Firm Management February 6, 2026

Wipfli Partners with The Caddie Network

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

February 6, 2026

February 6, 2026

February 6, 2026

February 6, 2026

Firm Management March 5, 2024

The Chattanooga-based top 100 firm has expanded outside of Tennessee after merging in Bizzell, Neff & Galloway on March 1.

Taxes March 5, 2024

Americans hate taxes so much that they would entertain some bizarre options for a tax-free life, according to WalletHub.

Taxes March 5, 2024

Allen Weisselberg pleaded guilty to two first-degree perjury counts at a brief Manhattan Criminal Court hearing on March 4.

Accounting March 4, 2024

Uncat won the inaugural “ABC Tournament” last year; nominations are open until March 9 to set this year’s field of 64.

Auditing March 4, 2024

AI creates an opportunity as accountants can more readily gain access to the data they need, enabling them to shift their focus to professional judgment and using their experience to analyze and examine information.

Accounting March 4, 2024

But a recent survey from Gartner revealed that staff acceptance of new technology dramatically reduces error rates.

Accounting March 4, 2024

Those willing to embrace change, adapt their strategies, and invest in the future are set to transform their services and client experiences in ways we're just beginning to imagine.

Payroll March 4, 2024

The dwindling numbers of CPAs is at a crisis level, but starting salaries are still too low to tempt more people into the field.

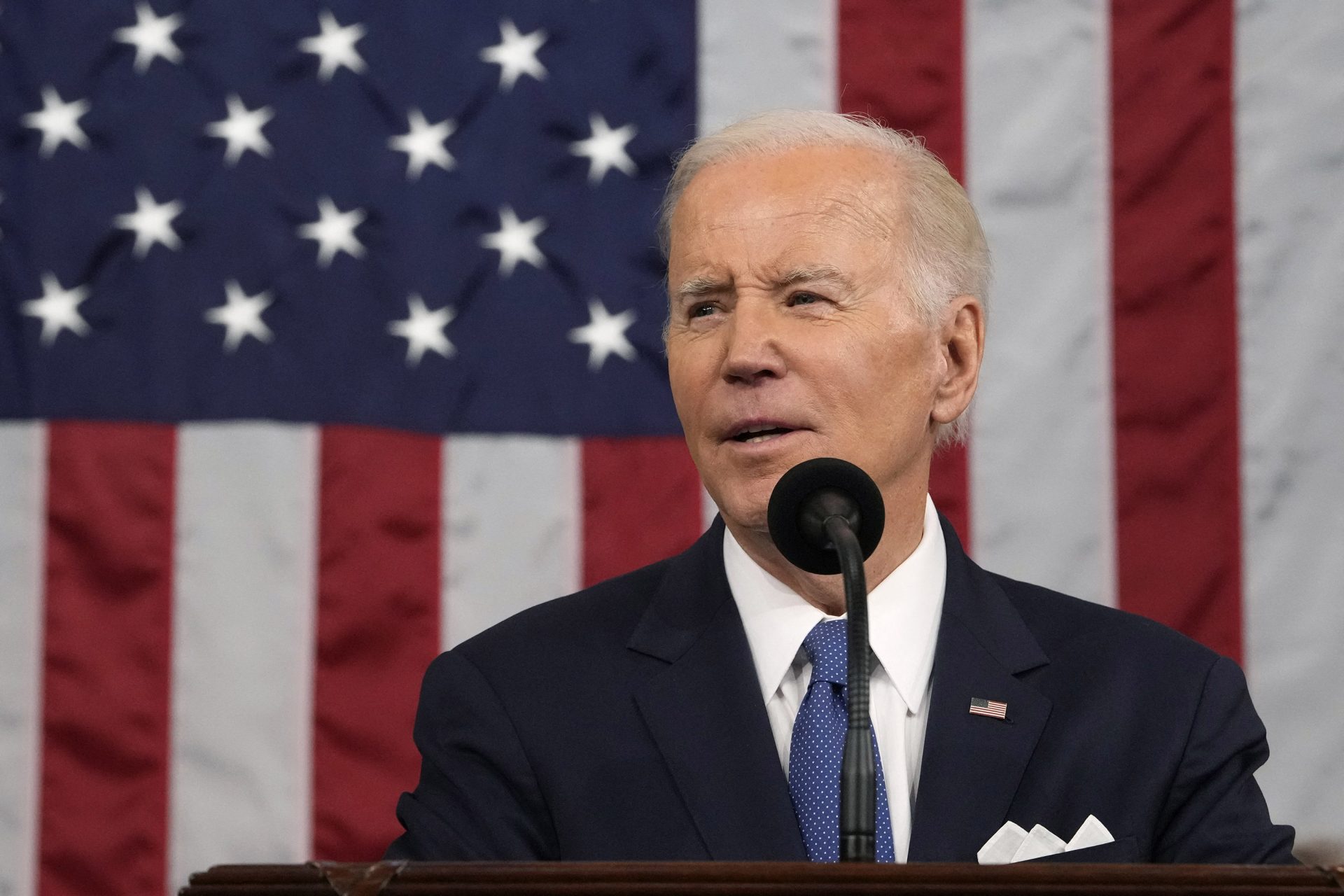

Taxes March 4, 2024

Biden's vow to raise taxes on the rich, which he expects to make during his speech on Thursday, faces obstacles in Congress.

Accounting March 1, 2024

As part of its effectiveness review of the PCC, the Financial Accounting Foundation is soliciting feedback from stakeholders.

Payroll February 29, 2024

A majority of employees would prefer personalized forms of appreciation over a bump in pay (52%) or a promotion (28%).

Taxes February 29, 2024

Only taxpayers that have paid their estimated tax payments by Jan. 16 can file by the regular April 15 deadline and avoid penalties.