Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 12, 2026

February 10, 2026

February 10, 2026

Taxes March 27, 2024

As of the week ending March 15, the IRS had issued just over 49 million tax refunds, close to 9% lower than at that point last year.

Taxes March 26, 2024

Nearly 940,000 Americans have unclaimed tax returns from 2020 and face a May 17 deadline if they want to get it back.

Taxes March 26, 2024

Sixty-nine percent of registered voters in seven swing states favor higher taxes on billionaires, according to a new poll.

Taxes March 21, 2024

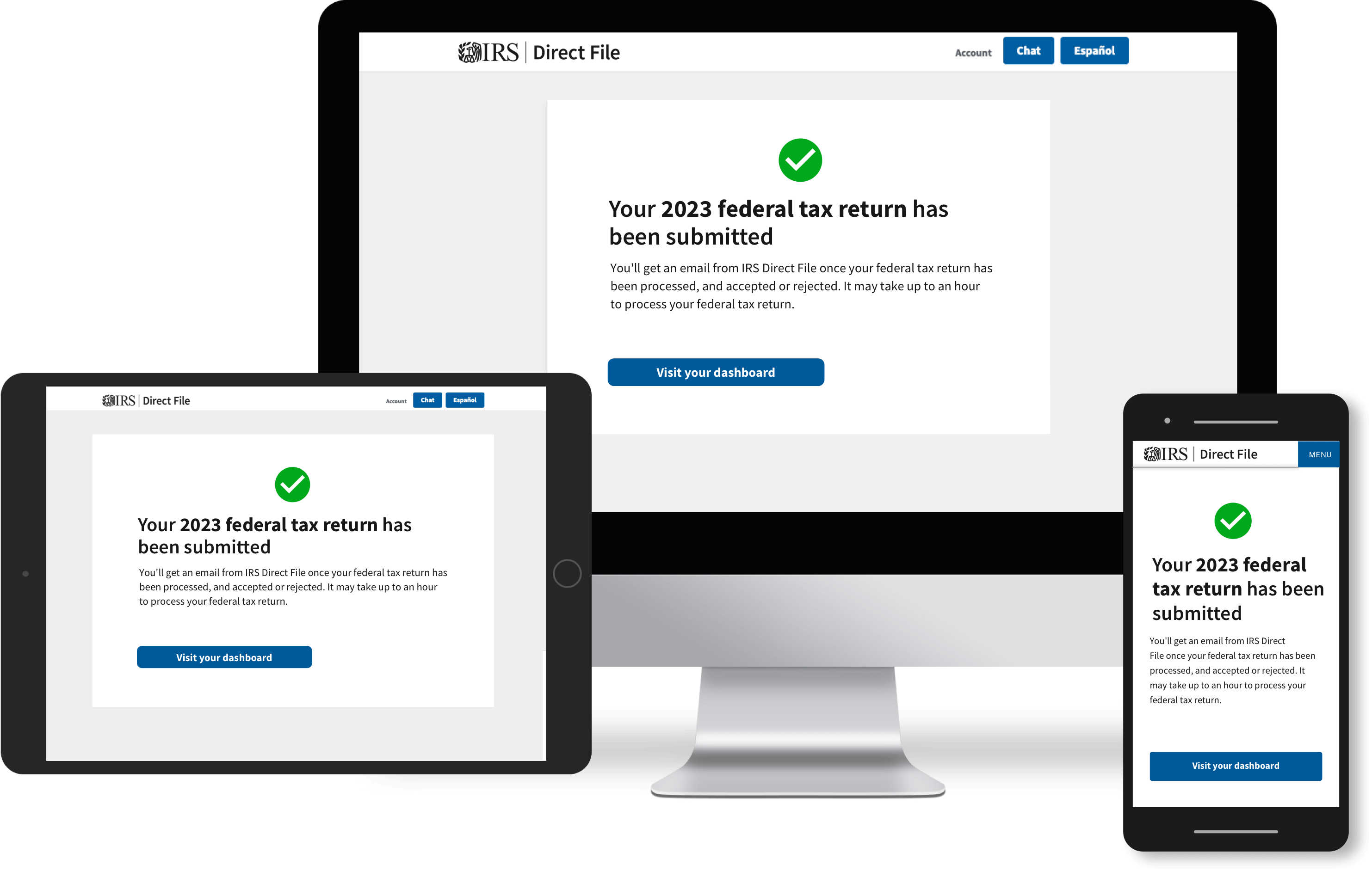

While the exact number was not available, the Treasury Department says Texas has the most filers on a per capita basis.

Taxes March 21, 2024

Ndeye Amy Thioub, 67, also taught college-level classes on accounting standards and ethics at Salem State University.

Taxes March 20, 2024

The tax, which would impact the top 0.05% of the nation’s households, would bring in $3 trillion in revenue over 10 years.

Taxes March 19, 2024

Stephen Jake McGonigle, 66, was ordered to pay the $1.2 million in restitution that he took from victims in the scheme.

Taxes March 18, 2024

The nation’s lawmakers may allow these provisions to expire as written into the TCJA, extend them indefinitely, for a period of time or even permanently, or otherwise modify them.

Taxes March 15, 2024

The president recently introduced several tax proposals targeting big businesses and the wealthiest Americans.

Taxes March 15, 2024

The agency's multilingual efforts are a part of its Strategic Operating Plan, which has received additional funding since the enactment of the Inflation Reduction Act.

Taxes March 14, 2024

Money mules are people who, at someone else’s direction, receive and move money obtained from victims of fraud.

Taxes March 13, 2024

Dr. Melissa Rose Barrett, of Baton Rouge, owed the IRS approximately $1.6 million in income taxes.