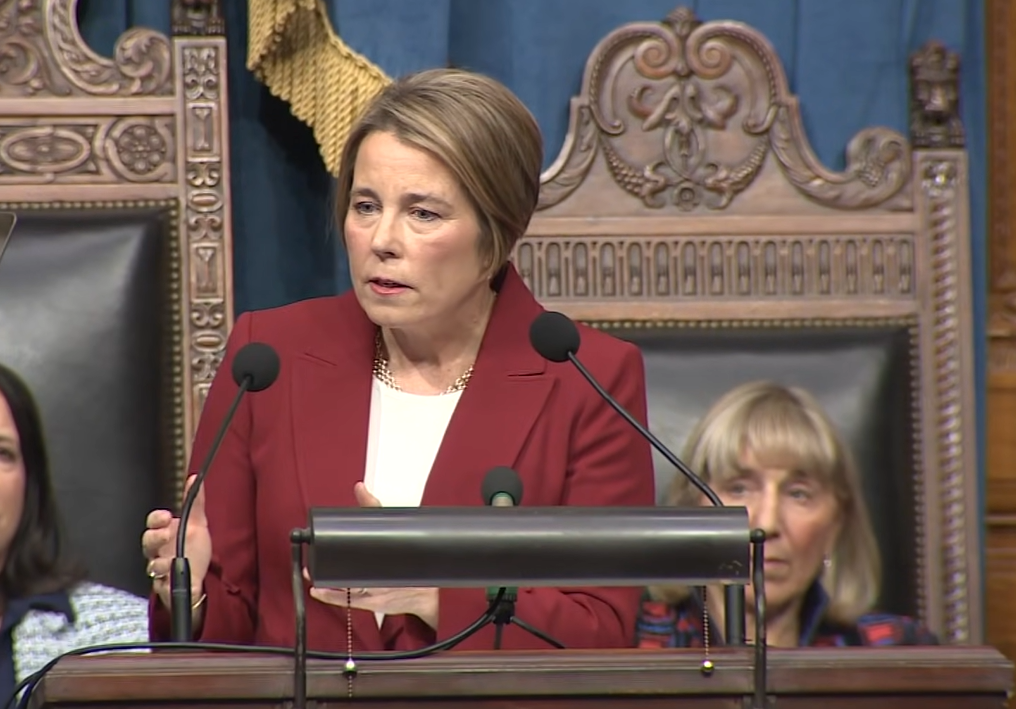

Taxes February 10, 2026

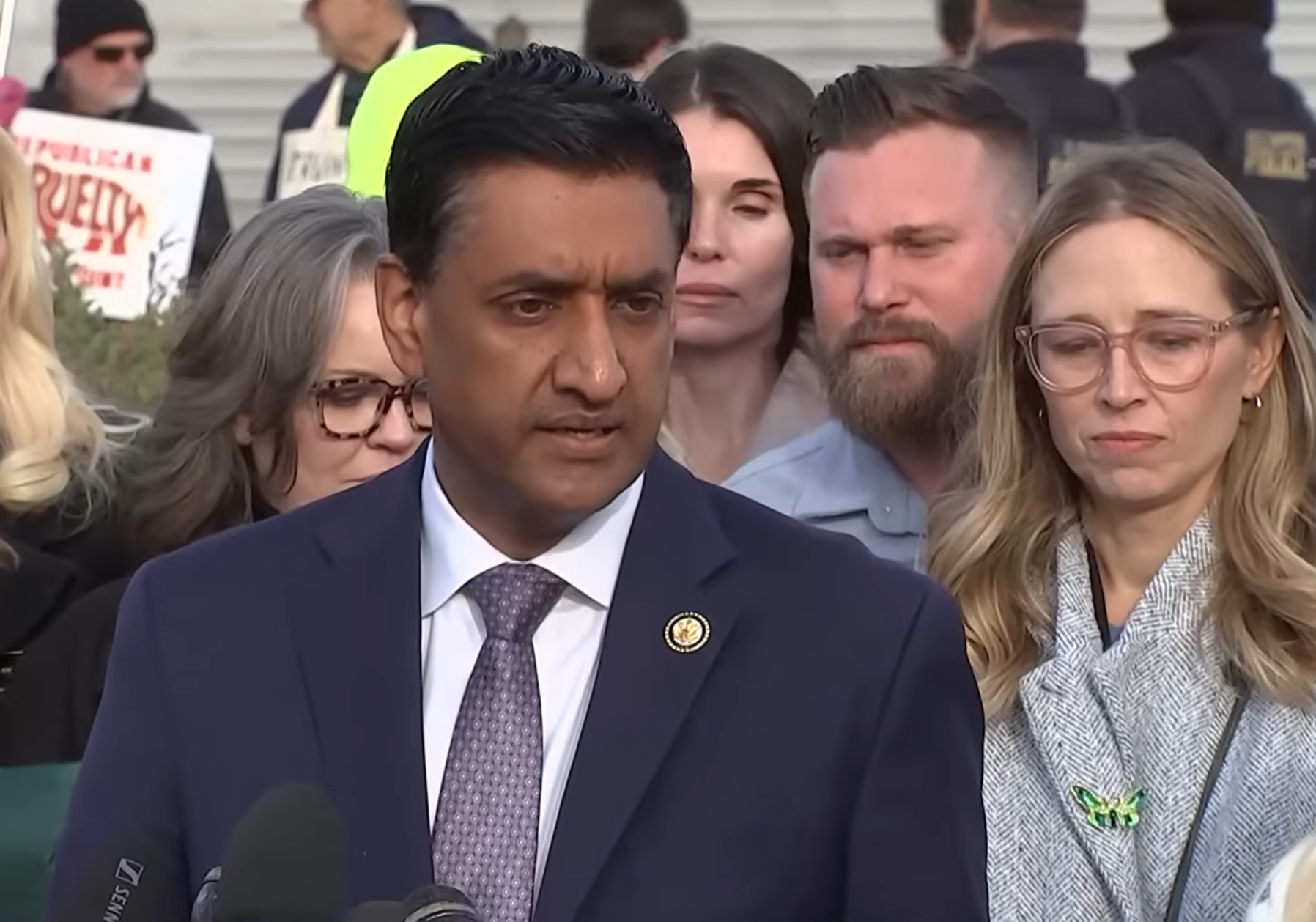

Sen. Bernie Sanders to Kick Off California Billionaire Tax Campaign

The independent senator from Vermont, who caucuses with Democrats in the nation's Capitol, will appear Feb. 18 to formally kick off the campaign to place a new tax on billionaires on California's November ballot.