Firm Management February 6, 2026

Wipfli Partners with The Caddie Network

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

February 6, 2026

February 6, 2026

February 6, 2026

February 6, 2026

August 24, 2011

Social media websites like Facebook, Twitter and LinkedIn have been around for several years now, and we’ve covered the subject as it relates to professional tax and accounting firms several times. But a recent Forbes article (10 Myths about Social Neworking for Small Business) reminded me that even when faced with sound logic, adaptation can...…

August 23, 2011

Join Randy Johnston and Darren Root on the latest episode of Tech2Go as they discuss moving your firm to the cloud. Tech2Go is a fast-paced roundtable monthly podcast featuring discussion with CPA Practice Advisor Executive Editor M. Darren Root, CPA.CITP, and regular columnist Randy Johnston. These thought leaders and their special guests tackle current...…

August 23, 2011

Smart investors have long understood the value of rebalancing — bringing their mix of stocks, bonds and other assets back in line on a regular basis. But this article from SmartMoney asks when the markets threaten to throw that mix out of whack on a daily basis, what’s an avowed rebalancer to do? Read full...…

August 22, 2011

Over the past several months, I’ve had the chance to assess the issue of computing “in the cloud,” both in terms of the benefits and the drawbacks. So far, the benefits outweigh the drawbacks. But this is a very fluid situation that will require some strong due diligence and more than a little caution. Cloud...…

August 22, 2011

Don’t miss the latest episode of TaxPrepPartner2Go, where Executive Editor Darren Root visits with Raj Kapur, Executive Vice President, The Center for Project Management, about how to effectively make changes in your firm. Sponsored by SurePrep CPA Practice Advisor has teamed with SurePrep to bring you a monthly podcast series — TaxPrepPartner2Go (TPP2Go) —...…

August 19, 2011

800-230-2322 www.taxworks.com The Tax Planner module from RedGear, the makers of TaxWorks, is designed to work with that specific tax system, providing several years’ of scenario planning for federal and state taxes, with support for all common tax treatments. However, the program can also be used as a stand-alone utility. RedGear offers program updates throughout...…

August 19, 2011

800-765-7777 www.lacertesoftware.com The Intuit ProLine Lacerte Tax Planner is a tool for developing customized tax scenarios to help tax and accounting professionals estimate the tax impact of proposed future transactions. The planner allows tax professionals to advise clients on how best to minimize tax liabilities using known and projected tax rates, rules, income and familial...…

August 19, 2011

800-739-9998 www.cchgroup.com ProSystem fx Planning provides comprehensive scenario-based income tax planning features in a system that can be used as a stand-alone program or as an integrated part of the ProSystem fx Suite of professional tax and accounting products. The program includes support for all tax treatments, including regular, AMT and capital gains, with extensive...…

August 18, 2011

866-304-3800 www.paylocity.com Best Fit Companies who want a web-based payroll and human resources application that integrates with many entry-level and mid-range accounting and ERP applications. Strengths Uses a single database for payroll and HR data, and allows documents to be attached to electronic personnel files in their native formats. Provides integration with many popular...…

