Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

July 18, 2016

Just like clockwork, twice a year the National Taxpayer Advocate (NTA) Nina E. Olson delivers reports to Congress on the state of affairs at the IRS. In the mid-year report released on July 7, Olson focused on a new initiative, the Public Forums on ...

July 8, 2016

To help ease the burden of hard-working parents, employers may institute a dependent care assistance plan for employees. Under such a plan, payments made to third parties like babysitters and day care centers are excluded from income if the costs ...

June 24, 2016

Winners of a crowdsourcing contest sponsored by the Internal Revenue Service were recently announced. “Tax Design Challenge” encouraged innovative ideas for the taxpayer experience of the future.

June 21, 2016

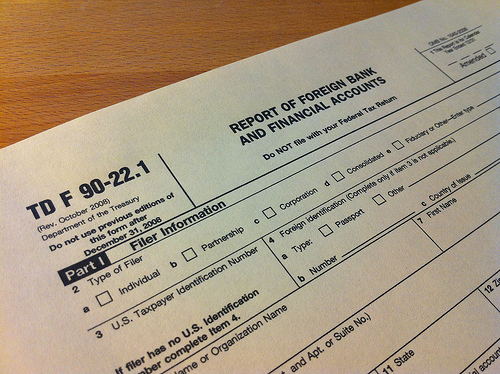

It's tax time again. Americans with bank or investment accounts located outside of the United States, or signature authority over such accounts, have until June 30 to file an FBAR.

June 16, 2016

Koskinen took over the reins at the IRS in December 2013. Despite the charges levied against him, he has previously said that he intends to stay on until the end of his four-year term.

June 15, 2016

The IRS says that, next tax season, processing of early-filed income tax returns with the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) will be delayed. Specifically, the agency will hold tax refunds until at least Feb 15.

June 13, 2016

Business tax non-compliance is a problem that plagues states across the U.S., but could be improved if states were able to more easily share data, according to new research by the Governing Institute. The survey of tax and revenue officials across 29 ...

June 8, 2016

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

June 8, 2016

After being disabled last spring, Get Transcript Online is now available for all users to access a copy of their tax transcripts and similar documents that summarize important tax return information.

June 6, 2016

Revenue Procedure 2016-33, posted on IRS.gov, along with temporary and proposed regulations published last month in the Federal Register, carries out legislation enacted in late 2014 requiring the IRS to establish a voluntary certification program for ...

May 20, 2016

CPAs, EAs and other tax professionals can register online for the 2016 IRS Nationwide Tax Forums for an opportunity to earn up to 19 continuing professional education credits at any of the five forums held throughout the country beginning this July.

May 17, 2016

The National Society of Accountants says that major changes to the technology and infrastructure the IRS uses is necessary to provide effective and responsible service.