Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

August 12, 2014

When you’re running a business and someone works for you or provides a service, you pay them. That’s easy. What isn’t always so easy is determining how you should treat those payments. Before you enter into a business relationship, it’s important to establish the type of relationship – is this person providing services as an…

August 12, 2014

The first thing you should do NOW, and the one thing you should not do, at least not yet.

August 11, 2014

When I think of August, I think of lazy hot summer days that last from whenever my friends and I wake up to when the streetlights come on - the sign to end summer play and return home for the night. I'm glad I have a head full of sweet summer memories from my childhood…

August 8, 2014

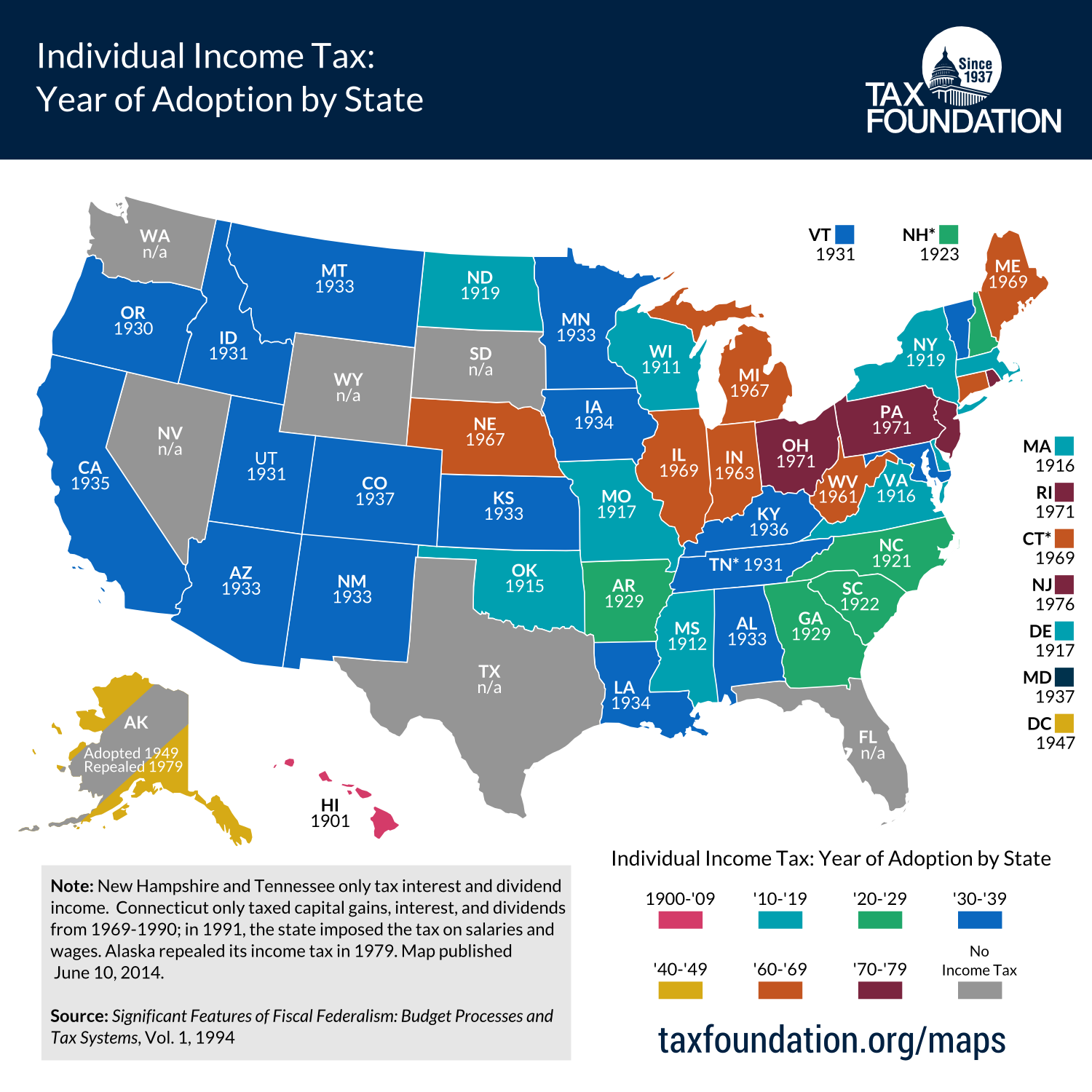

The last 18 months have been a period of significant change for the document management systems of many accounting professionals and their firms.

August 8, 2014

If you’ve been following Intuit the past year, chances are you’ve heard the company talk about its plans to remove pain points for small businesses. Every move the company has made seems to be a calculated step in the direction of building a seamless QuickBooks Online ecosystem for its customers.

August 7, 2014

CPA Practice Advisor’s free webinars offer live interaction with thought leaders in the accounting and tax profession. The live versions are eligible for CPE credit, allowing professionals to keep up with continuing education requirements online, and all webinars are archived for future viewing at any time.

August 7, 2014

For most accounting firms, choosing a software provider and staying the course is an easy and safe decision. Only when there are traumatic events in pricing changes, software not working and not getting fixed, technology changes or regulatory changes that the software doesn’t keep up with will we even consider a change.

August 7, 2014

So where do you place your firm's website on your list of priorities for your firm? Do you see it as a necessary evil that has to be dealt with just to “be in the game?” Or, do you see it as the gateway to serving your clients for the coming years? Chances are you…

August 4, 2014

A majority of U.S. taxpayers view tax scams as a major issue for them, with 78 percent of Americans believing they are vulnerable and could become a victim.

August 1, 2014

What should you be doing in your state and local tax practice this month? Here's your SALT checklist for August.

July 31, 2014

Accounting professionals who specialize in helping their small business clients stay compliant with State and Local Taxes (SALT), often need spcific informaiton that may behard to find. Here’s a brief list of websites that can provide useful tools and information for these professionals: SBA: Learn about your state and local tax obligations:http://www.sba.gov/content/learn-about-your-state-and-local-tax-obligations NOLO – 50-State...…

July 25, 2014

By now, you’ve probably heard of “content marketing,” even if you’re not sure what it is or why it’s being talked about in the accounting industry. It’s not just jargon thrown around by marketing professionals, and it definitely has a place in your firm. Simply put, content marketing is connecting with your clients without pushing…