August 18, 2011

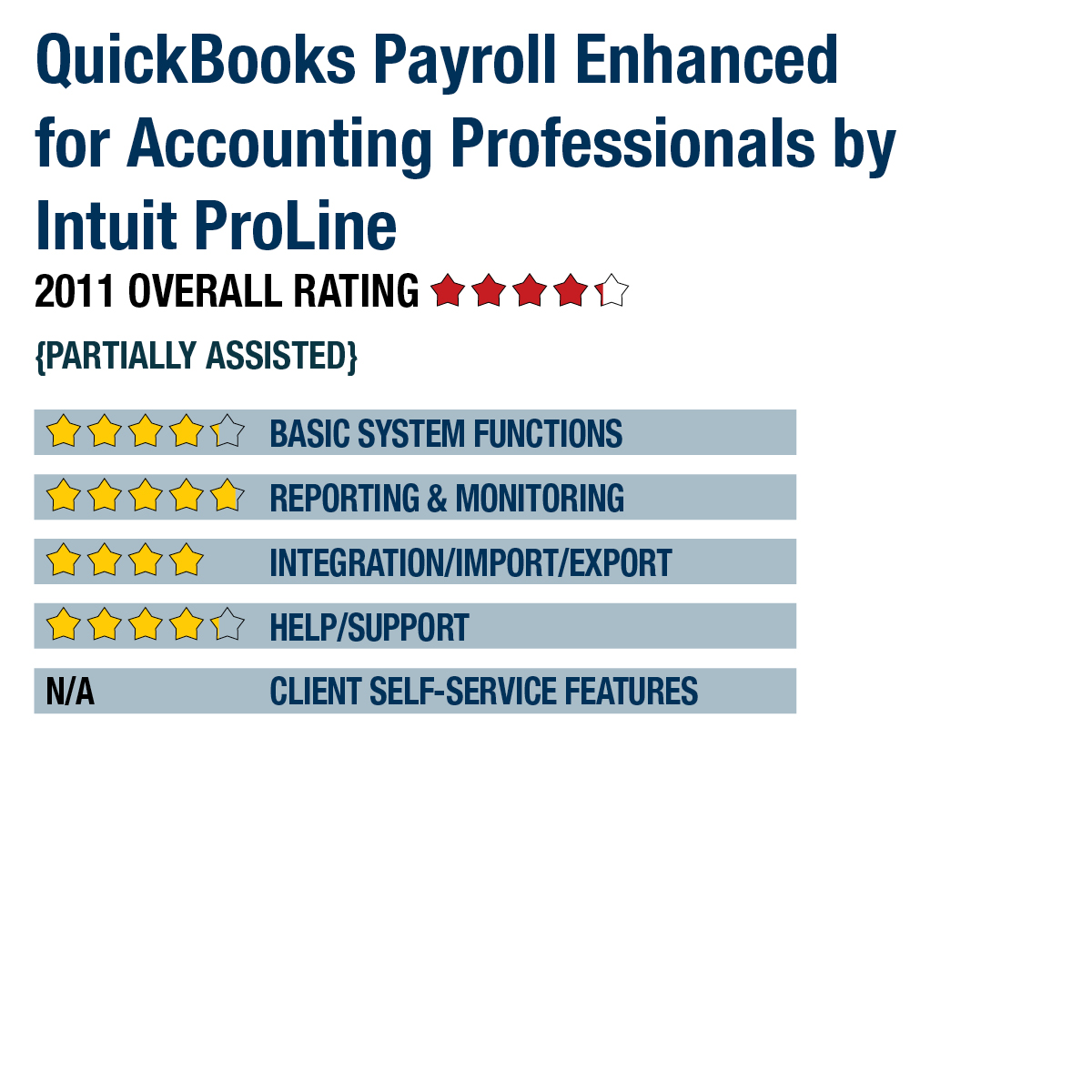

888-236-9501 www.accountant.intuit.com/payroll Best Fit Accounting professionals who do client bookkeeping/write-up or payroll preparation in QuickBooks for Windows, as well as those who need support for payroll integration with job costing in QuickBooks. Strengths Tightly integrated with the Windows version of QuickBooks; however, there is no support for QuickBooks Online, QuickBooks for Mac or third-party...…

August 17, 2011

Midwest Accounting & Finance Showcase Keeping you at the forefront of the profession for 31 years. August 23-24, 2011 Donald E. Stephens Convention Center, 5555 N. River Road, Rosemont, IL The Illinois CPA Society Society’s 31st Midwest Accounting & Finance Showcase offers an incredible value for finance professionals looking to earn CPE, network and talk...…

August 16, 2011

So you didn’t marry that high school sweetheart who turned into a billionaire and that brilliant business idea you had that was going to make you rich didn’t quite pan out as expected. So what else is left in that chocolate box of retirement options? Like an egg, you can cook retirement plans in...…