Firm Management February 6, 2026

Wipfli Partners with The Caddie Network

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

February 6, 2026

February 6, 2026

February 6, 2026

February 6, 2026

November 20, 2017

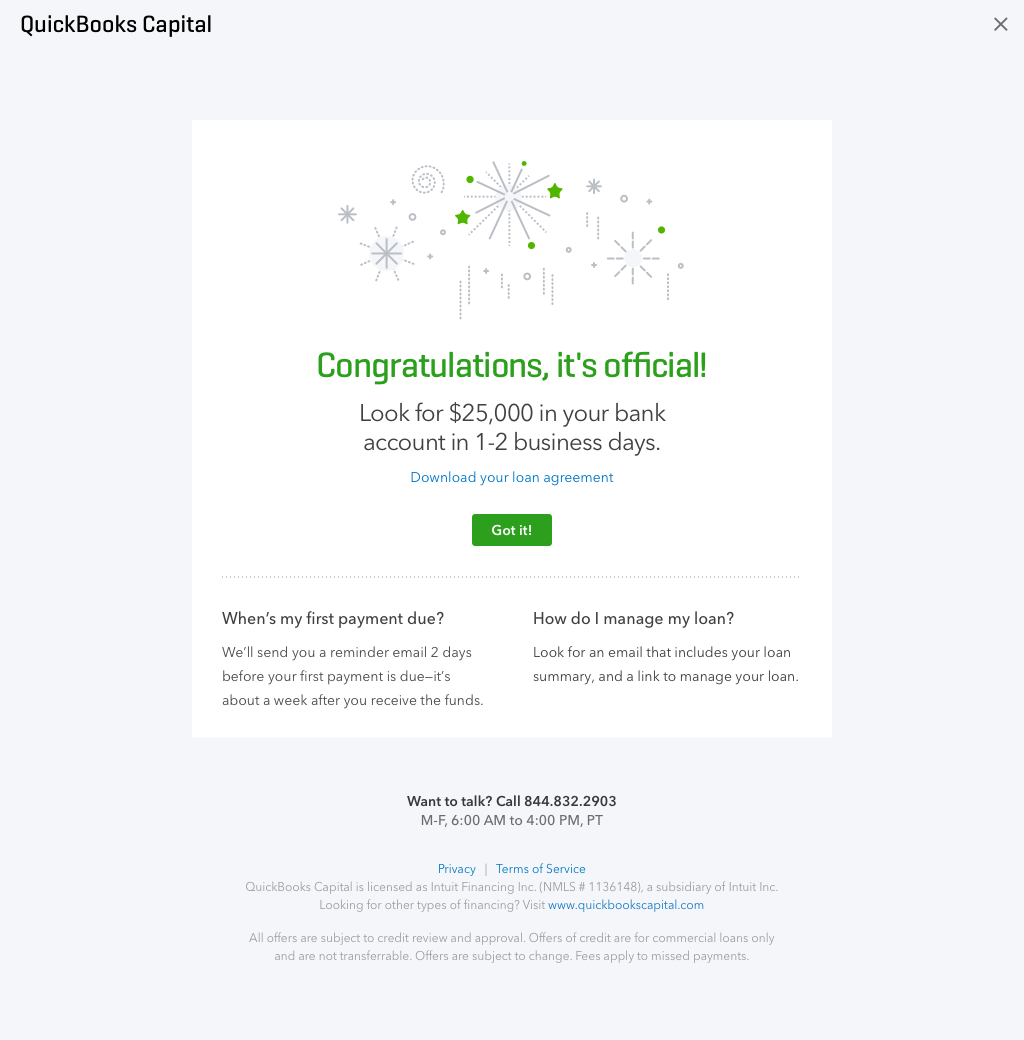

Intuit introduces a new lending solution, QuickBooks Capital, to help small business owners grow their businesses

November 20, 2017

It’s not hard to see why people don’t like passwords. We share a lot of sensitive personal information with companies, including Social Security numbers, health records, and bank account and credit card numbers. Even password managers don’t eliminate ...

November 20, 2017

Thurs. Dec 7 - Tune in for an hour or two, or settle in and spend the entire day with us. Wear your pajamas if you like – we won’t judge. Starting at 9 a.m. Eastern time and for the next 10 hours you can collect up to 10 CPE credits, we’ll ...

November 17, 2017

All in an effort to minimize filing fraudsters, the IRS has accelerated major information form filing. And to drive home their emphasis, the IRS has drastically increased preparer penalties.

November 16, 2017

New technology tools are frequently showcased first at the Consumer Electronic Show (CES) in Las Vegas every January. While many innovative products have been initially introduced during CES, there have been a number of useful hardware and software ...

November 16, 2017

Many firms today are in the midst of “growth initiatives.” This, in its most basic of definitions, refers to trying to grow a firm from its current size to a larger size through increased focus and training on business development activities.

November 15, 2017

There are two theories that are killing our profession: Pricing by the hour and maintaining timesheets. They are stifling growth, wealth creation and innovation, inhibiting customer service, destroying morale and the quality of life, not to mention ...

November 15, 2017

Who are the most influential leaders in the professional accounting space? Increasingly, they are female professionals who are CPAs, consultants or are the developers behind the technologies that help all accounting and tax pros be more efficient and prod

November 7, 2017

The start of a new year is the perfect time to touch base with your clients or reach out to new ones. Don’t limit your discussion to traditional tax issues. Take the time to ask existing and prospective clients about their business plans overall.

October 25, 2017

Entrepreneurs go in business for a number of reasons, and you would be hard pressed to find retirement benefits to be one of them. Yet ask employees about why they chose or stick with a job, and benefits, including retirement, are often listed.

October 24, 2017

Your website should also offer an easily accessible list of services that your firm offers. You’ll also want to provide a convenient way for potential clients to get in touch with you regarding those services so a Contact Us page or an online ...

October 23, 2017

The latest Senate legislation to repeal and replace the Affordable Care Act (ACA), known as Graham-Cassidy, was not put to a vote before the September 30th budget reconciliation deadline. While Republican leaders have signaled that they are not ...