Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

May 12, 2020

Survey participants cited a need for lawmakers to pivot to a business-focused strategy to begin the recovery process. Respondents said 39 percent of their business clients will recover to pre-crisis levels in six to 12 months once the stay-at-home restric

May 12, 2020

Survey respondents agreed cyberattacks are becoming more targeted (77%), severe (64%) and sophisticated (63%). Yet, they don’t have the resources and strategy in place to protect themselves.

May 11, 2020

Accounting firms are donating supplies, funds and services during COVID-19, according to a recent survey conducted by the Massachusetts Society of CPAs (MSCPA). Fifty-one of the MSCPA’s member firms and companies responded to the survey, which was ...

![Face-Book-SEO-Logo[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/05/Face_Book_SEO_Logo_1_.5eb9a0182cbe9.png)

May 11, 2020

As a required necessity in capital markets, the traditional process of information retrieval, identity verification, and document checks known as “Know Your Customer” (KYC), has been painful for all parties involved.

May 11, 2020

Expert offers tips for anyone who's worried about what to do next (or not to do, as the case may be) in the volatile coronavirus market: First, make sure both you and your financial advisor are fully engaged.

May 11, 2020

The tools economists use to measure economic activity to predict economic growth or recession across the U.S. are evolving – especially with the rise of online sales. And now, as the pandemic is shifting consumer habits and straining industries ...

May 11, 2020

When the Tax Cut and Jobs Act (TCJA) was signed into law by President Trump in December 2017, its steep reduction of the U.S. corporate tax rate from 35% to 21% addressed what was widely considered the principal factor in companies' shifting ...

May 11, 2020

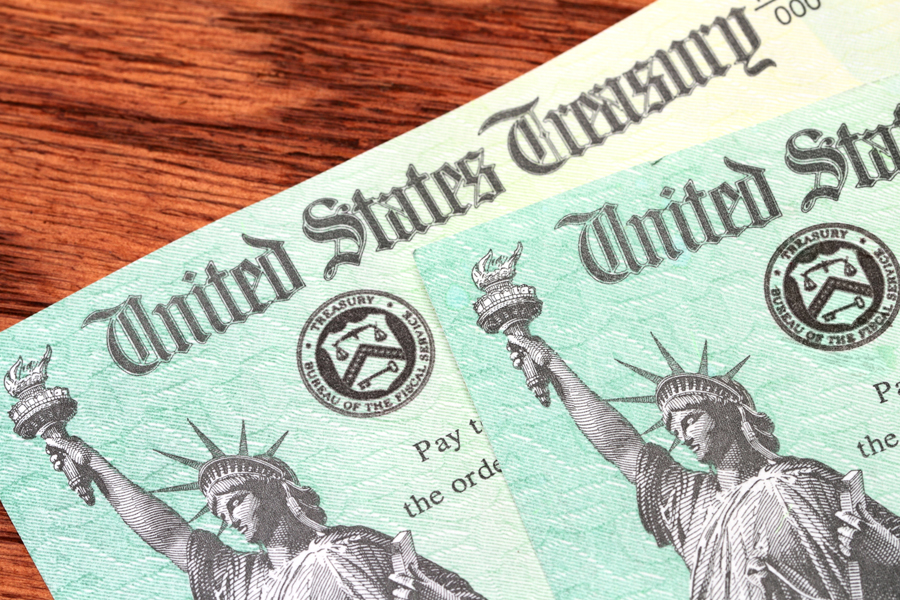

Some Americans may have received a payment amount different than what they expected. Payment amounts vary based on income, filing status and family size.

May 11, 2020

‘An Accounting and Finance Professional’s Guide to Safe Work in a COVID-19 World.’

May 11, 2020

The IRS has sent Coronavirus stimulus payments to deceased people by mistake. It’s unclear how many such checks have been delivered, but it’s thought to be significant, because about 2 million people in the U.S. die each year.

May 11, 2020

The IRS has discovered that it has mailed checks to deceased people by mistake. It’s unclear how many such checks have been delivered, but it’s thought to be significant, because about 2 million people in the U.S. die each year.

May 10, 2020

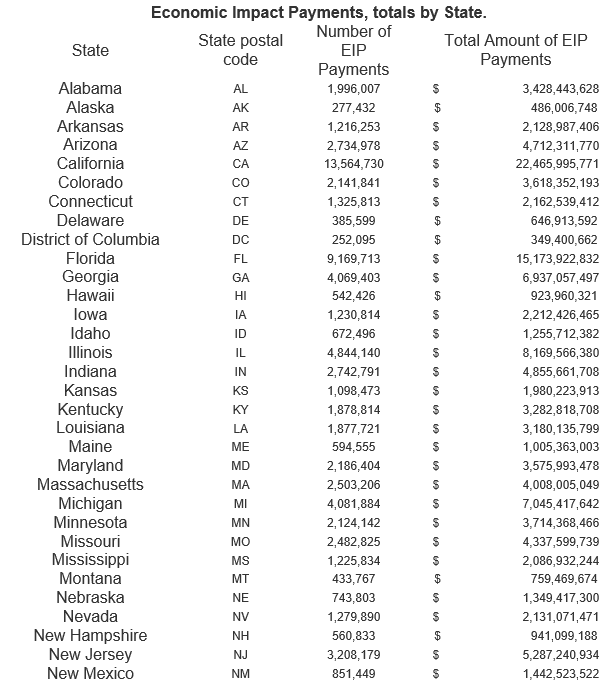

The Treasury Department and the IRS have released updated state-by-state figures for Economic Impact Payments, with approximately 130 million individuals receiving payments worth more than $200 billion in the program’s first four weeks. (Up through May 8)