Taxes February 12, 2026

Senate Votes to Overturn D.C. Tax Decoupling, as Locals Push Back

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

Taxes February 12, 2026

The Senate passed a joint resolution on Thursday blocking changes to the District of Columbia’s tax code, which will now head to President Donald Trump’s desk.

February 12, 2026

February 10, 2026

February 10, 2026

April 16, 2020

Specifically, researchers asked a group of 15 influential individuals working in local, regional and international public accounting firms about when they recognized the seriousness of the crisis, how the pandemic has affected their client and ...

April 16, 2020

The Tax Blotter is a roundup of recent tax news and court rulings.

April 16, 2020

With reports that the PPP’s initial $349 billion pool of funds will be fully subscribed as early as today, the need for quick and decisive action by Congress is clear. Small businesses are the nation’s economic engine and supporting and stabilizing ...

April 15, 2020

At last, The Treasury issued guidance related to self-employed individuals and how the Paycheck Protection Program (“PPP”) applies to them. If you remember, the initial CARES Act language included 1099s as part of payroll costs for small businesses ...

April 15, 2020

SSI recipients will receive a $1,200 Economic Impact Payment with no further action needed on their part. The IRS projects the payments for this group will go out no later than early May.

![Islands-Group2[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/04/Islands_Group2_1_.5e973ed1511e8.png)

April 15, 2020

There’s a lot to learn, and not a lot of time to learn it. The business landscape is changing overnight: Another unknown may be how to handle sales tax on takeout or delivery services.

April 15, 2020

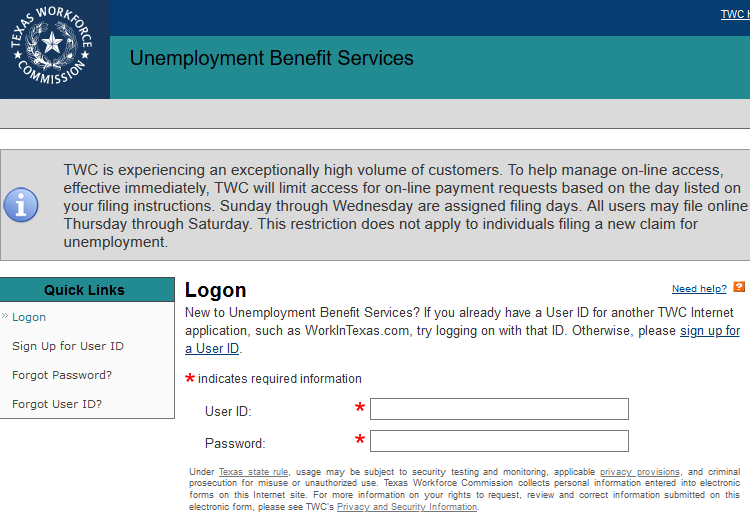

Overall, unemployment website crashes have been reported in Alabama, Arizona, Arkansas, Colorado, Connecticut, Florida, Hawaii, Illinois, Iowa, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Missouri, Montana, Nevada, New Jersey, New York, ...

April 15, 2020

The IRS has unveiled the new Get My Payment with features to let taxpayers check on their Economic Impact Payment date and update direct deposit information.

April 15, 2020

The last few weeks have been extraordinarily challenging for most Americans, as many of us have been cloistered in our homes, told to shelter in place, and been urged to refrain from gathering with family or friends.

April 15, 2020

Get My Payment also allows people a chance to provide their bank information. People who did not use direct deposit on their last tax return will be able to input information to receive the payment by direct deposit into their bank account, expediting ...

April 14, 2020

The IRS, state tax agencies and the nation’s tax industry continue to see an upswing in data thefts from tax professionals as cybercriminals try to take advantage of COVID-19 and Economic Impact Payments to create new scams.

April 11, 2020

Company preparing to accept applications for billions of dollars in requested PPP relief next week. 1 in 12 American employees is paid through QuickBooks Payroll