Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The IRS this week announced tax relief for individuals and businesses in Montana affected by severe wind storms and flooding that occurred the second and third weeks of December 2025.

Taxes February 5, 2026

The revelation came Thursday during a Senate Banking Committee hearing where Treasury Secretary and Acting Commissioner of the Internal Revenue Service Scott Bessent testified.

Taxes February 5, 2026

“What I would do? Tell them to pay me, but I’ll give 100% of the money to charity,” President Donald Trump said in an interview with NBC News, floating the American Cancer Society as a potential beneficiary.

Taxes February 4, 2026

Many fraudulent tax schemes have been circulating on social media, promoting misuse of tax credits or deductions that most taxpayers don’t qualify for.

IRS February 2, 2026

Core tax systems remain operational during a shutdown, meaning Americans can still file their tax returns and receive refunds, according to the Internal Revenue Service.

Taxes February 2, 2026

In an email to tax professionals on Monday, the IRS said it recently updated qualifications for Simple Payment Plans, formerly known as “streamlined installment agreements,” to include business taxpayers.

IRS February 2, 2026

The IRS announced last week that it's accepting applications for the Electronic Tax Administration Advisory Committee through Feb. 28.

Taxes January 30, 2026

The suit was filed Thursday in Miami federal court by the president, his sons Donald Jr. and Eric, and the Trump Organization, which manages the president’s real estate holdings.

IRS January 29, 2026

As the 2026 tax season gets underway, the head of the IRS announced a major shake-up, initiating personnel and operational changes intended to improve taxpayer service and modernize the agency.

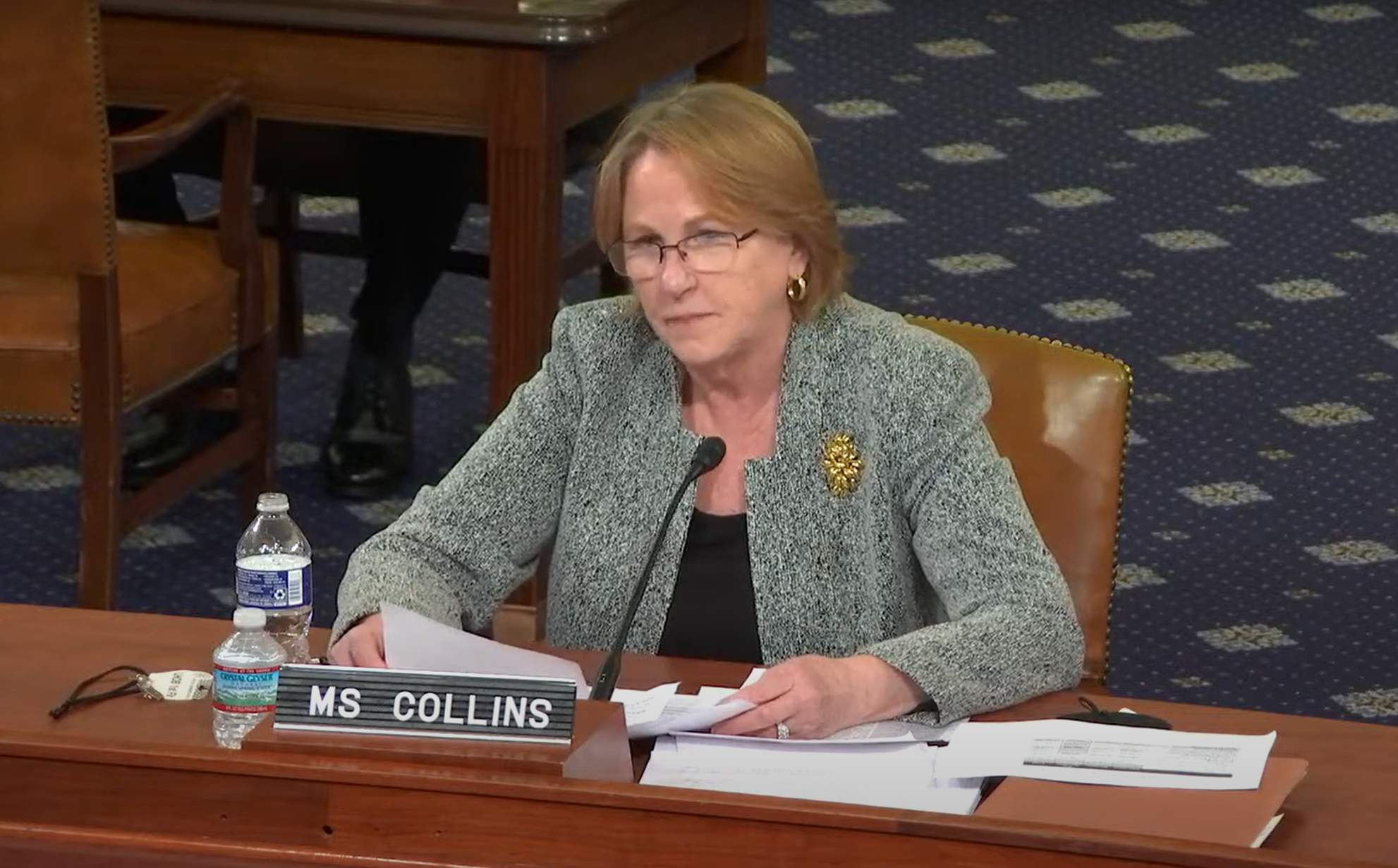

Taxes January 28, 2026

As the IRS enters the 2026 tax season facing workforce reductions and implementing major tax law changes, National Taxpayer Advocate Erin Collins warns in a new report that taxpayers could encounter more challenges when filing their taxes this year.

Taxes January 27, 2026

The IRS released frequently asked questions on Tuesday regarding how an executive order from President Donald Trump will impact the way taxpayers receive tax refunds and make tax payments.