Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 12, 2026

February 10, 2026

February 10, 2026

Taxes August 7, 2024

Tax pros should always enable MFA within tax software products and cloud storage services containing sensitive client data, and they should never share usernames.

Taxes August 7, 2024

The Inflation Reduction Act, or IRA, extended and expanded tax credits PDF that allow taxpayers to claim residential and energy efficient home energy credits.

Taxes August 6, 2024

The checks will be delivered to families who received the Empire State Child Credit in the 2023 tax year. Filers are eligible for the credits if they have children under age 17 and qualify for the federal child tax credit.

Taxes August 1, 2024

The case will go before the state's Supreme Court after a lower court ruled earlier this year that the tax is unconstitutional.

Taxes July 30, 2024

Between October 1, 2021, and April 1, 2023, the IRS closed 1,175 cases with disciplinary actions, for 1,068 current employees, with confirmed tax noncompliance issues.

Taxes July 26, 2024

Direct File will now be a permanent option for taxpayers in states that choose to participate, and New Jersey said it's in.

Taxes July 25, 2024

The agency provided an update July 25 on its Strategic Operating Plan, which sets out several priorities for the IRS to accomplish.

IRS July 25, 2024

Danny Werfel said he's "fairly optimistic" the Supreme Court ruling won't deter future efforts to provide better taxpayer services.

Taxes July 24, 2024

Notice 2024-60, issued by the IRS on July 24, details how taxpayers can claim the credit for the sequestration of carbon oxide.

Taxes July 24, 2024

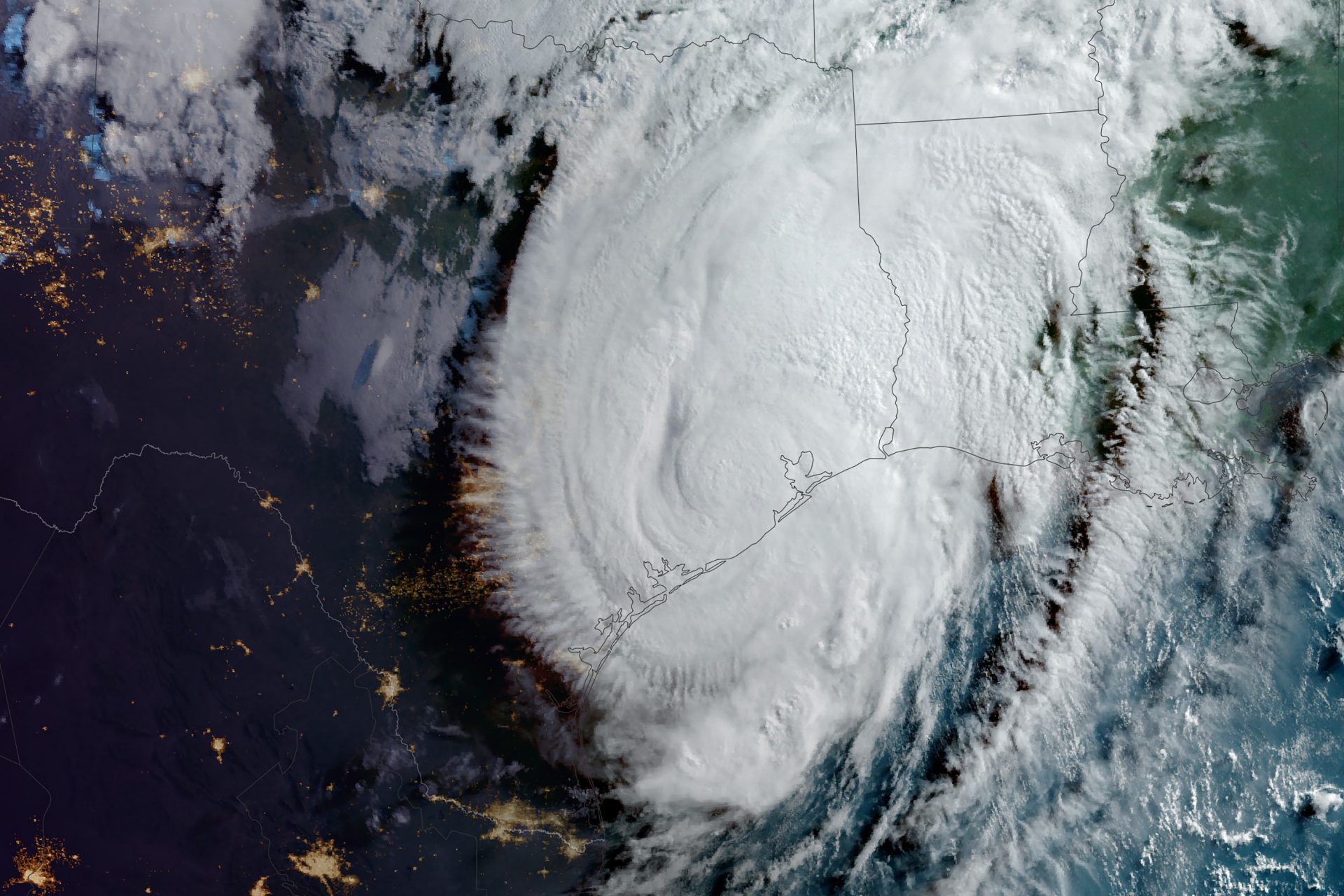

Individual and business taxpayers in 67 counties now have until Feb. 3, 2025, to file their returns and make tax payments.

Taxes July 23, 2024

Donald Trump’s 2017 Tax Cuts and Jobs Act was the biggest corporate tax cut in U.S. history. But how has it affected the economy?

Taxes July 22, 2024

The decision in Connelly v. United States last month impacts certain types of smaller businesses, in particular closely held companies.