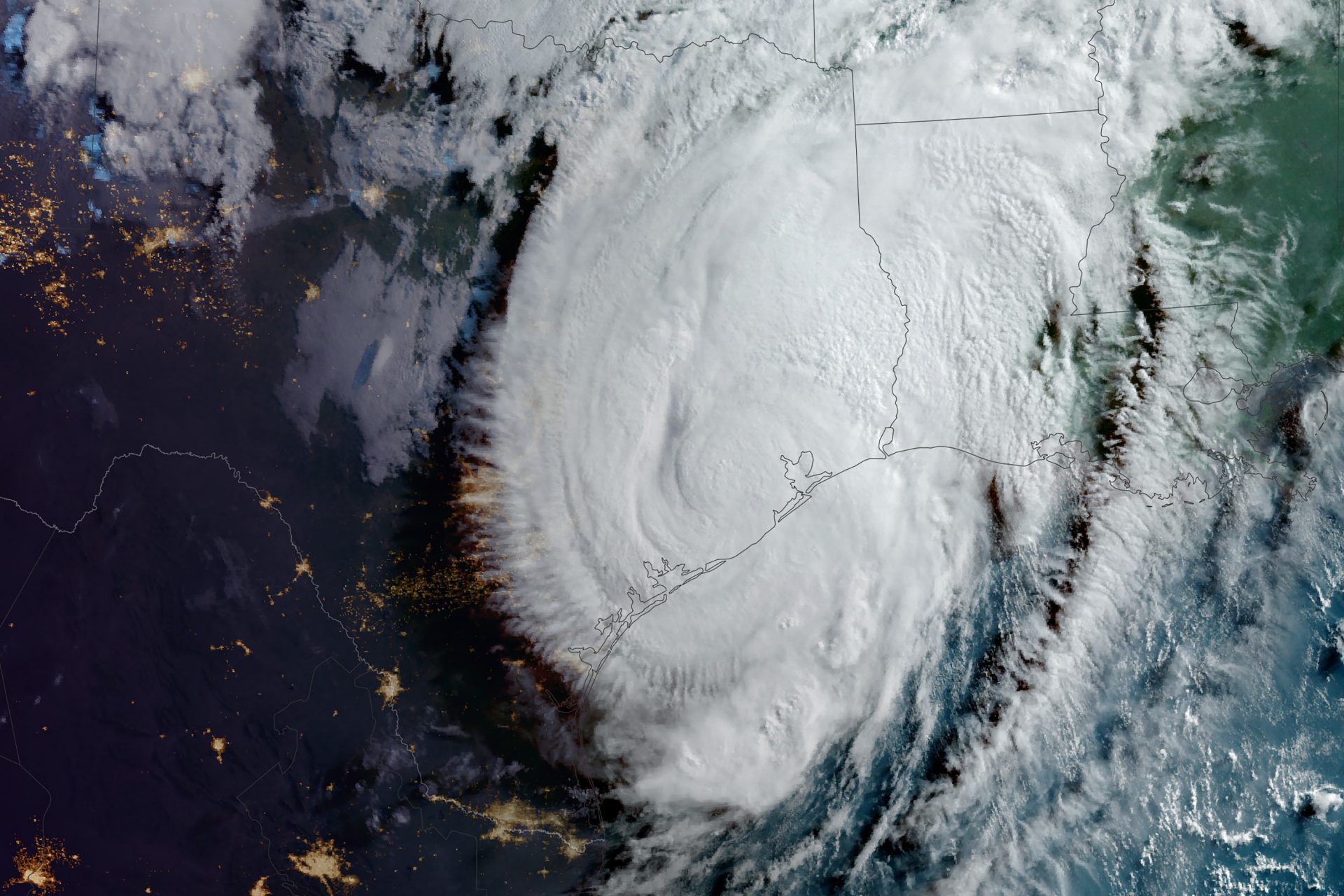

Taxpayers in 11 counties now have until Nov. 1, 2024, to file various federal individual and business tax returns and make payments.

IRS July 5, 2024

“We have just now started to put my cat Emmett out there as the expert on tax scams,” the IRS chief recently said in a TV interview.

Taxes July 2, 2024

The IRS and its Security Summit partners announced the start of its annual "Protect Your Clients; Protect Yourself" campaign.

Taxes July 1, 2024

The final regulations are viewed by proponents as critical to policing a largely unregulated sector plagued by tax avoidance.